The Best Payroll Software for Accountants

Get the best software for your business. Compare product reviews, pricing below.

Payroll software helps businesses with payroll processing tasks such as wage calculation, tax filing, and more. Certified Public Accounts (CPA), chartered accountants, and accounting departments alike know how important accurate payroll is for keeping employees happy and content. Payroll software designed for accountants is one way of helping individual CPAs and entire accounting departments get a better handle on salary and wage compensation services.

What is Payroll Software for Accountants?

There are many generic payroll solutions out there, made for startups to global enterprises. Yet payroll software specifically for accountants has a few distinct differences from these general solutions. To start, these specialized products are designed to provide more advanced accounting functionality to experienced CPAs.

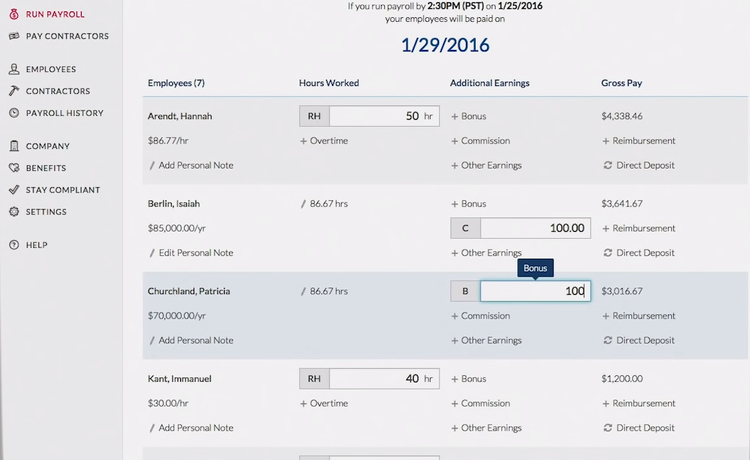

Some of the main features include payroll processing, along with wage calculations, overtime management, and tax filing. More and more, full-service payroll software is also used to facilitate the transition from paper check printing to direct deposit payment in addition to other accounting and bookkeeping tasks.

Features of Payroll Software for Accountants

- General ledger integration: Summarize all your financial transactions by accounts payable (AP) and accounts receivable (AR) in order to balance payroll

- Salary and wage calculation: Calculate employee paychecks based on hours worked, overtime rates, or specific salary requirements

- Deductions management: Withhold funds from paychecks to cover employee payroll taxes, benefits, wage garnishments, health insurance, 401(k) or retirement contributions, and more

- Check printing and direct deposit: Batch print physical employee paychecks for distribution instead of writing individual payroll checks and/or automatically deposit funds to employee bank accounts

- Pay stubs: Keep copies of both physical and digital paychecks for tax filing records, each stub provides detailed payroll information such as hours worked, salary/wage earned, deductions, tax withholdings, etc.

- Overtime management: Calculate alternate pay rates or allow for the accrual of vacation time based on overtime hours

- Electronic tax filing: Digitally submit direct deposit payroll returns without paper-based documentation; generate W-2 and 1099 tax forms for employees

- Time and attendance tracking: Allow employees to self-report time worked for wage calculation purposes

- Employee self-service portal: Build a custom portal accessible via desktop or mobile app for staff to check on paycheck data such as withholding settings, vacation accrued, tax forms, or enact changes to their accounts

- Certified payroll: Perform third-party verification of wage payments and confirm compensation is in accordance with prevailing wage standards

- Multiple state tax tables: Calculate varying tax rates based on different state requirements

Best Payroll Software for Accountants Benefits and Advantages

Accountants who use a payroll software to automate their work can enjoy these incredible benefits:

Keep Pay Day On Time and Accurate

No one wants paychecks to arrive late on payday. For accountants, scrambling to get every check out on time can be incredibly stressful even under normal circumstances. Overtime has to be calculated, each one has to be signed by a CEO or manager, and the pay stub copies have to be collected for tax records. Not to mention, outside circumstances can cause additional delays, such as federal holidays causing banks and post offices to close. If the checks aren’t out early, those shutdowns could delay employee payments by an entire business week.

Automated payroll software expedites the entire payroll process so checks can go out faster with fewer errors. The first step is to switch to direct deposit. By digitizing the payment process, outgoing payments won’t be delayed by missing time cards or missing signatures. Even if you continue to run payroll with batch print paychecks, payroll software makes the whole operation faster by calculating wages based on the parameters set by the accounting department.

Payroll software with direct deposit is vital in ensuring timely payments for freelancers, temps, and gig workers. Rather than deal with separate paperwork and tax forms, use software to pay everyone from new hires to special consultants. CPAs can run payroll for both in-house and outsourced employees all with one software.

Tax Compliance and Reporting

A major benefit of online payroll software is the ability to stay on top of tax reporting and remittance payments. As mentioned above, digital payments create virtual pay stubs which are easier to track and organize for future use. In the event of an audit, the stubs can be quickly retrieved through custom search parameters, no more digging around in file cabinets for hours without results.

Payroll penalties from the IRS can add up and cost your business hundreds or thousands of dollars each year to rectify. This particularly affects small and medium businesses without dedicated accounting departments capable of reviewing every pay stub for possible errors. By utilizing user-friendly payroll software, accountants can spot mistakes sooner rather than later and prevent costly penalties from tax payments. Cloud-based payroll solutions offer greater online security for your taxes as well. Store copies of important tax forms online, making sure they are available for usage at all times or just for year-end reviews.

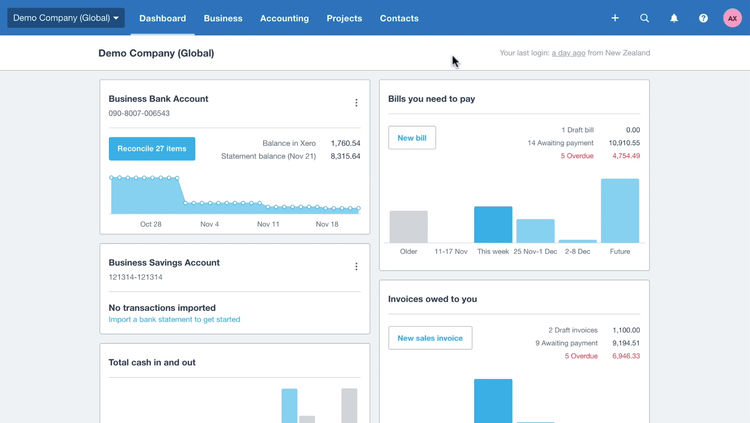

Easier Integration with Additional Software

Many companies use separate payroll and accounting software. While they can be integrated together, a single payroll software with comprehensive accounting modules can cut down on miscommunication between separate systems and offer greater ease of use, even for small business owners without accountant certification or training.

Fortunately, payroll systems can integrate with more than just accounting software. Some popular integrations include:

- Compensation management software

- ERP platform

- HR software

- Human capital management (HCM) software

- Time and attendance software

- Time tracking software

- Project management software

For example, integrating payroll software with HR solutions makes it easier for both departments to ensure employees are properly compensated. Or a project manager can work with payroll software and certified accountants to keep labor costs under control. There are many options out there for accountants who want to improve their services with additional software.

Payroll Trends for Accountants

Payroll services have evolved alongside changing business trends as more and more companies incorporate online processes. One obvious trend is the increase in cloud-based software for increased remote access. Yet there’s more accountants need to be aware of than just going digital:

Direct Deposit over Paper Paychecks

Payroll has changed a lot thanks to the Internet, particularly noticeable with the rise of direct deposit over paper paychecks. The process is significantly more efficient than other payment methods, providing employees with their money faster than ever before. Essentially, employees submit a bank routing number so money is directly transferred to their accounts. No more waiting for the mail or going to the bank with a paper check. Direct deposit has quickly become the most popular option for paying workers of all types across every industry.

In fact, many new hires expect to at least have the option of direct deposit. Enrolling employees during the onboarding process can prove your company is up-to-the-times when it comes to agile payroll and compensation. And direct deposit is useful for on-demand pay for qualified employees.

Salary and Wage Analysis

Another new trend in payroll is an increase in salary and wage analysis. Reviewing historical data can reveal more effective ways to compensate current employees. This analysis of payroll data is also useful when auditing past payments before submitting any tax documents.

Artificial intelligence (AI) can further streamline your payroll services by calculating wages and distributing paychecks digitally. And machine learning makes it easier to classify different employees based on their salary, wages, or other compensation factors without spending hours on manual data entry.

Increased Incentives

Finally, more companies are looking for creative ways to incentivize their workforce. Payroll software is useful for coming up with unique reward programs based on variables like overtime or attendance. These incentives can be determined in conjunction with HR departments to develop effective yet fair offerings. And with direct deposit, these special bonuses can be instantly distributed to deserving employees.

Payroll Software for Accountants Pricing

As an accountant, it’s your job to keep costs down and build a better budget. Start by finding affordable payroll software for your business. Software as a service (SaaS) options range from $5 per month per user or employee all the way up to $45 per month. Or there may be a one-time payment for a perpetual license. Some of these are available for $1,999.

Total range: $2-20/employee/month

- Low: $2-$5/employee/month (just payroll)

- Mid: $5-$10/employee/month (payroll and HRMS)

- High: $10-$20/employee/month (full HRMS and talent management)

Certain accounting solutions include payroll modules, though specific add-ons may increase the overall costs. As a result, implementing an independent payroll software can lead to more cost savings from all your future payroll runs.