The Best Fund Accounting Software

Maintaining accurate records becomes difficult as your funding sources become more complex. We reviewed the best software for nonprofits, government entities, and educational institutions, focusing on budgeting, grant management, and reporting.

- All-in-one financial solution

- Customize and export timely financial reports

- All-in-one financial solution

- Cloud accounting solution

- Intuitive, reliable, and secure

- Cloud accounting solution

- Very clean and intuitive layout

- Software is scalable

- Reports are incredibly detailed

Fund accounting software helps you better manage and report on multiple funding sources like grants and donations while ensuring compliance with specific restrictions or purposes. We’ve compiled a list of popular systems for various organizations to help you find the best solution.

- Aplos: Best Overall

- Blackbaud Financial Edge NXT: Most Comprehensive Reporting

- Red Wing CenterPoint Fund Accounting: Best In-Depth Fund Accounting

- MIP Accounting: Most Customizable

- FastFund: Best for Multi-Funded Organization Reporting

- AccuFund: Most Economical for Nonprofits and Government Agencies

- Fund EZ: Best for Detailed Fund and Departmental Accounting

- Sage Intacct: Best for GAAP Compliance

- VADAR Cloud: Best Tax Collection System

- Fundamentals: Best for Microsoft Dynamics Integration

- QuickBooks Online: Best for Startups

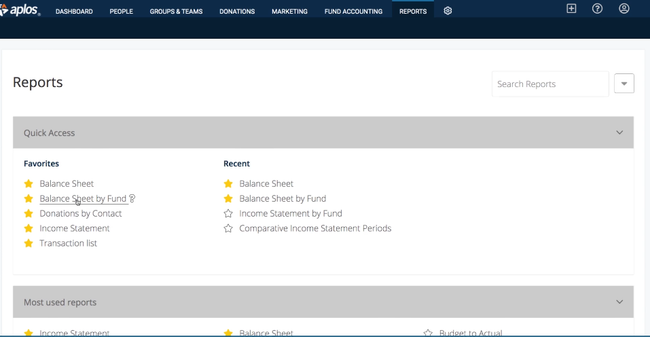

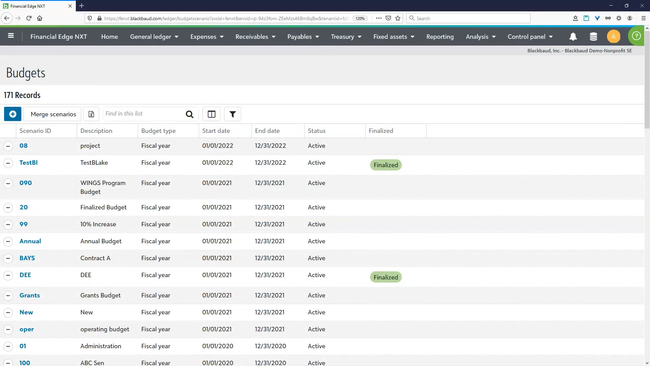

Aplos - Best Overall

Aplos’s fund accounting module makes it easy for your organization to track incoming money. You can set donor restrictions, ensuring your team properly allocates and uses every donation. For example, if one of your donors gives for a specific project, you can restrict that amount and use it only as directed. Or, label unrestricted funds accordingly so your team knows that the donation is flexible. It’s crucial for proper spending practices and complying with FASB guidelines.

When you spend donor funds, you can provide them with detailed reports outlining where you used their money. If a person provided specific instructions for use, you can prove to them that your organization stayed true to their request. It’s a great way to build trust with new givers and retain strong relationships with regulars.

Aplos is also affordable for small to midsize nonprofit organizations. The Lite plan starts at just $79/month, which is cheap compared to other products on the list like Sage Intacct. That said, if you want features like budgeting, pledge tracking, and recurring transactions, you’ll need to upgrade to the Core package at $99/month, which is still a good value.

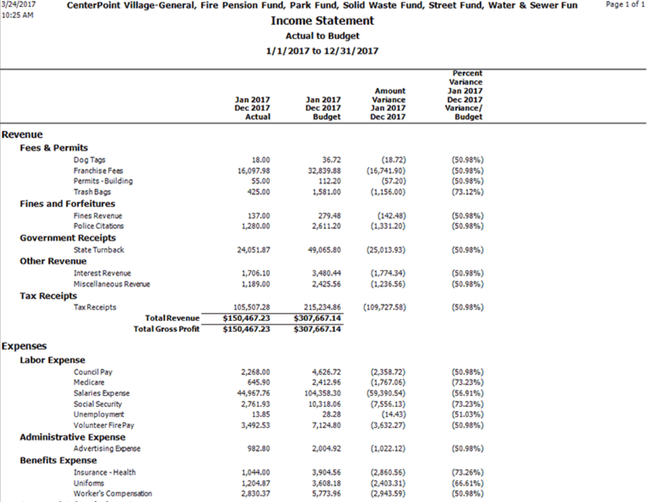

Blackbaud Financial Edge NXT - Most Comprehensive Reporting

Blackbaud Financial Edge NXT stores records for every grant, fund, or program for easy access. This allows you to create detailed reports on every financial metric, like invoices by payment status or aged accounts payable. It’s great for nonprofits and government entities to ensure overall integrity and track program success.

The system is also highly customizable, letting you configure report dashboards to view important high-level KPIs. Filter data by department, grant, or project to analyze different segments individually. Further, you can export them to systems like Excel in view-only access for stakeholders for better visibility. These can be bank reconciliation reports, budget vs. actuals, or even cash disbursement journals.

Blackbaud Financial Edge NXT is best for mid to large nonprofit organizations or governments looking to streamline fund accounting and manage projects. Unfortunately, pricing is not disclosed publicly, so you’ll need a custom quote to find the exact cost for your business.

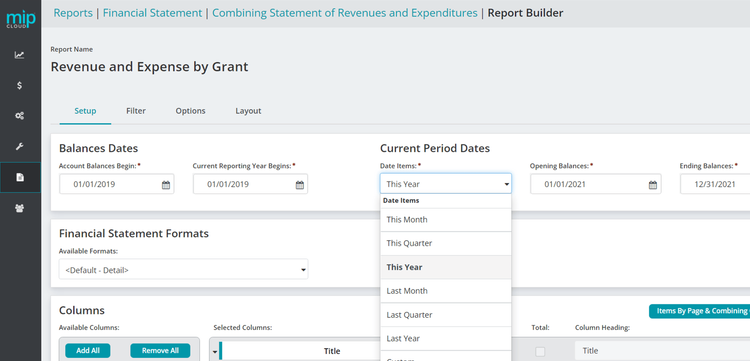

Red Wing CenterPoint Fund Accounting - Best In-Depth Fund Accounting

CenterPoint Fund Accounting’s in-depth fund accounting is designed to help manage financial sectors’ financial activities, specifically government entities, nonprofit sectors, and educational institutions. With this feature, you can create, manage, and track budgets for various funds, whether grants or donations, ensuring that your funds are utilized according to legal requirements and donor intent.

This feature provides comprehensive reporting capabilities, enabling you to track income and expenses separately for each fund. This can help you analyze the financial health of individual funds. You can also create and manage budgets at a fund level, helping you to plan your finances more effectively and stay within your budgetary constraints.

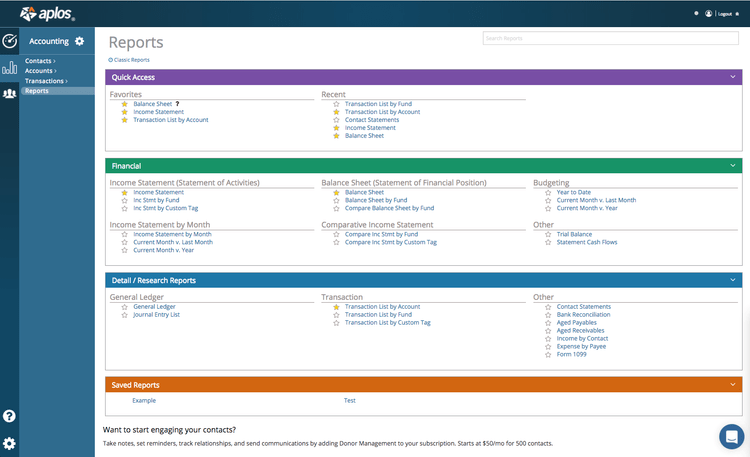

MIP Accounting - Most Customizable

MIP Accounting exclusively serves the financial management and fund accounting needs of thousands of nonprofits and government agencies. In addition to positive user reviews, MIP has received the Campbell Award for several years. This software is focused strictly on custom designs for your system to enable you to manage effectively, get timely information, streamline processes, and provide strong controls.

MIP is a fully integrated system with comprehensive functionality including fund accounting, procurement, budgeting, payroll, human resources, timekeeping, fixed asset management, grant management, dashboards, and more. This flexible structure enables you to manage and report on multiple cost centers at the general ledger level, including multiple organizations, funds, projects, grants, programs, departments, locations, etc.

FastFund - Best for Multi-Funded Organization Reporting

FastFund Nonprofit Software is a fully integrated fund accounting system designed by CPAs. Affordable modules include general ledger, accounts payable, accounts receivable, cost allocations, payroll, and fundraising.

Handles the complex reporting requirements of multi-funded organizations. Designed to maintain separate financial records for each program. It also features a user-definable chart of accounts that defines funds, cost centers, and accounts. Powerful reporting capabilities produce custom reports to meet all your fiscal requirements, including multi-year reports, budgets, and reports that comply with FASB 116 and 117.

AccuFund - Most Economical for Nonprofits and Government Agencies

AccuFund Accounting Suite is specifically designed to meet the unique financial management and reporting needs of nonprofits, municipalities, and other government agencies. The software features an intuitive Windows interface across all modules, making it easier for new users to learn and use efficiently. Additional modules are available to customize the software for each organization.

Since AccuFund charges a one-time perpetual license fee, the total cost of ownership of AccuFund is typically lower than its competitors. This affordability is achieved through reasonably priced software, lower training costs due to its ease of use, and minimal hardware requirements, which reduce both initial investment and ongoing management costs

Fund EZ - Best for Detailed Fund and Departmental Accounting

Fund EZ features a 22-character account number structure that efficiently tracks funds, general ledger accounts, and cost center departments, with all data flowing smoothly to the general ledger for auto-posting. There are detailed modules for accounts payable and receivable, allocations, client billing, fundraising, general ledger, and purchase orders. Each of these modules comes with a suite of features designed to streamline various accounting tasks, such as managing vendors and clients, tracking donations, recording transactions, and creating detailed financial reports.

Sage Intacct - Best for GAAP Compliance

Sage Intacct is a GAAP-compliant financial management software system. This highly scalable system can support multi-entity operations, making it a valuable choice for larger nonprofits and government organizations.

Sage Intacct offers a wide array of core accounting applications, including general ledger, accounts payable and receivable, cash management, and order management. Additional functionalities such as built-in dashboards, real-time reporting, and revenue management, make it an ideal choice for organizations needing advanced financial management capabilities.

VADAR Cloud - Best Tax Collection System

VADAR Fund Accounting is designed for small to mid-sized municipalities managing property, sales, and local taxes or fees. The software provides customizable tax collection tools within its Receivable and Property Tax Suite. It simplifies tax payments and billing online, ensuring a transparent process with full audit trails for every transaction.

VADAR offers an integrated design where tax collection is woven into the fund accounting software. This integration allows for data imports from assessment databases, easy tax bill creation, and management of property assessments and taxable values. The system also handles delinquent taxes, making it a full-fledged solution for tax collection needs.

Fundamentals - Best for Microsoft Dynamics Integration

Fundamentals is powered by Microsoft Dynamics 365 Business Central and a fund accounting software built for nonprofits and governments. It is cloud-based, making it a top choice for users who want to use the software at any time on any device.

Fundamentals offers functionality that is true to what nonprofits and governments need. Key functionalities include real-time fund allocation, comprehensive audit trails, multi-currency and multi-bank account management, and detailed budgetary controls. The software offers capabilities for managing multiple companies and currencies, as well as consolidation, alongside robust reporting features that are compliant with FASB/GASB standards. Additional features include grant management, general ledger customization, inventory tracking, and project management, with optional advanced and team apps for expanded functionality.

QuickBooks Online - Best for Startups

QuickBooks Online is full accounting software that non-profits and government sectors may use since it’s a cost-effective solution. However, the system lacks some industry-specific features of fund accounting solutions like fund segregation, grant tracking, and donor relationship management.

What is Fund Accounting Software?

Fund accounting software is designed to enable improved allocation and management of resources designated for specific uses. A common application found within nonprofit accounting software, funds are a special type of accounting entity that provides a self-balancing set of accounts allowing the reservation of cash and non-cash assets for specific purposes or activities.

Nonprofits and government entities commonly use fund accounting because these organizations need to track expenditures and balances across multiple funds. Software automates these processes so these organizations can focus on other work instead of getting bogged down by bookkeeping.

Key Features

- Fund management: Gain a complete overview of your organization’s financial data, from cash flow to incoming donations and grants

- Donation tracking and management: Keep tabs on donations and manage how those funds are allocated

- Financial reporting: Create comprehensive reports on all company spending and analyze patterns on a quarterly or annual basis

- Accounts payable: Accounts payable software provides the ledger and related functionality for managing money owed by an organization

- Accounts receivable: Accounts receivable software provides the ledger and related functionality for managing money owed to an organization

- General ledger: General ledger software functionality provides the ledger and related functionality for providing a complete record of the financial activity of an organization, including transactional records and account structures

Benefits

A few of the most common benefits companies experience when utilizing fund accounting software include:

Track Expenditures to Fund Sources

A fund is a unit of a financial organization with a self-balancing set of accounts designed to record cash and other assets together with related balances and liabilities. Fund accounting software provides the automated ability to create financial statements and balance sheets for each fund.

Organizations providing funds often require clear reports detailing how the money has been spent. Fund accounting software can create detailed reports designed for this purpose. By improving your ability to document the impact of previous expenditures, you can help promote your ability to receive future funding.

Industry-Specific Applications for NPO Operations

Just as there are accounting packages designed with manufacturers or retailers in mind, software developers have created fund accounting software to meet the specific accounting requirements of nonprofit and government organizations. Using software geared for commercial, for-profit operations can lead to several issues for nonprofits and government entities.

While the profit motive may not be behind it for nonprofits and government entities, every organization seeks to maximize efficiency. Fund accounting software provides an accounting approach to eliminate time-intensive workarounds necessary to make standard commercial packages work.

Tighten Your Financial Management

Fund accounting software modules provide several inherent benefits. Donations, grants, and endowments are frequently provided to the non-profit organization with specific instructions on using the funding. Tracking these financial assets in funds allows the non-profit organization to see how each dollar was spent easily. The results of failing to meet specific spending restrictions can have negative consequences, including discontinued funding.

The first step to meeting spending restrictions is knowing where every penny is allocated. For any government entity, GASB standards actually require that accounts be kept on a fund basis. Fund accounting software allows governments to track various funds, including general/operations, special revenues, capital projects, debt services, permanent, fiduciary, and proprietary funds.

Pricing Guide

Prices for fund accounting software will vary based on factors like your user count, the size of your company, and the features you need. Here’s a breakdown:

Low-Tier

- Average Cost: $1,000-$10,000/year

- Company Size: 1-25 employees or less than $500k annual budget

- Examples: Fund EZ, Aplos, QuickBooks NonProfit

Mid-Tier

- Average Cost: $10,000-$60,000/year

- Company Size: 25-250 employees, or $500k-$5M annual budget

- Examples: Blackbaud Financial Edge NXT, AccuFund, Albia MIP

High-Tier

- Average Cost: $60,000-$200,000/year

- Company Size: 150-500 employees or $5M-$50M annual budget

- Examples: Sage Intacct for Nonprofits, NetSuite Social Impact, Multiview

Enterprise

- Average Cost: $250,000+ per year

- Company Size: 500+ employees, or $50M annual budget

- Examples: Workday for Nonprofits, Unit4 ERP

Market Trends

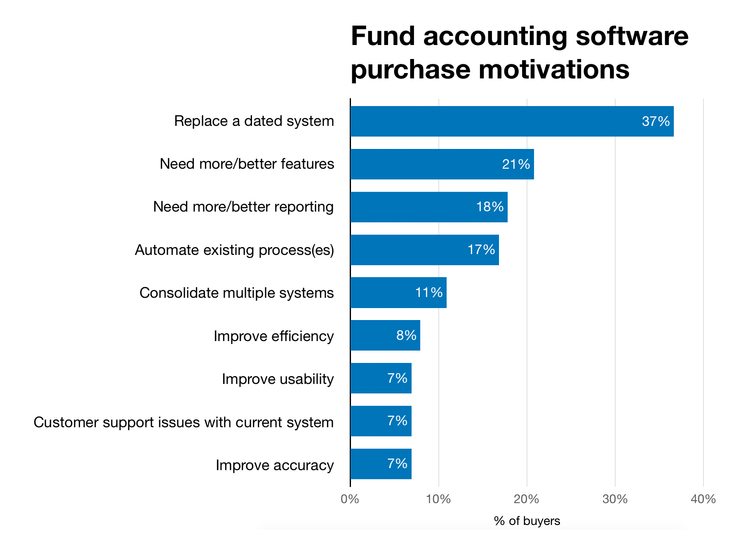

- Adopt cloud-based systems. Many government and nonprofit organizations operate with strict budgets and adopt “make do with what you have” ideologies, resulting in aged/dated systems. Yet 37% of potential buyers wanted to “replace a dated” system with new web-based fund accounting software.

- Separate fund and grant management. Most for-profit businesses may use the terms “fund” and “grant” interchangeably, but it’s not as simple for nonprofits. A grant is money a business would receive from the government, while a fund is money that has been set aside for a specific expenditure. Fund accounting software can keep the two types of funding separate.

- Provide transparency. Most millennial donors want complete transparency of where their charitable funds are going and how they address an organization’s specific needs. A nonprofit with software can effectively show where donated funds have been allocated to attract and retain more contributors.

- Make decision-making easier. An Aberdeen study found that 28% of business managers need data to make decisions in under an hour, and 42% of managers need data to decide within a day. To provide visibility among the vast amount of reports separate employees may be dealing with, dashboards become the way to shift ad hoc reporting to real-time reporting.