The Best Payroll Software

Our guide highlights the top payroll software for US and Canadian companies. We evaluated key features like time tracking, tax compliance, and integration with tools like QuickBooks, whether you manage hourly employees, contractors, or multi-location operations.

- Offers an intuitive user interface

- Includes compliance management

- Automates HR-related tasks

- Easily handle multiple companies

- Tax tables for all 50 states

- Supports multiple pay rates

- Extensive reporting, including integration with Aatrix for US federal and state reports

- Customizable payroll categories and user-definable payroll calendar

- Advanced security with definable access limitations

Payroll software makes it easier to calculate wages, pay employees, and handle tasks such as tax filing. To help you find the best solution, we’ve used our advanced research methodology to curate our best payroll processing software.

- Paycor: Best Overall

- Denali Payroll: Best for Accounting Firms

- Paymate Clarity: Best Job Costing and Allocation Tool

- Patriot Software: Best for Professional Services

- OnPay: Best for QuickBooks Users

- Payroll4Free: Best Free Option

- Gusto: Best Online Payroll Options

- CheckMark Payroll: Best for Mac

- PayBuddy: Best Canadian Payroll Option

Paycor - Best Overall

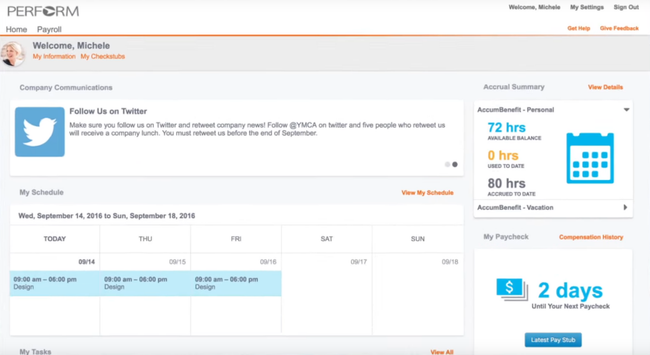

Paycor allows you to customize payroll workflows fully. You can set up everything from taxes to payment methods, including direct deposit, pay cards, and paper checks. Its built-in OnDemand Pay or Earned Wage Access (EWA) tool is worth mentioning. It lets employees access part of their earnings before payday, with no added cost to employers.

This platform tracks wages in real time, factoring in overtime, hourly rates, and deductions. Employees can then log into Paycor’s web portal or mobile app to check how much they’ve earned. Employers can set limits on how much employees can retrieve, safeguarding financial stability while saving HR teams time through automation.

Once an employee makes a request, funds are deposited directly into their account or Paycor Mobile Wallet almost instantly. During the next payroll cycle, Paycor automatically deducts the early-accessed amount, ensuring compliance without overpayments. Paycor’s built-in compliance tools ensure all early payments adhere to state and federal wage laws, giving you peace of mind while offering your team greater financial flexibility.

Denali Payroll - Best for Accounting Firms

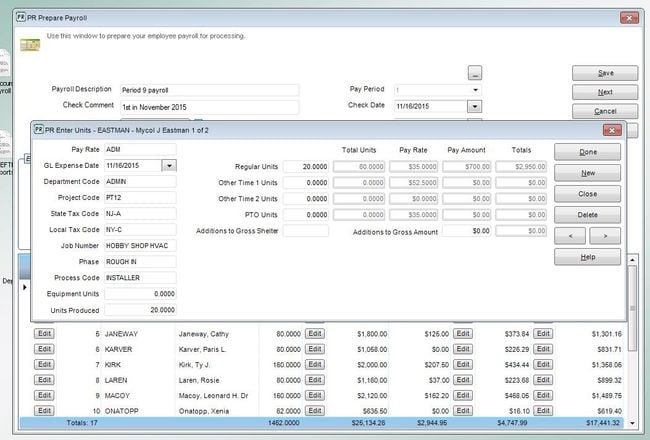

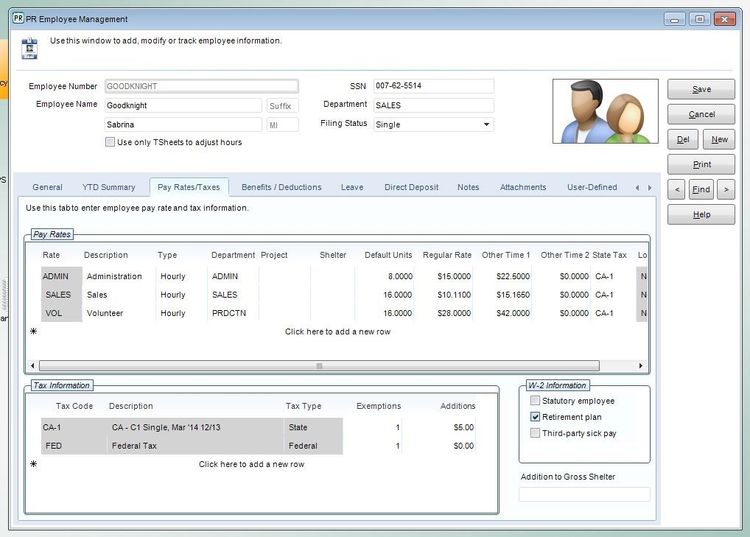

Denali Payroll from Cougar Mountain Software is a mid-market payroll solution designed to support businesses with anywhere from one to 1,000 employees. Its department codes module makes it a solid pick for accounting firms managing complex payroll structures.

In Denali, you can create unlimited department codes and link them to specific general ledger accounts for tracking payroll expenses. For example, you can record admin employees’ wages in a separate account from those in sales or production. If needed, you can even group multiple departments under a single expense account for simplified reporting.

Additionally, you can assign tax expenses, like federal withholding or unemployment insurance, to specific GL accounts. This makes multi-state payroll management much easier. Similarly, you can map benefits, like 401(k) matches or health insurance contributions, to certain accounts for better oversight of employee compensation packages.

When you process payroll, Denali automatically posts debits and credits to the right accounts. This saves you time and removes the hassle of manual reconciliation or corrections.

Paymate Clarity - Best Job Costing and Allocation Tool

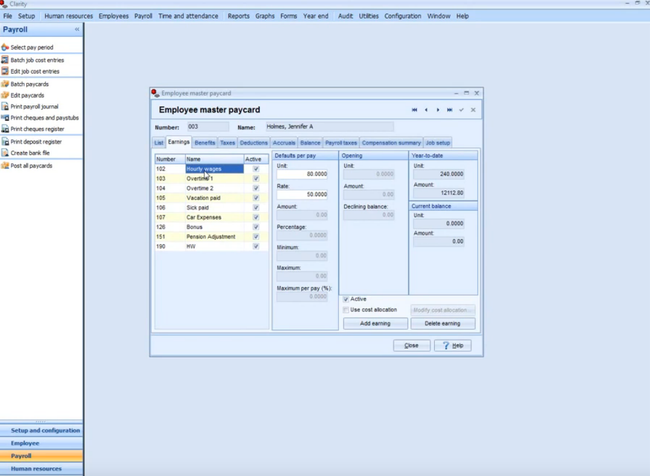

Paymate Clarity’s makes payroll simpler by combining wage calculation with smart cost tracking. When employees log their hours, Clarity’s payroll module links these records to predefined cost dimensions, including:

- Locations

- Tasks or work codes

- Cost centers or departments

- Specific projects or jobs

You can define these to align with your business structure, each with its own unique parameters like wage rates, overhead percentages, and benefit allocations. Clarity can even split employee costs across multiple departments or jobs based on hours worked or preset percentages. This helps you track project profitability and uncover opportunities to save on labor costs.

For companies with complex payroll needs, Clarity handles pay grids, multiple union agreements, and overtime rules. It’s a good fit for medium- to large-sized companies looking for reliable, on-premise payroll software.

Patriot Software - Best for Professional Services

Patriot Payroll is an ideal fit for nonprofits and small service businesses, especially those without an accounting background. It offers a simple payroll solution that lets you run unlimited payroll, print checks or deposit pay directly into employees’ bank accounts, set pay schedules, and print W-2 forms. Staff can also use the employee portal to see their paystubs and access other payroll info they need.

The most attractive part of Patriot Software for small businesses is the price. The base price starts at $17/month with $4/month extra for each additional user.

OnPay - Best for QuickBooks Users

OnPay is one of the top small business payroll solutions. The base package lets you assign tasks to your payroll staff, track deadlines, and sync with your primary accounting solution, such as QuickBooks or Xero. The online platform goes beyond payroll by providing benefits administration such as health insurance deductions and 401(k) contributions.

A payroll system for your small business like OnPay will ensure you have the features you need to pay your employees on time. Most payroll solutions bill on a per-employee/month basis, meaning the bigger you get, the more you’ll pay. OnPay charges one of the lower per-employee rates at $6/month. There is a free trial for the first month of service.

View more options on our small business payroll software guide.

Payroll4Free - Best Free Option

Payroll4Free is a forever-free payroll solution, making a great choice for start-ups and small businesses looking to save on operating costs. All basic services are free as long as you have less than 25 employees. Payroll4Free does have small ads placed inside the software in order to justify the program being free, but it remains a fully-featured program to let you pay your employees.

Features include paying employees and contractors, tax calculations and forms, and vacation time tracking. Direct deposit is available. However, you’ll have to use your own bank to transfer direct deposit funds to your employees or pay a $35 per month charge.

View more options on our free payroll software guide.

Gusto - Best Online Payroll Options

Gusto is one of the most widely used online payroll options. It lets users log in from anywhere using a web browser or mobile device. Its payroll capabilities include deductions and filings, direct deposits, W-2s, and 1099s. It also includes additional HR features such as onboarding, benefits management, and time tracking with paid time off.

There are 3 plans available for Gusto, depending on the feature set your business needs. Advanced features available in higher plans include permissions, onboarding capabilities, time-off requests, and an employee directory with surveys.

CheckMark Payroll - Best for Mac

CheckMark Payroll offers both a Mac and Windows version that operate exactly the same, meaning one version receives the same updates and attention as the other. In a world where a large percentage of payroll solutions are intended to be used on PCs or are web-based options, this is a relief for those loyal to their Mac operating system.

Automatic updates keep the software operating with the latest patches for enhancements, tax updates, bug fixes, and more. The software provides a free trial and an easy transition into their paid package. Unlike many tiered software, CheckMark provides all available features with their base product. The difference between their Pro and Pro+ is the amount of included support.

PayBuddy - Best Canadian Payroll Option

PayBuddy is a Canadian payroll solution within the NetSuite ecosystem. It offers features like attendance and leave management, payroll processing, and real-time financial reporting. Its integration within NetSuite ensures a unified platform for managing payroll and financial data, significantly reducing manual entry and enhancing data integrity.

PayBuddy’s capability to handle complex payroll calculations and compliance requirements, including provincial and federal taxations and CRA obligations, makes it a valuable tool for Canadian businesses looking to optimize their payroll operations within the NetSuite environment.

What Is Payroll Software?

Payroll software is designed to manage all elements of executing employee compensation, including wage calculation, check printing or direct deposit, and payroll tax management. Payroll software remains the key financial focus of all HR software packages and a necessary tool for payroll departments or human resources.

Full-service payroll software calculates and tracks employee salaries, wages, bonuses, tax withholding, and deductions. It prints employee paychecks, provides reports to manage employee pay records better, and generates complete weekly, monthly, quarterly, and annual payroll tax-related forms and reports.

Key Features

- Salary and wage calculation: Calculation of employee paycheck amounts based on time tracking hours worked, specified salary and wage rates, and any other contributing factors

- Check printing: Print physical employee paychecks for distribution and tax filing records. Batch printing can offer efficiencies versus writing individual payroll checks

- Paystubs: Provides detailed paycheck information covering hours worked, salary/wage earned, deductions, tax withholdings, etc.

- Deductions management: Allows custom control over withholding funds from paychecks to cover taxes, benefits, garnishments, health insurance, retirement contributions, etc.

- Multiple state tax tables: Calculate varying tax rates based on individual state requirements

- Overtime management: Pay overtime at alternate pay rates or allow for the accrual of vacation time based on overtime worked

- Electronic payroll tax filing: Allow for the digital submission of direct deposit payroll returns without requiring paper-based submissions

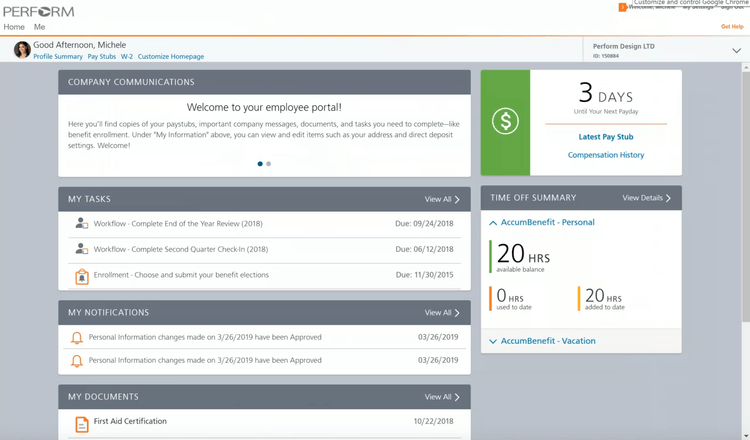

- Employee self-service payroll portal: Allow staff to check on paycheck data such as withholding settings, vacation accrued, and tax forms, as well as enact changes without additional administrative support

- Time tracking: Allow employees to report time (either in real-time or after-the-fact) for wage calculation purposes

- Direct deposit: Allow for automatic deposit of payroll funds to employee bank accounts

- Certified payroll: Ensures third-party verification of wage payments and confirms that wages are in accordance with prevailing wage standards

Benefits

Critical business benefits of using effective full payroll software include:

- Reduced administrative effort, time, and cost of compensating employees through software automation features

- Increased employee satisfaction based on accurate and timely payroll delivery

- Easier observance of governmental requirements for payroll tax filing and remittance

- Improved staff retention through the execution of compensation packages that reward employee performance

The following benefits can remove the frustration caused by using an outdated, manual payroll method:

- Automate Tasks: Manual payroll systems are incredibly time-consuming. Cloud-based payroll software systems have been proven to save time by automating tasks.

- Increase Accuracy and Minimize Errors: Payroll software can assure your business accurately withholds taxes for employees and pays into mandatory fees such as Worker’s Compensation. Once the initial information is input into the system, payroll software can automatically calculate figures and log them in the appropriate accounts, reducing errors. Avoiding simple mistakes saves your company money and resources.

- Save Time: Automating these actions makes generating payroll a much simpler and quicker process than trying to perform these duties manually. Timely and accurate employee payment is critical to any business of any size. Late payment of withheld taxes can even result in substantial financial penalties.

How to Choose Software

Whether your organization is a small business, a non-profit organization, or a multinational corporation, you must have an accurate and timely way to account for payroll expenses, withhold and pay government taxes, and generate the proper reports required by law. This, more often than not, means the implementation of full-service payroll software into your accounting system. Without this automated software, the detailed elements of each task could quickly become overwhelming.

- New buyers and small businesses: Small business owners will look for an easy and affordable way to pay their employees. A small business payroll system’s core functionalities include wage calculation, check printing, and deduction management. Self-service payroll systems allow employees to contribute to their time tracking and tax filing.

- Existing users desiring functions beyond core payroll: Buyers that already have an online payroll solution but are unsatisfied with the functionality may desire additional features to meet their growing needs. If a business has enough employees, they may avoid printing pay stubs and look for an employee self-service portal. They may also desire a way to file payroll taxes electronically and better manage employee benefits such as overtime accumulated.

- Large companies and global enterprises: Larger employers will have more complex payroll processes. For example, companies with 500+ employees will likely need an entire department to process payroll. New regulations such as the Affordable Care Act have made accurate record-keeping more important than ever before. Many recommended options will include solutions with a heavy human resource management side to them. This could include a self-service tool that lets employees do anything from submitting time off & PTO requests to managing 401k contributions.

Does QuickBooks Work as a Payroll Software?

Payroll is an available add-on for Intuit’s QuickBooks Desktop or QuickBooks Online. It is also available as a standalone payroll option to use alongside an alternative accounting program.

QuickBooks Payroll is one of the least expensive options on the market, starting at $36/month plus $2/employee/month. It can also be billed annually for additional savings. There is a free trial available for 30 days. Learn how you can set up Payroll with your accounting system:

Common Pain Points

- Software integration issues: Manual intervention will be needed when your accounting solution does not interact correctly with your timekeeping program. This may require an employee to manually transfer the data into the appropriate program, which means a lot of hours spent doing data entry rather than focusing on other work. Payroll software can integrate with both solutions, creating a single system for handling these tasks.

- Incorrectly handling payroll taxes: Handing an amount incorrectly on taxes can be very burdensome for employees and employers. Many employers struggle to calculate taxes yearly, which can require manual adjustments and put them at risk of human error. Payroll systems will let you automatically deduct and cover payroll taxes for your employees. These funds are then submitted to the government on their behalf.

- Compliance risks: Businesses must adhere to several local, state, and federal laws when processing payroll. These laws are affected by the number of employees and will affect how much tax is withheld. Online payroll software keeps you up-to-date on the latest minimum wage laws and provides any periodic reporting required to the government to ensure compliance with wage laws.

Payroll Software Trends

- Payroll Software vs Outsourcing Payroll. Before deciding which direction to take your business, you’ll need to analyze the skill set of your workers, the risk tolerance of your business, and the costs involved. It’s not as black and white as evaluating the cost of software against the cost of a payroll service.

- Payroll is the most requested add-on to accounting software. In a survey of over 3,000 accounting software projects, it was determined that over 25% of accounting software buyers required payroll to be an included functionality.

- Increase in next-gen technology. In a recent study by Eightfold AI, of the over 250 HR executives polled, 77% said they use AI in payroll processing.