The Best Accounting Software for Enterprises

Accounting software can help manage financial transactions, generate reports, and maintain accurate financial records. We tested the best systems for enterprises that support numerous users, departments, and locations.

- Advanced cross-platform analytics

- Integrates with Microsoft products

- Extensive customization options

- Automated and controlled financial planning and reporting

- Flexible scalability

- No expensive hardware required for deployment

- Brainstorms from community suggestions

- Configuration flexibility

- Powerful frameworks

In this guide, we used our advanced methodology to rate the top platforms for enterprises.

- Dynamics 365 Finance: Best Financial Reporting

- Oracle Fusion Cloud: Best Global Support

- Workday: Best Budgeting and Forecasting

- SAP S/4HANA: Best Advanced Billing

- Acumatica: Best for International Operations

- Multiview: Best for Healthcare

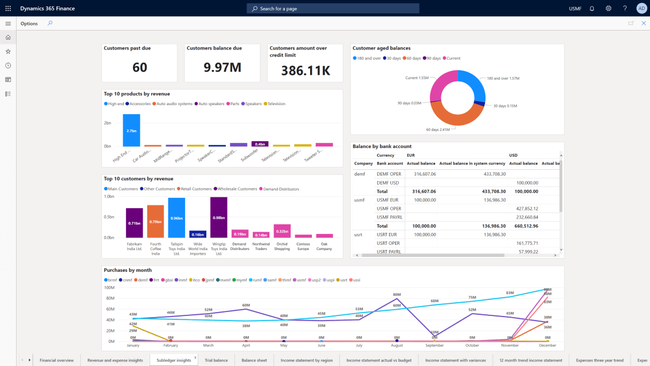

Dynamics 365 Finance - Best Financial Reporting

Dynamics 365 Finance offers a reporting feature that can provide detailed insights into your financial health. The functionality pulls real-time data directly from the software’s general ledger and other integrated modules, such as accounts payable, accounts receivable, and project management.

For instance, you’re a global retail company with operations in the U.S., Europe, and China. It can be challenging to consolidate financial reports for your quarterly board meetings, especially when each subsidiary operates in a different currency and adheres to specific local tax regulations.

Using Dynamics 365 Finance, all data from each subsidiary will flow automatically into a centralized database. The system will update the exchange rates in real-time, ensuring accurate currency conversions. You can set up a consolidated financial statement that combines revenue, expenses, and profit margins across all locations.

Power BI dashboards can present insights into regional sales performance, operating costs, and year-over-year growth trends. Dynamics 365 Finance also automatically generates compliance reports tailored to specific jurisdictions, ensuring adherence to local financial regulations and tax requirements.

Dynamics 365 Finance starts at $210/user/month, making it one of our most affordable picks. It best suits businesses with complex financial processes looking for in-depth reporting and analytics.

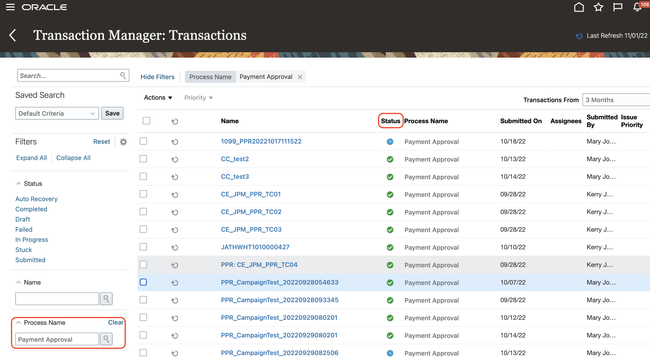

Oracle Fusion Cloud - Best Global Support

Oracle Fusion Cloud’s multi-currency and multi-language support enables you to conduct transactions internationally with accurate financials across regions without manual calculations.

The system uses AI and machine learning capabilities to continuously update global tax rules, regulatory requirements, and accounting standards. For example, if you operate in 10 countries, you’ll need a system to consolidate financial data while adhering to local laws, such as Germany’s VAT laws or Japan’s consumption tax. Oracle Fusion Cloud automatically applies Germany’s VAT rates and can adjust Japan’s consumption tax during transactions. The database’s real-time updates ensure that tax calculations are accurate and reflect current laws.

The system can convert all transactions, such as euros, rupees, and yen, into your corporate currency using up-to-date exchange rates. The built-in audit trail tracks all financial transactions, making it easier for both internal teams and external auditors to verify compliance. Users can access the platform in their preferred language, including translated reports, menus, and notifications.

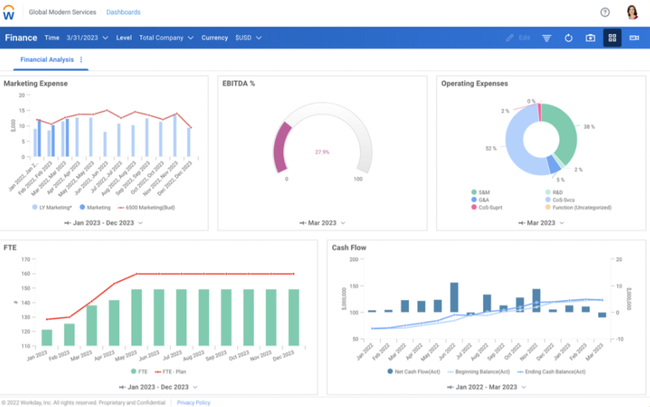

Workday - Best Budgeting and Forecasting

Workday ERP’s budgeting and forecasting feature can help you manage your financial goals, plan for your upcoming expenses, and adapt to changing market conditions. This functionality consolidates data from different entities and regions into one system, ensuring everyone is aligned.

Suppose you experience any economic changes throughout the year that cause supply chain disruptions. In that case, you can utilize Workday’s scenario analysis tool to model how prolonged disruptions could impact inventory costs, staffing, and revenue. Based on the software’s analysis, you can adjust your budget to allocate more funds toward supplier diversification and employee overtime pay.

The database also offers rolling forecasting projections that update in real time as new sales data from all regions flow into the system. The predictive analytics module identifies a downward trend in any product category, enabling you to focus on boosting sales for these items. The software’s custom dashboards will portray these adjustments so you can make informed decisions quickly.

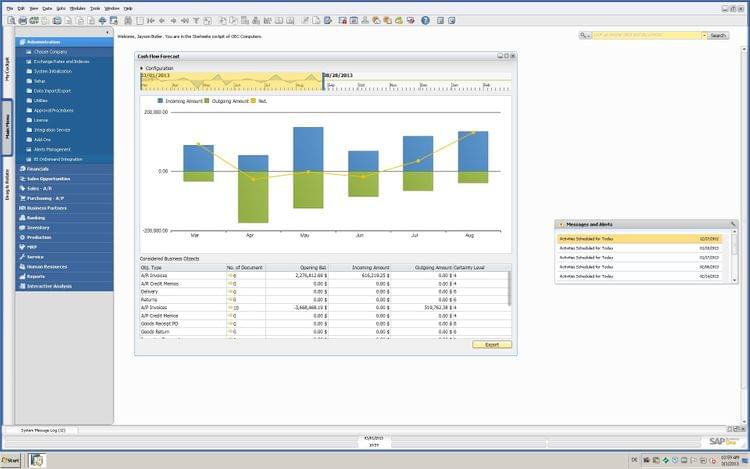

SAP S/4HANA - Best Advanced Billing

Enterprises typically deal with large volumes of transactions and customer accounts, making it difficult to track and bill clients accordingly manually. Automated billing systems, like SAP S/4HANA, can handle vast amounts of data, streamlining tax calculation, invoice generation, adjustments, and final invoice delivery, allowing you to scale without compromising accuracy.

SAP S/4HANA supports multiple billing methods, such as time-based, milestone-based, and usage-based billing, allowing you to tailor your invoicing processes based on clients’ needs. You can set up billing rules for each client, including specific fees per item and additional services like packaging or expedited shipping.

The software supports invoicing in multiple currencies, which is ideal for seamlessly managing international transactions. Once the billing is ready, SAP S/4HANA will automatically generate invoices in real-time and send them to the appropriate customer. The system can also manage recurring billing and subscriptions for long-term contracts.

Acumatica - Best for International Operations

Acumatica is an ERP with a strong focus on accounting. The cloud-based architecture offers unlimited users for flexibility and scalability. Additionally, we found Acumatica’s pricing model quite flexible, based on actual resource usage and modules employed rather than user count.

One of Acumatica’s notable features is its multi-entity support, facilitating global financial consolidation for companies with international operations. Industry-specific editions make Acumatica a solid choice for those in construction, distribution, manufacturing, retail-commerce, and services.

It’s important to note that Acumatica is currently more of a middle-market software, but the system is growing to include more enterprise functionalities.

Multiview - Best for Healthcare

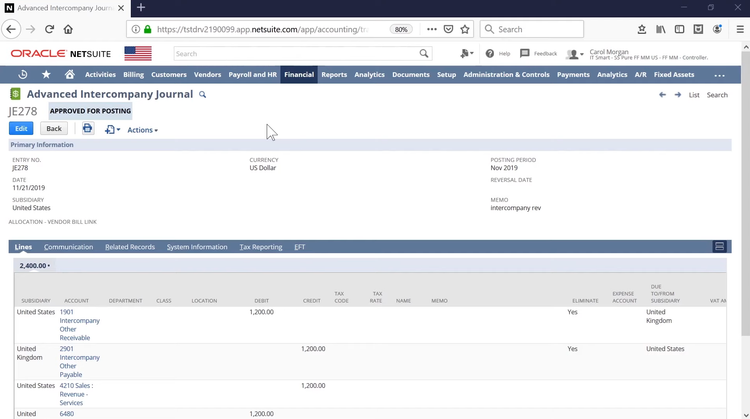

Multiview is best for large organizations in healthcare, higher education, and nonprofits. Its accounts payable module allows for multi-entity management and self-balancing intercompany transactions. This functionality helps generate up-to-date financial records across different business units or subsidiaries.

On the receivables side, Multiview ERP provides tools for managing cash receipts, customer credit, and collection issues, all within an integrated reporting framework. The general ledger module further supports this with a full audit trail, electronic workflow approvals, and document management tools. Multiview’s ability to handle miscellaneous and invoice-collected payments makes it a solid pick for enterprises improving their financial operations.

Systems We Don’t Like

Despite the name, QuickBooks Desktop Enterprise isn’t the best solution for enterprises due to its scalability and lack of customizations. The system can only handle up to 40 users and has limited transactions.

What Is Enterprise Accounting Software?

Large businesses use enterprise accounting software to cover core accounting processes while including advanced capabilities to balance your books. These additional tools give your business more insight and control into your financials.

In addition to the standard accounts payable, accounts receivable, and general ledger capabilities found in all accounting software, you’ll also find features such as:

- Bank reconciliation

- Depreciation schedules

- Advanced billing and invoicing

- Budgeting and forecasting

- Payroll

- Multi-language, currency, and entity

Enterprise accounting software differs from small business accounting software due to the robust accounting tools offered. These financial management features provide a larger level of automation to the business, meaning your employees can spend less time doing menial accounting tasks such as recurring invoices/billing/purchases and late payment reminders.

These enterprise-level accounting solutions can also allow for multiple users with user permissions, which is important for a bigger company that wants to control its employees’ access to specific software parts and monitor audit logs.

Many enterprise resource planning (ERP software) tools automate business needs on a level that is on par with enterprise accounting options. These management software options will provide all the capabilities of an enterprise accounting option while providing access to non-financial capabilities such as inventory control, e-commerce integration, and supply chain management.

Key Features

- General Ledger: A central repository for accounting data transferred from all sub-ledgers. Helps prepare financial statements that showcase company assets, liabilities, equity, revenue, and expenses.

- Accounts Payable: Manages money your company owes to others. Includes check-writing capabilities, vendor management, 1099 processing, and purchase order reconciliation.

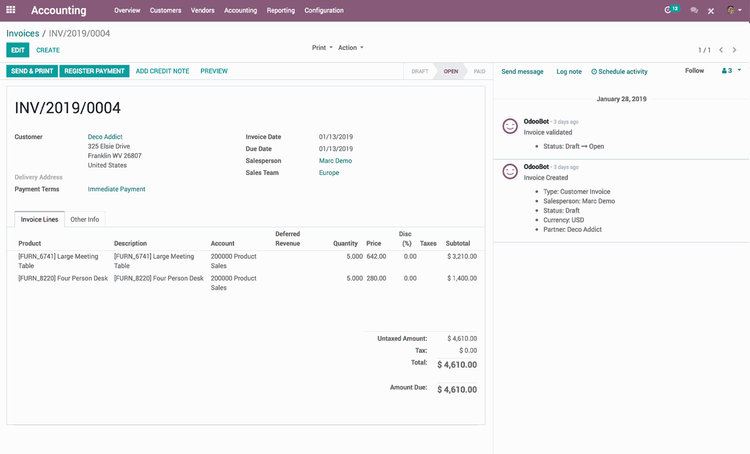

- Accounts Receivable: Manages money owed to the organization, such as debts and unpaid invoices. Includes a customer database, invoice creation, and recurring billing.

- Fixed Asset Management: Provides automation for depreciating asset value for optimal asset management strategies and accurate business tax filing.

- Bank Reconciliation: Imports bank records, often in real-time, and attempts to auto-match bank and accounting records.

- Billing/Invoicing: Create, send, and manage outbound invoices for client work. Collect payments online via credit card payments or ACH bank transfers.

- Purchase Orders: Creates financial documents issued to vendors when buying supplies or services. It can be included within accounts payable or as a standalone module depending on additional features needed, such as automatic generation based on inventory levels or approval and requisition workflows.

- Payroll: Executes employee compensation via wage calculation, check printing and direct deposit, and payroll tax management. Includes deductions management, benefits administration, and time tracking.

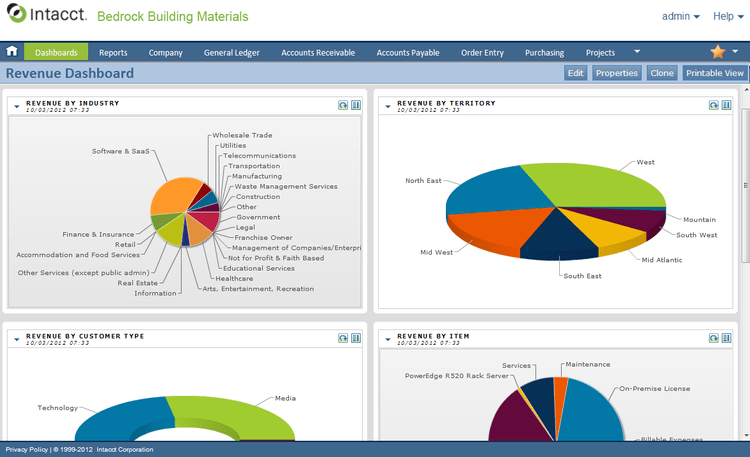

- Business Intelligence: Creates financial plans for your business through dashboards and visualizations. Includes budgeting and forecasting capabilities such as departmentalized reporting, budget vs actual comparisons, and budget approval workflows.

Primary Benefits

Despite the name, enterprise accounting software is not exclusively for larger businesses. Many small and midsize companies looking for enterprise-level features can benefit from an enterprise accounting system. Some of the top benefits of enterprise accounting programs include:

Improved Focus on Your Departments, Divisions, and Entities

A general rule of thumb is that the more advanced an accounting system is, the more easily it can handle multiple subsidiaries within your organization. Your business may operate different departments or divisions under different names, and without the proper accounting system, keeping financials separate can be messy. Limiting user access so that only members of specific divisions can edit fields related to their divisions can also cause headaches.

A more robust accounting system will help you support multiple divisions within the same company. Any transaction between related companies (intercompany transactions) can easily be handled, and users can only access files necessary to them.

Easily Add Modules at Your Convenience

Enterprise accounting software usually has a modular design, meaning the software can be bought in bits and pieces. For example, if you only required AP, AR, and a GL to begin, you could purchase the software at an appropriate price. Down the road, you can add on the advanced invoicing or budgeting/forecasting tool and pay the difference in cost.

This level of flexibility means enterprise accounting software can offer broad capabilities without forcing you to begin using (or, worse, pay for) features you have no interest in. Likewise, you can continue to use existing systems side-by-side with your newer enterprise option if your staff is reluctant to give up a solution it likes.

For example, many companies use a separate solution for customer relationship management (CRM). While your new enterprise accounting system may have its own CRM module, if it doesn’t force you to use or purchase it, the transition to the new software might go over better with your staff.

Gain Insight on Your Business Performance With Advanced Reports

Prebuilt reports, dashboards, data visualizations, and more can all be created with the advanced reporting capabilities of most enterprise accounting software. These reports can be used for both internal uses or for any regulatory compliance required by your organization. These reports aim to help interpret the results of your company’s financial performance and anticipate future performance and gains.

Pricing Guide

The cost of enterprise accounting software starts between $100,000 - $500,000 per year. However, there may be a few outliers that can cost you millions of dollars per year. These solutions come at a higher price point due to the level of use, the number of users needed, the number of required applications, and integrations with other systems.

Many enterprise accounting solutions allow you to purchase a base package and add capabilities as your business grows. Additional features such as advanced budgeting, forecasting, and payroll almost always increase the cost of the base package.

Will QuickBooks Work For Enterprise Accounting?

No, QuickBooks isn’t an enterprise accounting software. It is best suited for companies under $10 million and 30 users.