The Best Grant Management Software

Grant management software helps organizations track lifecycles, budgets, and compliance. We’ve analyzed top platforms for various organizations, including nonprofits and government agencies.

- Provides regular grant updates

- Has an efficient search functionality

- Interdepartment workflows reduce paperwork

- Built on Salesforce infrastructure

- Provides actionable strategies from data

- Comes in two packages as Nonprofit Cloud or Nonprofit Cloud for Grantmaking

- Purpose-built to amplify impact of grants

- Streamlines the grant process from start to finish

- Custom reports for pre-award, post-award, project financials

Grant management software is a specialized tool that helps organizations streamline the process of making, obtaining, managing, and reporting on grants. We ranked our favorites based on our advanced review methodology.

- eCivis: Best Overall

- Salesforce for Nonprofits: Best for NPOs

- AmpliFund: Best for Government Agencies

- Zengine: Best for Program Management

- Blackbaud Financial Edge NXT: Best for Nonprofit Accounting

- MIP Fund Accounting: Best Fund Accounting Tools

- Submittable: Best for Submission-Based Programs

- SylogistMission ERP: Best for Faith-Based Organizations

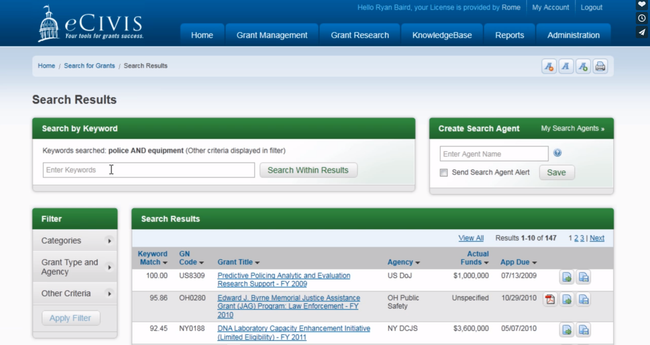

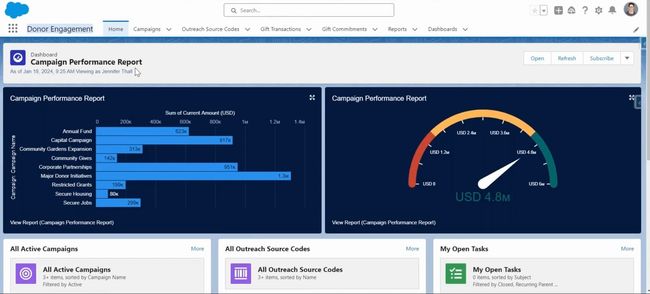

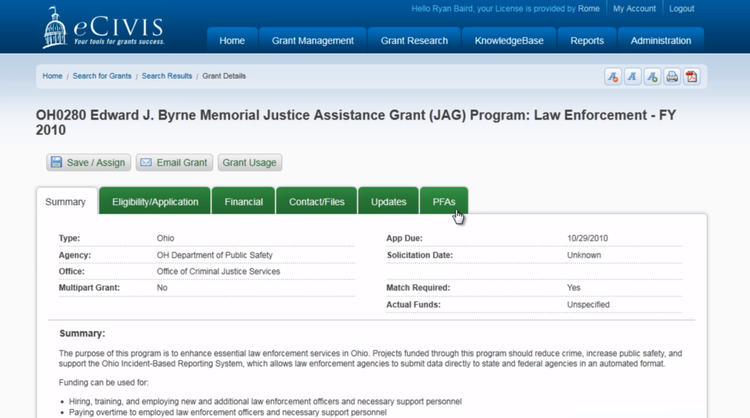

eCivis - Best Overall

eCivis’s tailored search capabilities are useful for local, state, and tribal governments. Unlike traditional methods that require manual searches through grants.gov, eCivis enables users to locate relevant grants quickly. They can make custom “search agents” with keywords and filters to get email alerts for new funding opportunities (NOFA).

eCivis centralizes grant management activities from application tracking and expenditure management to grant recipient oversight. This integrated approach simplifies performance tracking and reporting on grant utilization. eCivis is adept at helping prepare budgets and cost allocation plans, ensuring compliance with federal regulations and optimal use of grant funds.

Additionally, eCivis provides educational resources, including webinars, guides, and online courses. These are designed to enhance government employees’ skills in navigating complex grant management tasks. However, we found the breadth and depth of eCivis’ feature set excessive for smaller institutions and municipalities.

Salesforce for Nonprofits - Best for NPOs

Salesforce for Nonprofits is our top selection for NPOs, as it caters to both grant seekers and grantmakers in the nonprofit sector. This platform equips them with tools to manage the entire grantmaking cycle, including tracking grant applications, managing budgets and disbursements, and conducting due diligence.

For grantors, Salesforce for Nonprofits provides customized application forms that allow for document uploads and utilize branching logic to adapt based on the responses received. It also includes budgeting tools that link financial plans to disbursements, helping track expenditures against specific line items. For grant seekers, the platform offers access to customized grant portals and helps track participant enrollment and service deliveries.

However, the core plan, Nonprofit Cloud Enterprise Edition, starts at $60/user/month, billed annually. If you want application and budget management tools, you’ll need to add the Nonprofit Cloud for Grantmaking plan at $175/user/month billed annually. These costs can escalate quickly for smaller nonprofits.

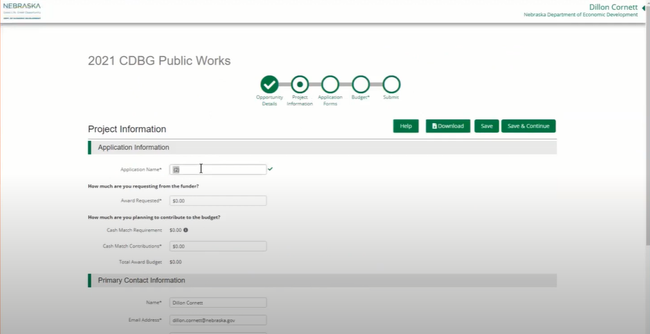

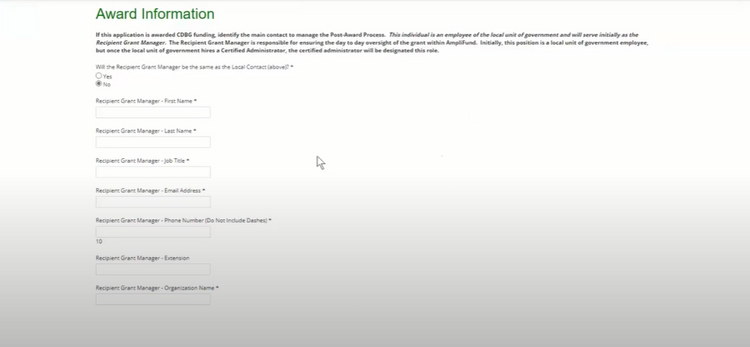

AmpliFund - Best for Government Agencies

AmpliFund is best for government agencies because of its grant lifecycle management module that maximizes efficiency across various levels. AmpliFund supports state, city, county, and tribal governments, allowing you to manage complex procedures, contract policies, and compliance through every step.

AmpliFund helps both government grant makers and seekers report on post-award outcomes. You can create and track budgets, indirect costs, and staff hours to capture data throughout the project. Based on the data you capture, flag at-risk items to ensure you don’t go over budget. Once you complete the program, create ad-hoc dashboards to report on performance and financial outcomes. It’s a great way to measure success and overall impact on your community.

The lifecycle management helps government agencies comply with the Federal Funding Accountability and Transparency Act (FFATA) and the Government Performance and Results Act (GPRA). While AmpliFund does not disclose its pricing publicly, it starts at a higher price point. The cost of implementation and ongoing usage could be a drawback for nonprofits or smaller government entities.

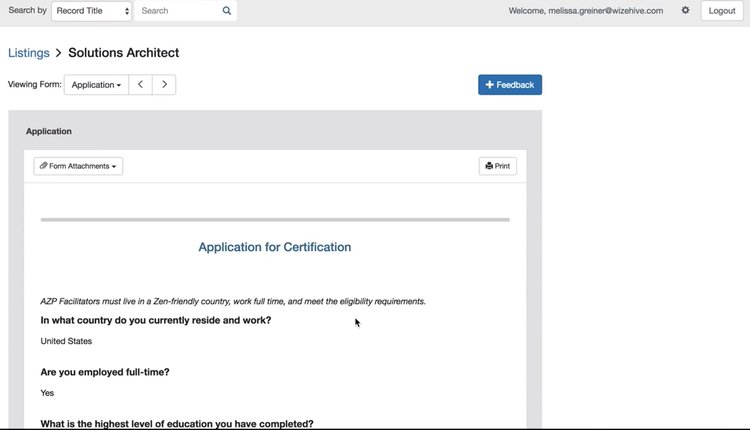

Zengine - Best for Program Management

Zengine by WizeHive is our top recommendation for managing scholarships, fellowships, and internships due to its support for application-based programs. Ideal for charitable foundations, nonprofits, corporations, and educational institutions, Zengine facilitates the entire lifecycle of these programs on a cloud-based platform.

It also allows you to create custom online application forms. Plus, it integrates with major software solutions like QuickBooks Online, Salesforce, GuideStar, and Slack, which broadens its utility and flexibility. Additionally, we found its CRM system comprehensive, making it easier to track applicants, students, donors, reviewers, and volunteers.

While Zengine offers a customizable dashboard, industry-specific customizations for reporting come at an additional cost. Additionally, some users have reported experiencing occasional bugs and speed issues with the software.

Blackbaud Financial Edge NXT - Best for Nonprofit Accounting

Financial Edge NXT by Blackbaud is a highly popular nonprofit accounting software option with grant management functionality. It’s best for medium to large non-profit organizations needing a detailed and customizable system. Key features include the organization and storage of crucial grant information, notifications for upcoming deadlines, and automation of reimbursement billing processes.

The software offers detailed records for each grant and fund, improving the accuracy and efficiency of tracking and reporting. It supports the management of intricate grant requirements, such as monitoring reimbursements, budgeting, allocations, and the overall grant reimbursement process. Additionally, users can manage detailed budgets at the grant level, minimizing the dependence on manual spreadsheets and allowing for the comparison of unlimited budget scenarios to prioritize expenditures better and assess funding needs.

While Financial Edge NXT is fairly intuitive and reliable in performance, it does have limitations. Users have noted restricted customization options for reports and a lack of drill-down capabilities in report line items.

MIP Fund Accounting - Best Fund Accounting Tools

MIP Fund Accounting, formerly Abila MIP, is our preferred choice for small to mid-sized associations, government agencies, and nonprofits. It supports essential functions like grant management, fund accounting, budgeting, human resources management, and reporting.

MIP helps track grant information and documentation, monitor budget positions, forecast expenditures, and gather performance data. Offered both as a purchase upfront or on a SaaS model, MIP provides flexibility in deployment, with options for a locally installed or web-based solution.

However, some users find MIP’s interface clunky and not very intuitive. Additionally, many user reviews express a need for more advanced reporting features, like improved capabilities for multi-entity reporting.

Submittable - Best for Submission-Based Programs

We picked Submittable for grantmakers, publishers, and organizations managing submissions and applications. It’s useful for nonprofits involved in grants, scholarships, or other submission-based programs. That’s because the platform has a drag-and-drop form builder supporting conditional logic and several file types, including text/document, image, audio, and video formats.

Key features of Submittable include application management, review, and reporting functionalities. It enhances communication through built-in tools for bulk messaging and customizable email templates. Additionally, the software allows users to assign applications to reviewers and customize forms to capture applicant information.

While Submittable has a comprehensive feature set, it does not publicly disclose its pricing. Even so, it’s generally more expensive than other grant management options.

SylogistMission ERP - Best for Faith-Based Organizations

SylogistMission ERP is a cloud ERP for nonprofits, NGOs, and faith-based organizations. It’s effective for entities needing financial management and grant tracking within Microsoft’s ecosystem. As a Gold Microsoft Alliance partner, SylogistMission ERP is well-equipped to leverage Microsoft’s latest technologies and tools.

SylogistMission ERP is built on Dynamics 365 Business Central, making it a good choice for users already familiar with Microsoft products. The ERP includes functionalities for managing budgets, awards, financials, and fixed assets. It also tracks KPIs like actuals versus budget and allows users to customize reports sorted by department, award, or fund.

However, pricing details aren’t disclosed publicly and require a developer quote. Additionally, the platform’s reliance on the Microsoft product ecosystem might make it less suitable for those unfamiliar with Business Central.

What is Grant Management Software?

Grant management software helps automate and manage nearly all administrative processes related to grant funding, from discovery to status tracking to post-award reporting. Grant management systems can be used by either grant seekers or grantors to streamline the entire funding process with access to databases, application templates, document management, and automated deadline notifications.

This software is most often used by:

- Nonprofit organizations

- Government agencies

- Research centers

- Universities and other educational institutions

Yet grant funding isn’t as easy as receiving or sending a check. Both grant seekers and funders must carefully manage the process to ensure compliance with the grantmaking process.

The Grant Management Process

The grant lifecycle has three main stages: pre-award, award, and post-award. Whether you are a grant seeker or grantor determines most of the work during the grantmaking process.

- Pre-award: An individual, organization, or company sets aside funds for competitive/merit, formula, continuation, or pass-through funding based on pre-award research efforts. On the side of grant seekers, pre-awards begin when the organization’s financial need is identified. They begin searching for applications for available grants that meet this need specifically or grantmakers who are open to various ideas.

- Awards: Seekers submit applications and additional information to the grantors for consideration. Submission management allows funders to organize incoming applications. A review process ensures the grant seeker(s) meet all eligibility requirements. Awards are then determined, and grant seekers are paid the predetermined funds.

- Post-award: Grants administration can range from generic follow-up reports to thorough audits to ensure stakeholders that the funding was used appropriately. Recipients may need to compile a project management report detailing how they used the funds.

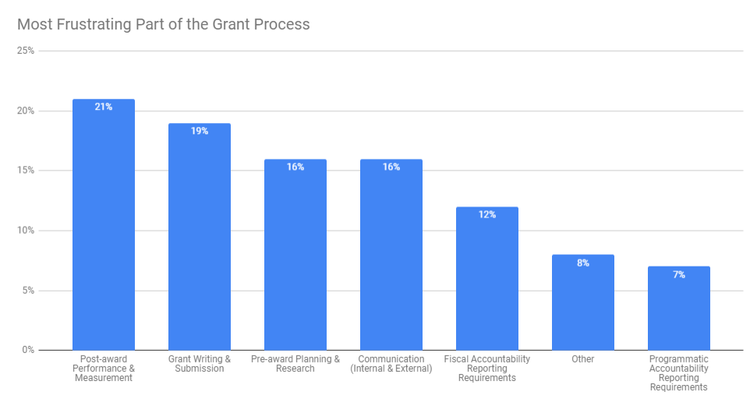

Without software, there are many ways this process can go wrong. These points were reported as the most frustrating parts of the grant management process among public sector and nonprofit organizations:

Fortunately, user-friendly software can help your organization avoid these frustrations with these popular features:

Key Features

- Grant database

- Grant application templates

- Document management

- Deadline notifications

- Post-award reporting

- Grantor compliance management

Benefits

- Find more applicable grants faster. With a database full of thousands of small to large federal and non-federal grant programs, a proper grant management system can narrow down the search based on your needs and funding criteria.

- Improve document management and organization. Grant management systems make uploading and storing important documentation such as application templates, financial statements, reporting data, and contact information for current, past, and potential grantors easier.

- Streamline communication and information sharing between departments and individuals. Users can check for grants across departments to ensure the organization has not submitted duplicate applications and can avoid accepting duplicate awards.

- Track application statuses. Easily see the status of every grant application submitted.

- Save time on grant writing and the submission of application forms. Create, modify, and store grant application templates to save time writing future applications.

- Get notified of important deadlines. The software can send alerts about upcoming deadlines, so your staff won’t miss an important meeting or forget to apply by its due date.

Pricing Guide

Grant management software pricing can range from below $3,000 to over $200,000 per year. How much grantseekers and funders should spend on software depends on the organization’s size and the expected functionality of the system. As your organization grows, you’ll want a grant management system to scale with your operations. A grant management system can help increase the number of grants without adding more administrative work. If you need more complex systems, you will have to pay more.

More Nonprofit Systems to Consider

Nonprofits, universities, and other institutions utilizing grant management systems may benefit from these additional software solutions:

- Nonprofit Accounting Software

- Fundraising Software

- Donor Management Software

- Fund Accounting Software

- Church Accounting Software