The Best Financial Management Software

We evaluated the leading platforms based on factors like reporting capabilities, customizable invoicing, and scalability. These systems streamline financial workflows and deliver real-time insights with tools like advanced analytics and cloud banking.

- Customizable invoicing

- Over 150 prebuilt reports

- Scalability for multi-entity support

- Feature sets for multiple industries

- Advanced reporting with customization options

- Hundreds of third-party add-ons available

- Combined ERP and CRM

- Creates quotes, orders, and invoices in Outlook

- Integrations with Microsoft applications

In our independent review of the top financial management systems, we ranked the best products based on cost-effectiveness and key features like budgeting, forecasting, invoicing, and billing.

- Sage Intacct: Best Overall

- NetSuite: Strong Reporting Capabilities

- Business Central: Integrated Product Ecosystem

- CustomBooks: Best Cloud Banking Features

- Workday: Best Versioning & Modeling

- Acumatica: Versatile Scalability

- Accounting Seed: Best for Project Accounting

- QuickBooks Online: Best for Startups

- Multiview: Best for Healthcare Organizations

- SAP Business One: Best for Purchasing

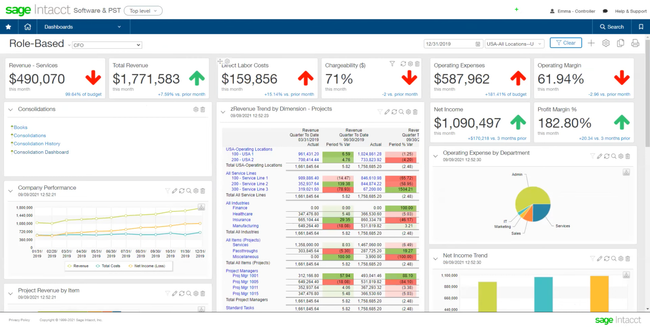

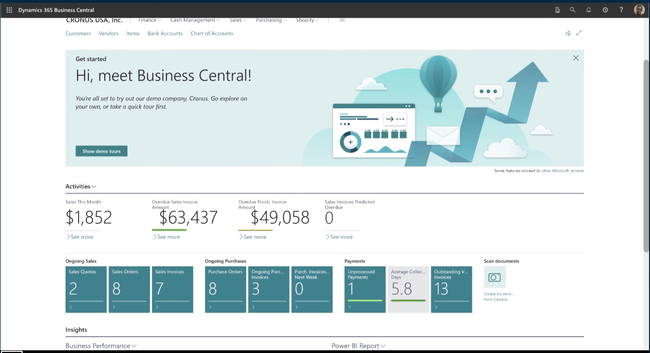

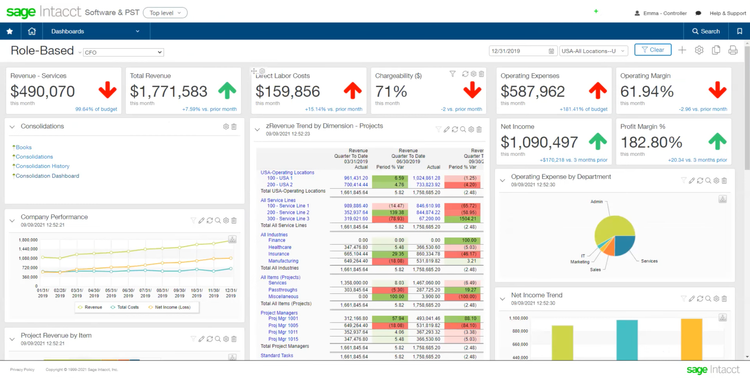

Sage Intacct - Best Overall

Sage Intacct delivers a user-friendly interface and customizable invoice templates, allowing users to quickly create and send them to customers. The platform also offers automated reminders and tracks invoices and payments in real-time.

Another key benefit of Sage Intacct is its reporting capabilities. With over 150 pre-built reports and dashboards, you can quickly get insights into your expenses, revenue, and profitability. Users can easily customize reports using the intuitive drag-and-drop report builder.

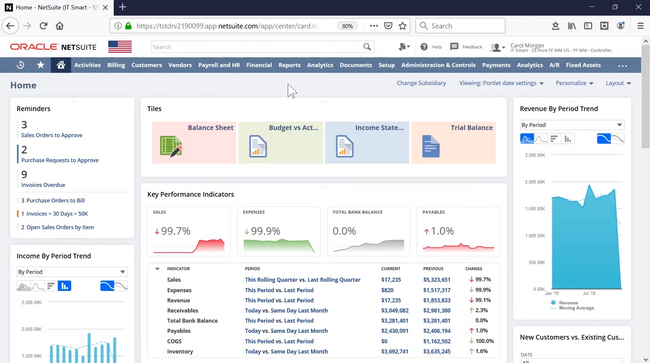

NetSuite - Strong Reporting Capabilities

NetSuite’s reporting module offers a range of pre-built financial reports. These include accounts receivable, accounts payable, and inventory. Users can also create custom reports that are tailored to their specific business needs.

NetSuite reporting module includes advanced financial analysis tools. Users can analyze budgeting and forecasting, trend analysis, and multi-currency reporting. NetSuite goes beyond pre-built reports by offering a highly customizable report builder. Users can create custom reports tailored to their specific business needs.

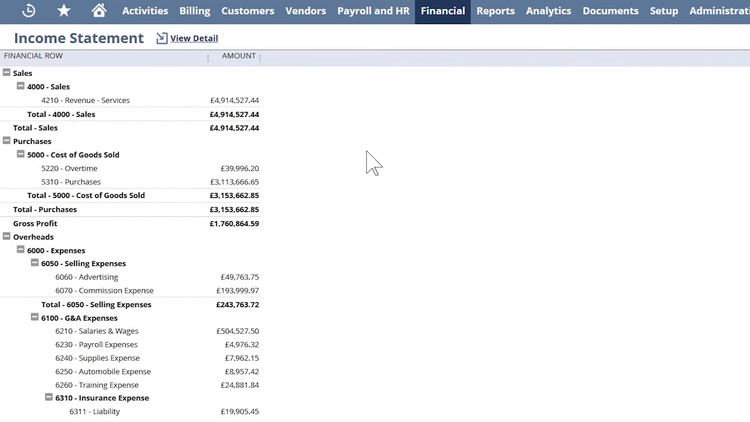

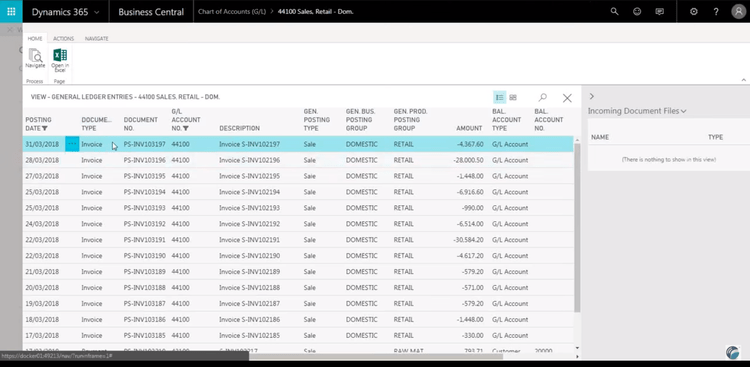

Business Central - Integrated Product Ecosystem

Dynamics 365 Business Central made it into our top picks because it integrates seamlessly with other Microsoft applications like Office 365, Power BI, and Azure. Business Central provides a user-friendly and familiar interface, especially for users already accustomed to Microsoft products like Outlook, Word, or Excel. This familiarity can lead to a shorter learning curve for users and faster adoption of the ERP system.

As part of the Microsoft ecosystem, Business Central offers an end-to-end solution for businesses, covering finance, sales, and customer service. This can streamline operations by providing a unified platform for various business functions.

CustomBooks - Best Cloud Banking Features

CustomBooks integrates your banking transactions directly into its system. You can link checking, savings, credit, and even PayPal accounts, and CustomBooks downloads transactions automatically twice a day. This reduces the amount of manual data entry for your team, making it ideal for smaller businesses with less time and resources for administrative tasks.

Once CustomBooks imports transactions, you can create custom categorization rules. These direct the software to auto-assign transactions to specific income or expense buckets based on recurring trends, like a transaction description or a vendor’s name. For more granular internal tracking, you can even add fields like company, class, and project.

The cloud bank tool includes an array of features:

- Transaction matching: Matches bank transactions with open invoices or previously recorded transactions and italicizes suggestions for user review.

- Batch categorization: Allows you to apply updates consistently across the ledger for multiple bank transactions in bulk.

- Approval workflows: Flags transactions for review and allows you to approve these within the software for audit readiness.

The Start Up Plan, at $19/month for unlimited users, includes the cloud banking tool, time tracking, project/jobs, and reports. While the system often requires multiple clicks to complete routine tasks, its deep functionality for unlimited users outweighs its crowded interface.

Workday - Best Versioning & Modeling

Workday Adaptive Planning’s in-memory modeling engine makes it quick and easy for finance teams to forecast with precision. They’ll set up your chart of accounts and define key drivers like tax rates and unit sales. Using Excel-style logic inside a guided interface, they can build formulas that connect assumptions across your income statement, balance sheet, and cash flow. No need to write code or SQL; just use spreadsheet-style logic and drag-and-drop dimensions like departments or regions.

Once the model is in place, your FP&A team can create versions—separate budgets or forecasts that use the same logic but different inputs. Just clone an existing budget or forecast, name it, and assign who can edit or view it. This lets you build rolling forecasts or simulate potential changes without disrupting your base plan. You’re not limited to static time periods, either. Your financial analysts can generate rolling 12-month or multi-year projections using seasonal, monthly, or quarterly timeframes.

Instead of recreating reports to run scenario analysis, you can compare any two versions with a few clicks. For example, you can stack your “May Forecast” against your original “Annual Budget” to isolate the financial impact of delaying hiring. Plus, changes ripple in real time across the modeling system; Workday automatically recalculates dependent line items and updates any related dashboards. It even flags variances in reports so you can see the impact instantly.

The minimum software package starts at $25,000 per year; for that reason, Workday is not intended for small businesses. It’s best for larger organizations needing company-wide planning. Final costs depend on your desired package, contract length, and the number of licenses and integrations needed.

Acumatica - Versatile Scalability

Acumatica bases total ownership costs on the number of modules and resource usage, such as transaction volumes and data storage, rather than user count, making it ideal for growing businesses. It also has customizable workflows, empowering users to tailor processes to align with their unique business needs. This adaptability ensures that businesses can maintain efficiency and evolve with ease.

The platform also delivers real-time financial insights, enabling informed decision-making and real-time monitoring of financial health. For organizations with multiple entities or subsidiaries, Acumatica offers robust multi-entity management within a unified system.

Accounting Seed - Best for Project Accounting

Accounting Seed is ideal for service-based industries or those with complex project management requirements. Its support for multiple currencies caters to international businesses dealing with diverse currency transactions.

Accounting Seed’s native integration with Salesforce makes it a good fit for companies relying on the platform for customer relationship management. This integration enhances efficiency by eliminating data silos and providing a holistic view of customer interactions and financial transactions.

QuickBooks Online - Best for Startups

QuickBooks Online offers automated bookkeeping for startup businesses investing in their first accounting system. Specifically, its invoicing module allows you to create professional bills for every customer efficiently. It comes pre-built with templates, so you can add your logo, brand, and colors. From there, just add the specific line items and email it directly to the client from within the system.

Once the customer receives the invoice, they can pay via credit/debit cards, ACH, or through platforms like PayPal. This reduces delays and increases your cash flow, which is crucial for startups without much capital. And when it’s received, the system automatically records the payment, eliminating the need to input transactions manually.

In addition to invoicing, QuickBooks Online offers a solid accounting suite. This includes features like expense management, full general ledger, and automated bank feeds. However, Intuit is notorious for raising prices in recent years. This has made the lowest Simple Start plan a bit pricey, starting at $38/month for one user.

Multiview - Best for Healthcare Organizations

Multiview has strong compliance features and comprehensive audit trail capabilities. These include Sarbanes-Oxley (SOX) compliance, ensuring that financial data adheres to regulatory requirements.

The platform also provides detailed audit trails, tracking every financial transaction, change, or access. Multiview also excels in vendor and expense management, simplifying the tracking and management of expenses, invoices, and payments.

SAP Business One - Best for Purchasing

SAP Business One’s purchasing module helps small to midsize companies manage supplier relationships. The module centralizes your information, helping you quickly reference vendor details, past orders, and current pricing agreements. This allows you to analyze all of your supplier arrangements to ensure you’re paying the lowest costs for inventory. You can even track and record goods returned to vendors to receive proper credit.

The purchasing module also streamlines your procurement processes to help increase operational efficiency. It provides easy-to-follow guides for creating purchase orders and goods receipts. For clear audit trails, link purchasing documents to every order. Plus, you can configure quotations to automatically send an email to vendors, so they can easily update their offer.

SAP Business One is an ERP system built for smaller businesses looking for an all-in-one financial management solution. Pricing starts at $410/user/month, and can be deployed in the cloud or on-premise.

What are Financial Management Systems?

Financial management systems help businesses track income and expenses and plan for growth. Commonly referred to as a subset of accounting software, these management systems go beyond simple bookkeeping to help businesses make better spending decisions, create accurate financial reports, and manage assets through advanced automation. These systems also have some human resources management, inventory control, and billing and invoicing functionality.

Financial management solutions are often an important part of a complete enterprise resource planning (ERP) system. Larger businesses benefit from ERP integrations which streamline business functions all from one shared system. Financial management software helps you create a system to find the data you need without switching between different workflows.

Key Features

| Feature | Description |

|---|---|

| Financial Accounting | Revenue, profitability, and expense tracking. Main modules include general ledger, accounts payable (AP), and accounts receivable (AR). |

| Billing and Invoicing | Create and send invoices and bills for products and services rendered. Track outstanding and paid invoices. |

| Human Resources | Manage payroll, employee benefits, certification and licensing tracking, and applicant tracking. |

| Fixed Asset Management | Track the value of depreciating fixed assets in real-time. |

| Inventory Control | Track on-hand inventory assets and the costs associated with them. |

| Cash Management | Forecast internal cash flows at your company, even when dealing with multiple currencies. |

| Financial Reporting | Create financial statements for internal or external use. |

Advanced Features

| Feature | Description |

|---|---|

| Budgeting and Forecasting | Create financial plans using historical data and estimates of future market conditions. |

| Bank Reconciliation | Import real-time records on bank accounts and check if bank and accounting records match. |

| Business Intelligence (BI) Tools | Compile advanced reports on financials, operations, business performance, personnel, and more. Report on historical data or perform predictive analysis. |

| Fund Accounting | Manage income and distribution of grants, state aid, scholarships, and work-study programs. Primarily used by government agencies, nonprofits, and educational institutions requiring strict compliance standards. |

Benefits

Financial software helps businesses manage important information related to all financial processes, which leads to a lot of benefits:

Automate Processes

The system records real-time income and sales data and tracks outstanding balances. It can also send automatic payment reminders for upcoming and overdue payments. The software also assists with creating invoices to be sent out after services are rendered.

Financial management systems also keep track of the money you owe to your vendors. Want to streamline payments? The system can automatically send recurring payments as needed to avoid accruing late fees.

Streamline Reporting and Analytics

Reporting and analytics functionality in financial software gives you a deeper look into your company’s overall financial operations. A comprehensive system allows you to break down sales by date range, best-selling products and services, top-performing sales reps, and more. This gives your finance teams the ability to clearly analyze sales data and make better business decisions based on historical trends.

Financial management systems also help businesses with reporting requirements laid out by the generally accepted accounting principles (GAAP). Compliant financial statements you can run include income statements, cash flow statements, and balance sheets.

Types of Financial Management Tools

Most ERP and FP&A systems include financial management functionality, as these solutions manage a variety of business processes within an organization. These systems link back-office operations with customer-facing functionality to keep businesses fully connected. Examples of ERP software with strong financial systems include Oracle ERP, Sage Intacct, and SAP Business One.

Along with ERP integration, financial management systems work best with enterprise performance management software and customer relationship management software. Better known as EPM or corporate performance management (CPM), these solutions monitor key performance indicators (KPI) related to your business, including financials. CRM solutions allow your company to build better customer relationships and accurately prepare invoices for any financial transactions.

Business intelligence (BI) tools are another great tool for CFOs to analyze financial data. While many ERPs have built-in dashboards, many standalone tools can help add additional analysis to different metrics. Examples can range from budget variance analysis to revenue growth rates or even general profit margins by product. These insights have become essential for any business to make data-driven decisions and drive growth.

Functionality by Industry

Industry-specific ERP options are available for managing financials unique to your industry. For example, international eCommerce shops will need the ability to facilitate transactions in multiple currencies and will need a single platform capable of making those exchanges. Some other examples include:

| Industry | Financial Functionality | Description |

|---|---|---|

| Construction and Service-Based | Job Costing | Assign costs to labor, equipment, and materials needed for a job. |

| Wholesale and Distribution | Order Management | Record sales, track order status, create invoices, and manage backorders. |

| Process Manufacturers | Recipe Management | Manage the price and type of ingredients in a recipe, as well as batch scaling and substitute info. |

Price Guide

Financial management systems can range from $500 to $500,000/year depending on your business size:

| Tier | Company Size | TCO Range | Example Software |

|---|---|---|---|

| Entry-Level | 1–20 employees | $500–$5,000/year | QuickBooks Online, FreshBooks, Xero |

| Mid-Tier | 20–100 employees | $10,000–$25,000/year | Microsoft Dynamics 365 Business Central, Acumatica, Sage Intacct, NetSuite |

| High-Tier | 100–500 employees | $25,000–$100,000/year | Microsoft Dynamics 365 Financials, SAP Business ByDesign |

| Enterprise | 500+ employees | $100,000–$500,000/year | Oracle ERP, Workday, SAP S/4HANA |

Financial management software is priced based on a few specific variables, which include:

- Number of users

- Size of organization

- Functionality needed

- Number of languages and/or currencies needed

A few free, open-source financial management systems are available, though these solutions generally have limited functionality as they are geared more towards personal finance or startups and small businesses.