The Best Human Resource Software

Human Resource (HR) software is a tool used by companies of all sizes to streamline employee on and offboarding and manage employee information like benefits and taxes.

- Is scalable and customizable

- Has many HR, IT, and finance integrations

- Supports multiple countries and ensures compliance with federal workplace regulations

- Available on desktop or mobile devices

- Single unified HCM system

- Offers a variety of performance management tools

- Quick setup and ease of use

- Integrates with WordPress, Squarespace, etc.

HR software helps companies recruit, retain, and manage employees. Key functions include document management, payroll, and time-tracking. Using our advanced review methodology, we researched the top HR systems on the market and ranked our favorites below.

- Rippling: Best Overall

- Workday HCM: Best for Enterprises

- BambooHR: Best for Tech Companies

- Paylocity: Best Payroll Functionality

- Paycor: Best for Manufacturers

- Paycom: Best for Healthcare

- Gusto: Best for Small Businesses

- ADP Workforce Now: Best for Retailers

- iSolved: Best for Large Professional Firms

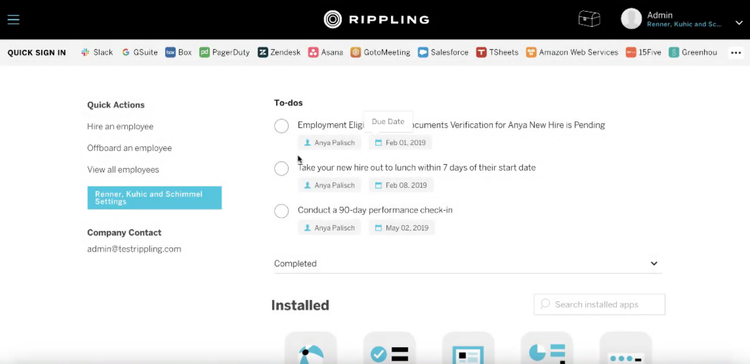

Rippling - Best Overall

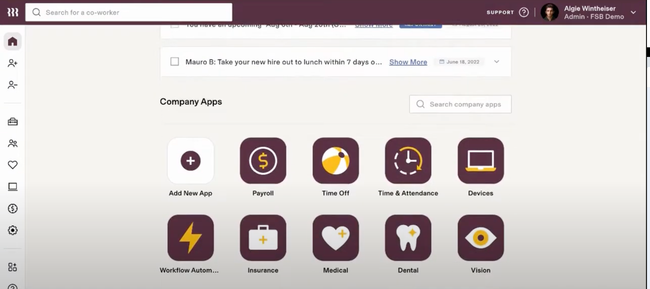

Rippling offers comprehensive features, including human resource management, IT, global payroll, and benefits. The system can be tailored to several industries to support small to enterprise-level businesses. It has strong time and attendance tools that allow employees to clock in from anywhere through the mobile app, which is essential for companies with global workforces. The logged hours are automatically tracked and synced to payroll for an efficient payment process.

Rippling’s IT management features are also noteworthy, as they help remote employees stay productive and reduce technical issue downtime. Once a remote worker is onboarded, management can create new user accounts for over 600 apps, like Slack and Google Workspace. This lets employees get up and running right away, either in the office or remotely. The IT data for each employee integrates with their HR data, helping keep all their information in one place.

Rippling’s base price is $50/month plus $8/user/month. Full pricing is available with a quote, and it can vary depending on the desired features. Some users have reported a steep learning curve due to the breadth of features included. Because of this, it offers “Rippling University” for training.

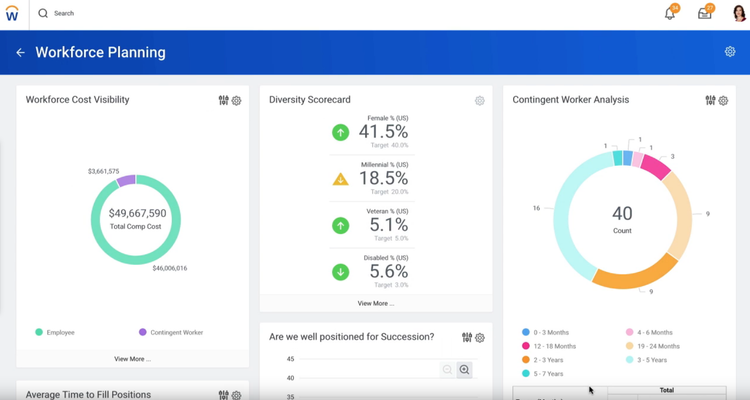

Workday HCM - Best for Enterprises

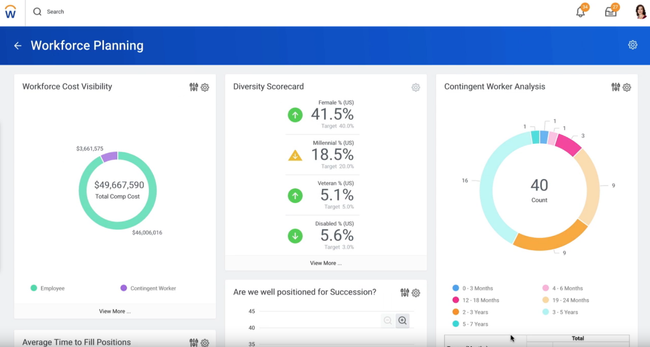

Workday HCM’s workforce management module is effective for enterprises by creating reports on key metrics. These include labor costs, total overtime, and average base salary by department. Analytic metrics are essential for global companies with thousands of employees to identify trends and visualize the entire workforce on one dashboard.

Workday HCM’s employee experience module is also effective, which can help companies support their workers. The system provides a personalized experience for employees, with dashboards to complete tasks like time off requests, provide feedback, and view tax files. Additionally, its case management capabilities are ideal for large businesses. It can help HR teams solve cases faster with detailed histories and quick-reference employee data. Because of its many modules, Workday HCM has a steep price compared to other systems, starting at $100/user/year.

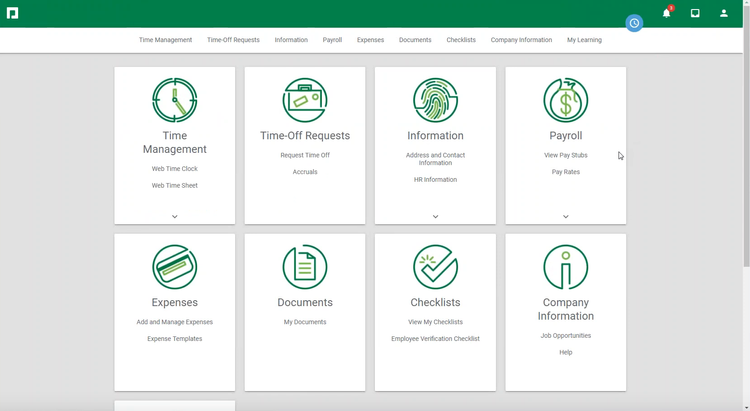

BambooHR - Best for Tech Companies

BambooHR has strong recruitment features and over 100 integration options. Specifically, it integrates with top job sites like ZipRecruiter and Indeed to provide fast postings and find top talent. Its Applicant Tracking System mobile app even lets recruiters post jobs, review candidates, and see resumes on the go. This is important for the tech industry, as there is a high demand for top talent.

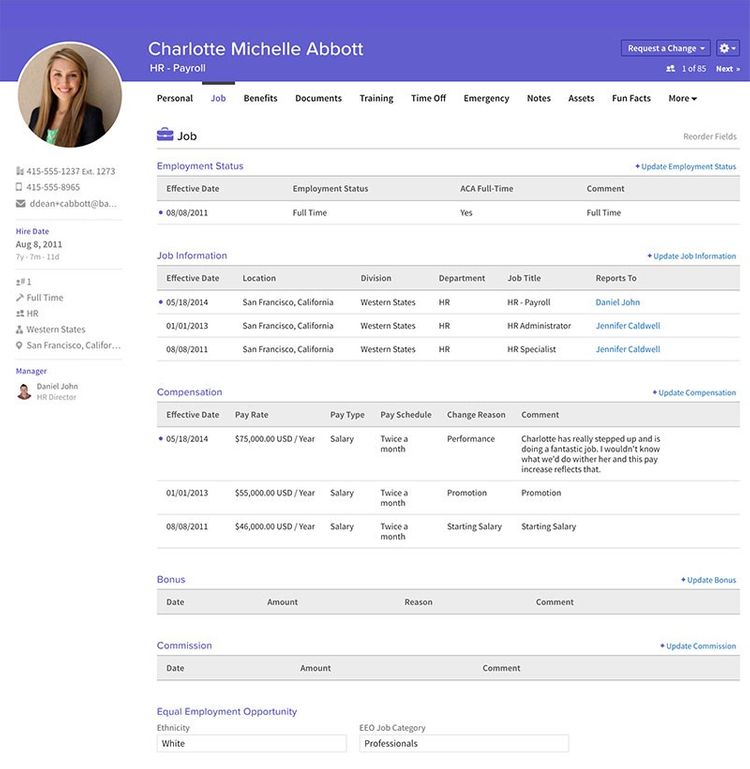

You can also use the self-service onboarding, which has a customizable preboarding packet, streamlining tedious paperwork like filling out forms. Equipped with e-signatures, the digital forms allow new hires to quickly acclimate to their new roles. Management can set goals, conduct reviews, and generate performance reports for existing workers. Management can make better-informed decisions, and employees can feel recognized.

BambooHR’s Core plan includes hiring and onboarding, HR, and benefits tracking, making it a good option for mid-sized companies. However, we dislike that the payroll, benefits administration, and time tracking modules are separate add-ons.

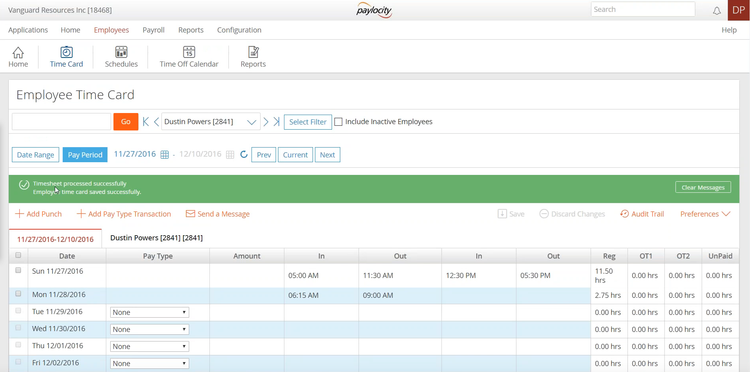

Paylocity - Best Payroll Functionality

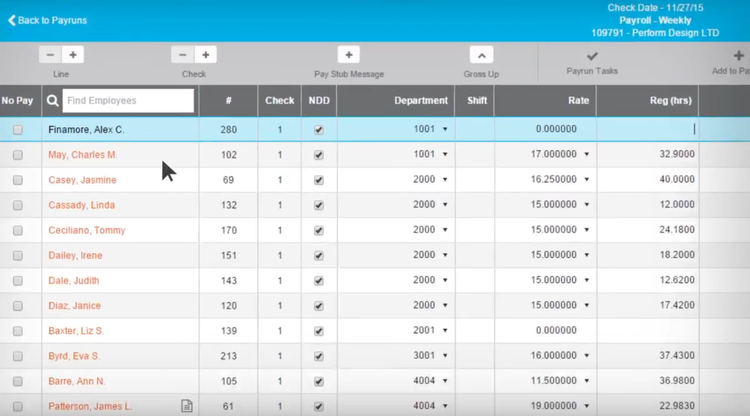

Paylocity’s payroll module is highly customizable. You can configure check types and customize time off accruals to fit specific employee needs. It also helps keep businesses tax-compliant by auditing each employee based on location, ensuring they pay the correct amount for their state/country. From there, the payroll module can connect to the general ledger, 401(k), and retirement plans for complete data synchronization.

The payroll tools integrate seamlessly with Paylocity’s HR module. Its document library ensures teams can access important files and employee information in one database. With role-based permissions, only authorized team members can see sensitive employee data to ensure security. Additionally, we like that it has built-in time-tracking with data insights, helping management view analytics on employee time and payroll to identify trends.

While we like Paylocity’s modular approach to pricing, we don’t like that there are six different modules that, when combined, may price out smaller businesses.

Paycor - Best for Manufacturers

Paycor is a great option for manufacturing companies looking to streamline their HR, time-keeping, and payroll processes. Its attendance tracking module allows you to keep a single system of record that is customizable for specific rules to tailor to each department. The system can create reports on data like hours worked, overtime spend per department, and total approvals, all from one dashboard. This helps manufacturers identify overspending and analyze overtime limits.

You can also use the learning management module, which is ideal if you’re looking to train and retain top talent. Easily provide them with training modules and issue certifications directly through the system to streamline development. Furthermore, these modules can be used as new-hire training courses, helping companies stay current with updated OSHA safety standards and compliance. However, one downside to Paycor is that some users reported slow response times in customer service.

Paycom - Best for Healthcare

Paycom is an associate of the American Hospital Association (AHA) because of its strong security measures to keep sensitive patient data safe from cyberattacks. These measures include audit logging, multifactor authentication, and 256-bit Encryption on all data. This allows you to be sure that the system will meet the needs of the healthcare industry.

We also like Paycom’s healthcare-specific HR and payroll features. Its payroll module offers flexibility in calculating different rates for overnight nurses, per-diem workers, and overtime rules for accurate, complex payroll. In the HR module, management can track different licenses and certifications for different types of hospital employees. This helps them assign the correct workers to patients requiring the correct credentials. One downside of Paycom is that costs can quickly add up through its modular structure.

Gusto - Best for Small Businesses

Gusto’s HR solution is best for small businesses because of its simple payroll module and affordability. You can run it unlimited times a month, so you don’t have to worry about hitting limits or being charged extra for more runs. It adheres to tax regulations for all 50 states, and users can submit payroll from their mobile devices. The software integrates with accounting systems like Xero and QuickBooks. It also syncs with POS systems like Clover for retailers.

Gusto’s low price is attractive to startups and small businesses. The Simple plan is $59/month plus $8/person and includes payroll, hiring, onboarding tools, and employee health benefits. However, this plan does lack some key features, such as PTO management, time clock, and next-day direct deposit. While these are available on the Plus plan, the $99/month plus $14/person may be too expensive for startups.

ADP Workforce Now - Best for Retailers

ADP Workforce Now offers strong features for midsize to large retail businesses. Because the retail industry experiences high turnover, we like ADP’s recruiting and onboarding modules to help combat that. The system offers a screening service to quickly run compliant background checks on new employees to ensure they are fit to be hired. It also aims to streamline the new-hire process with digital form signing and training modules.

The mobile app also lets team members clock in and out through their phones, helping avoid punch-in lines at a single kiosk. To ensure correct usage, management can set a geographic location pin on their store so the time clock only works on-site. We also like that it integrates with ADP’s Payroll software, letting workers view their paychecks, tax forms, and shifts all on the app. While it includes effective features, we found during our research that its customer support has been lacking, with slow response times.

iSolved - Best for Large Professional Firms

iSolved’s talent management module is well-suited for professional firms. The module offers an employee portal where users can collaborate with their peers and management, helping foster healthy relationships within the company. This helps large firms with multiple locations keep their consultants connected to the organization. Its compensation management also helps supervisors stay on top of every worker’s performance and ensure they are getting paid what they deserve.

You can also use iSolved’s HR capabilities, which help keep accurate, easy-to-access employee records. The digitized files eliminate paper filing and streamline workflows, helping manage the entire employee lifecycle from the offer letter to the final paycheck. It also lets management set up benefit plans for their workers to attract and retain top talent. We recommend iSolved for midsize to large professional firms, as its complex modules aren’t suited for small businesses.

Systems We Also Like

Zoho People is another good option for small teams that need a simple and affordable HR solution. The system includes tools like an employee database, performance analytics, and timesheets on an easy-to-use interface. It even has a free plan for up to five users.

What is Human Resource (HR) Software?

These systems manage employee information while automating tasks involving the people in your organization, such as employee scheduling, recruitment, and boosting productivity. HR software helps your organization achieve its goals by allowing managers to allocate employee time and resources more effectively through better record-keeping and increased employee performance.

HR systems can also be referred to as a human resource management system (HRMS) or a human resource information system (HRIS). Each term refers to all-in-one software that allows you to manage your organization’s human capital.

Key Features

- Employee Information Database: A complete directory of employee profiles including personal information, job description, salary history, banking and tax info, benefits information such as enrolled insurance, time off requests, and job performance feedback.

- Recruiting and Onboarding: Post current openings on various job board websites. Integrate new employees into the organization by familiarizing them with the client base and products/services offered. Implement an applicant tracking system to find the best employees.

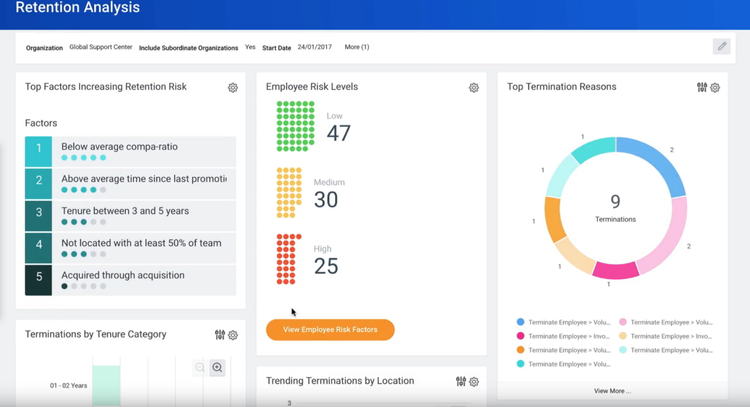

- Talent Management: Helps your business retain, promote, and train workers. Functionalities include leadership development, succession planning, compensation management, and performance management.

- Benefits Administration: Streamlines the enrollment process for employee benefits. Helps reconcile benefit standard costs and determines eligibility based on selected criteria. Includes reporting on employee elections and how they relate to your company budget.

- Performance Reviews: Discover data-driven employee analytics and facilitate management/employee communication, identify employee strengths and weaknesses, set individual goals, make informed compensation decisions.

- Payroll: Use HR management to control all elements of executing employee compensation, including wage calculation, check printing or direct deposit, and payroll tax management.

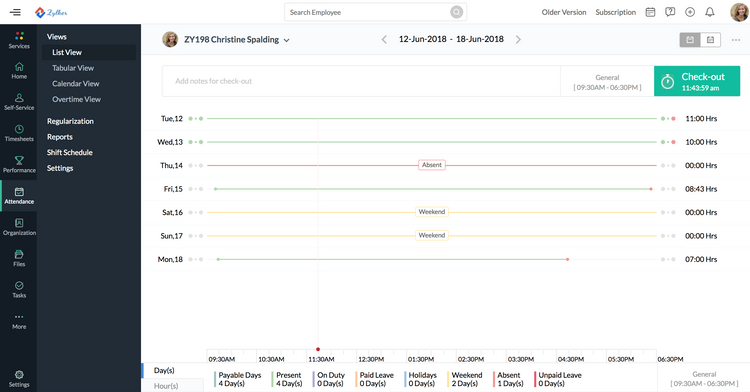

- Time Tracking: Allow employees to report time (either in real-time or after-the-fact) for wage calculation purposes. Manage time off requests.

Primary Benefits

Human resource information systems are designed to streamline your HR processes, consolidate files, and help your company become more efficient. This lets your staff focus on developing employee talent rather than focusing on shuffling paperwork.

Improve the Productivity and Efficiency of Your Team

An HR system can measure employee satisfaction, streamline workflow and tasks, let employees self-manage various tasks, and improve their skills and training. This can and will improve engagement and help monitor employees who can potentially drag your company down. Whether the cause is disinterest in their work, poor management, or other factors, HR software can help determine the underlying cause of poor performance.

For example, surveys can gather anonymous feedback about how employees feel about their jobs, management, their level of pay, and more. Employees may feel more power over their responsibilities through a self-service portal, such as clocking in for the day from their own computer while being able to view pay stubs, adjust their benefits, or request time off.

For your human resources staff, automating repetitive and intensive tasks and processes such as payroll and benefits administration can free up their time to handle other areas of focus, such as attracting new talent, onboarding new hires, or retraining struggling employees.

Improve Regulatory Compliance

A human resources department must follow federal, state, and local regulations covering areas such as recruitment, labor relations, benefits, and employee termination. The most common requirements and provisions HR professionals will deal with are wages, hours worked, employee health and safety, benefits, and worker’s compensation.

Systems store data on all the people in your company in one convenient place. Automated reminders can be created when action is required on an employee file, such as maintaining regulatory requirements for GDPR compliance, right-to-work checks, health and safety certifications, and more HR initiatives.

Integrate with Payroll Processes

There are frequently a few key integration points between payroll and HR software. Deductions must be calculated, funds withheld for retirement contributions, and pay stubs created and shared with employees. Payroll software packages allow you to process payroll and manage the information necessary to report back to the IRS and state taxing authorities.

Rather than using an outside payroll system, a fully integrated human resource software with payroll functionality will eliminate any double data entry. When payroll figures are adjusted, all impacted information will be automatically updated. This can save time when creating payroll reports, allowing you to quickly gather analytics that can be used by management.

HR Systems By Company Size

There are a variety of options depending on company size and the scope of your organization:

Small Businesses

Small businesses may feel their small number of employees means they can get by without human resource software. However, small businesses still need assistance in automating various HR workflows, as these companies likely have no dedicated HR staff—a single employee probably handles these tasks in-house, among other responsibilities. That means they must handle record-keeping, regulatory compliance, time and attendance, payroll, and more—all on top of their regular day-to-day work.

Due to tighter budgets and limited resources, small businesses should look for software that will make them as efficient as possible for the most affordable price without sacrificing ease of use. They should focus on core HR software, the base functionality needed to run their businesses, such as payroll, time tracking, and benefits administration.

Visit our Best HR Software for Small Business roundup page for a complete list of systems.

Mid-Sized Businesses

Businesses that have outgrown small business HR software will want to find a solution that offers core HR on top of additional functionalities—known as strategic HR. This added layer focuses more on talent management capabilities, such as recruitment, hiring, onboarding, and ongoing training.

Many stand-alone HR products offer strategic functions as an add-on to your base software package. This makes it possible to start small with a core HR and find a dedicated applicant tracking software, payroll solution, or performance management templates. However, mid-sized companies are better served finding a solution that offers these functions as a completely scalable option.

Enterprises

An enterprise or larger business will want a fully integrated HR suite to meet its needs. This option will handle all areas of managing your HR department from end to end. It likely runs independently of any ERP platform the business uses rather than being considered part of ERP software.

Additional capabilities found in enterprise HR software include learning management functions such as e-learning and optimized content management, which is meant for creating content for digital learning.

Pricing

HR software varies based on a number of different factors, including:

- The size of your business

- The number of employees you have

- The number of users requiring concurrent access

- The level of included services, such as support and hosting

It is also dependent on the functionality included. For example, a small business that only needs software for basic payroll and time tracking will be far less expensive than a complete HRIS system with learning management features and ERP integrations. Here’s a general breakdown of what you can expect to pay based on your employee count:

Entry-Level Tier

- Company Size: 1–20 employees

- Average Yearly Cost: $1,000–$6,000 per year

- Product Examples: Gusto, BambooHR Essentials, Zoho People

Mid-Tier

- Company Size: 20–100 employees

- Average Yearly Cost: $6,000–$20,000 per year

- Product Examples: BambooHR Advantage, Paycor, Rippling, TriNet

High-Tier

- Company Size: 100–500 employees

- Average Yearly Cost: $20,000–$75,000 per year

- Examples: ADP Workforce Now, Namely, UKG Ready

Enterprise Tier**

- Company Size: 500+ employees

- Average Yearly Cost: $75,000–$300,000+ per year

- Product Examples: Workday HCM, SAP SuccessFactors, Oracle HCM Cloud, UKG Pro

HR vs. HCM

There are many separate types of software to optimize various HR processes. Human resource software is commonly compared with human capital management (HCM)software, a collection of human resource applications that manage workforces through recruitment, onboarding, training, and performance management. Both options provide core HR functionalities, such as payroll, attendance, employee benefits, and in-depth reporting.

While HCM systems may initially seem more advanced by including onboarding and succession planning, many human resource systems will also provide these same capabilities. One can rest easy knowing that whether you’re in the market for HR software or HCM software, they offer many of the same benefits.