The Best Accounting Software For Midsize Businesses

We’ve reviewed the top accounting software for midsize businesses, examining key features like budgeting, forecasting, and payroll for various industries, such as manufacturing and professional services.

- Highly customizable

- Advanced audit trail

- Scalable, web-based ERP software system

- Multi-dimensional reporting capabilities

- Scalability for multi-entity support and user growth

- Simple and responsive user interface

- Multi-entity support

- Mobile accessibility

- Multi-warehouse inventory management

Accounting software for midsized companies automates financial operations for organizations employing between 50 and 249 people. The software handles core functions found in small business accounting software, like invoicing, billing, and reporting. However, it typically includes more advanced features as well, including inventory management and payroll.

Here’s our guide to the top solutions based on user reviews, our internal review process, and factors like pricing, integration options, and scalability.

- NetSuite: Best Overall

- Sage Intacct: Best Reporting Tools

- Acumatica: Best for Midsize Manufacturing

- Dynamics 365 Business Central: Best for Quick Setup

- Multiview: Best Multi-Entity Accounting

- SAP Business One: Most Scalable Option

- QuickBooks Desktop Enterprise: Best Built-In Payroll

- Accounting Seed: Best for Salesforce Users

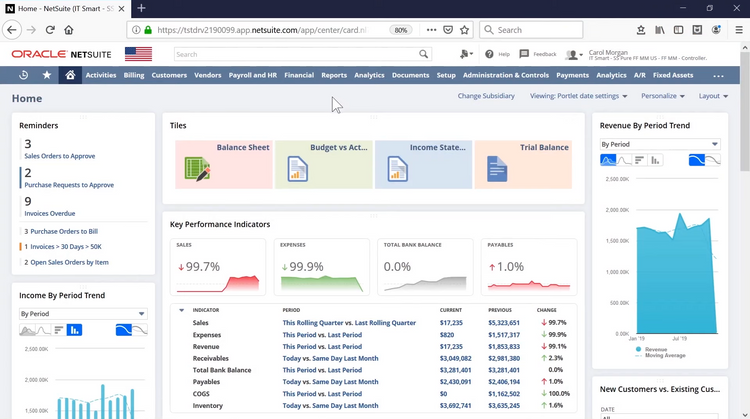

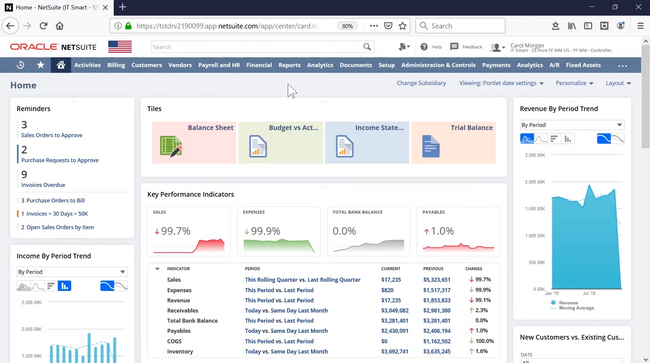

NetSuite - Best Overall

NetSuite is our top pick for mid-sized businesses because it integrates finance, operations, and sales, eliminating the need for multiple disparate systems. During our NetSuite review, we found the system especially adept at financial reporting. It has a drag-and-drop report writer called SuiteAnalytics, with 20 pre-built templates.

Additionally, NetSuite automates revenue recognition and streamlines forecasting. It supports multi-currency transactions and global operations. These include different currencies, taxes, and languages out of the box. This makes it a decent choice for medium-sized organizations with a growing global presence.

Overall, NetSuite is a solid pick for SMBs transitioning from basic accounting software like QuickBooks. It can automate repetitive tasks like reconciling account statements, creating journal entries, and managing accounts receivable and payable. As an ERP software, it can also handle asset management, sales force automation, and project management, supporting vertical-market companies stepping away from disconnected systems toward a more comprehensive and customizable platform.

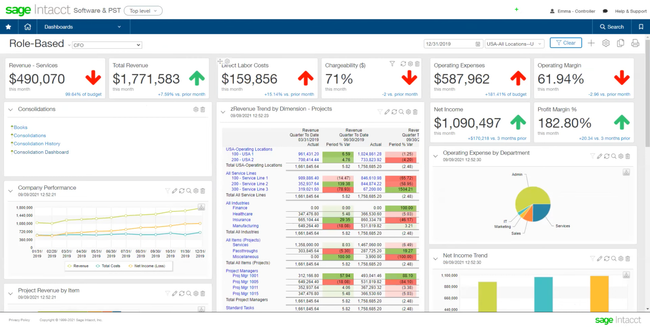

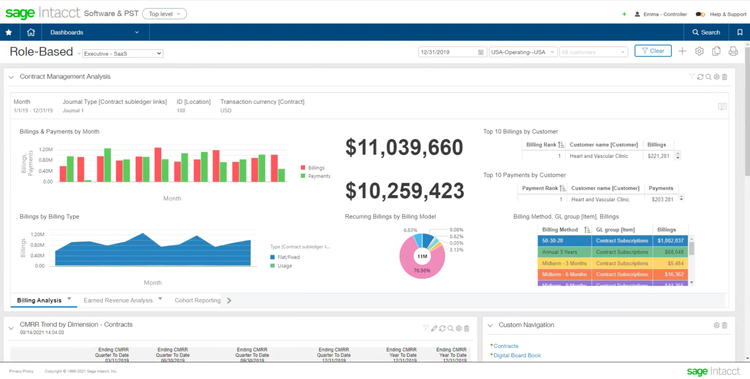

Sage Intacct - Best Reporting Tools

Sage Intacct includes in-depth reporting tools, giving better visibility into business financials. The software gives access to over 150 standard financial reports right out of the box and the flexibility to create custom reports. This allows for a full analysis of fiscal data without the need for external tools or reliance on Excel reporting.

The platform’s Financial Report Writer is an intuitive tool that simplifies the process of custom report creation. Users can start with standard templates and modify them by adding or removing data elements and adjusting sorting and selection options. This level of detailed reporting helps medium-sized businesses gain insight into their fiscal health, areas for improvement, and opportunities to drive growth and profitability.

Companies that have outgrown QuickBooks can utilize Intacct for automated billing processes, continuous closing, and complex multifactor forecasting. It allows in-depth analysis of variables like discounts, deferrals, and pricing strategies to generate more intricate forecasts beyond simple projections.

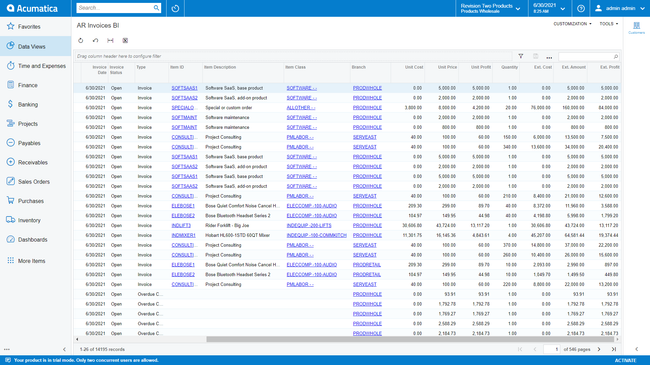

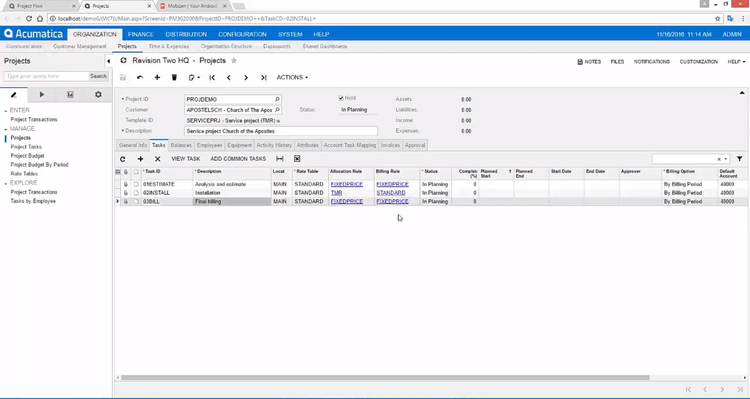

Acumatica - Best for Midsize Manufacturing

Acumatica is a solid option for midsize manufacturing businesses aiming to facilitate growth without increasing overheads. This ERP system supports diverse manufacturing methodologies such as make-to-stock, make-to-order, engineer-to-order, project-centric, job shop, batch, and repetitive manufacturing. Additionally, the system handles multi-entity and intercompany accounting, which is useful for medium-sized manufacturers with several plants.

Acumatica’s accounting suite includes the general ledger with a flexible chart of accounts, period management, and real-time posting. It also has accounts payable and receivable modules to manage incoming and outgoing cash flows. Manufacturers will find its fixed asset management tool helpful in tracking the depreciation of machinery and equipment. Finally, Acumatica simplifies compliance, tax reporting, and valuation of assets on the balance sheet.

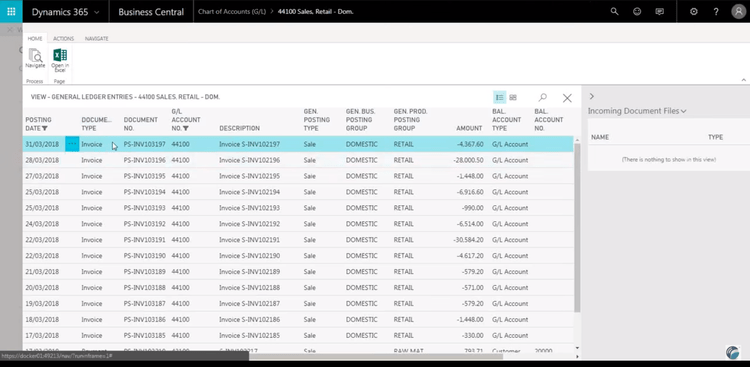

Dynamics 365 Business Central - Best for Quick Setup

Microsoft Dynamics 365 Business Central made our list because it’s designed to enable quick setup and ease of use for mid-size companies. Generally, fast implementation timelines reduce downtime, expenses, and strain on smaller IT departments common to growing businesses.

Business Central ensures swift setup through a series of quick start guides that cover everything from basic navigation to more advanced features and customization options. Additionally, Business Central provides documentation and tutorials covering how to use its accounting tools. These include basic setups like managing charts of accounts to more complex tasks like financial reporting, budgeting, and tax management.

In addition, Business Central facilitates global business expansion by supporting multiple currencies, languages, exchange rates, intercompany transactions, and compliance with various tax regulations. Through integrations with Excel and Power BI, Business Central users can perform advanced financial analysis to scale their companies effectively.

Multiview - Best Multi-Entity Accounting

Multiview ERP allows organizations to track financial performance across different divisions and handle intercompany costs and sales. It also helps ensure accounting, tax, and regulatory compliance across various geographic areas, managing multiple currencies and fluctuating exchange rates.

Multiview includes 18 integrated modules priced per user. These include accounts payable with electronic banking and accounts receivable with credit card processing. The general ledger module provides full audit trails with electronic workflow approvals. It also has a self-balancing system for intercompany transactions, eliminating the need for manual adjustments or reconciliations.

Overall, we think it’s a good fit for growing organizations with different departments, regions, and product lines. Multiview ERP gives medium-sized businesses real-time insights throughout their operations, helping them quickly adapt to changes and meet market demands.

SAP Business One - Most Scalable Option

Of the accounting software we’ve researched, SAP Business One is the most scalable option. As companies grow, this software allows them to increase data volume, add users, and incorporate advanced features.

SAP Business One’s accounting features include predefined or customizable chart of accounts templates, journal entry automation, and advanced expense management with alerts. The system also provides real-time general ledger updates, flexible reconciliation options, and detailed reporting. These include profit and loss statements, budget reports, balance sheets, and cash flow overviews.

Additionally, SAP Business One caters to medium-sized companies with a global presence. The system supports multiple currencies and localizations for over 40 countries in 27 languages. Moreover, the system’s flexible deployment options, including cloud-based (both private and public) and on-premise installations, only add to its scalability to meet diverse business needs.

QuickBooks Desktop Enterprise - Best Built-In Payroll

QuickBooks Desktop Enterprise includes a built-in Enhanced Payroll module, so you don’t have to integrate with a third-party system. This allows you to run payroll directly from QuickBooks, ensuring all of your books are aligned on a single system. Simply enter your employee hours and pay, and it automatically calculates earnings, taxes, and deductions. It’s great for reducing manual calculations, which leads to fewer errors and more efficient payroll running.

Additionally, QuickBooks Enhanced Payroll gives you several employee benefits. For starters, you can use various payment methods, including printed checks, free direct deposit, or both. Through the online portal, you can also give employees access to their pay stubs, W-2s, and time off balances. You can even offer 401(k) retirement plans. It’s really a win-win for both you and your employees.

The system is best for small to medium-sized businesses with ten to 50 employees and revenues ranging from $1 million to $10 million. While not as comprehensive as an ERP like NetSuite or Acumatica, it’s a strong solution if you’re a smaller midmarket business that needs more than just basic accounting. It’s still a sizable cost, though, with the most basic plan starting at $2,210/year for one user. And with the recent discontinuation of Desktop Pro and Premier, there’s some doubt surrounding the future of Desktop Enterprise.

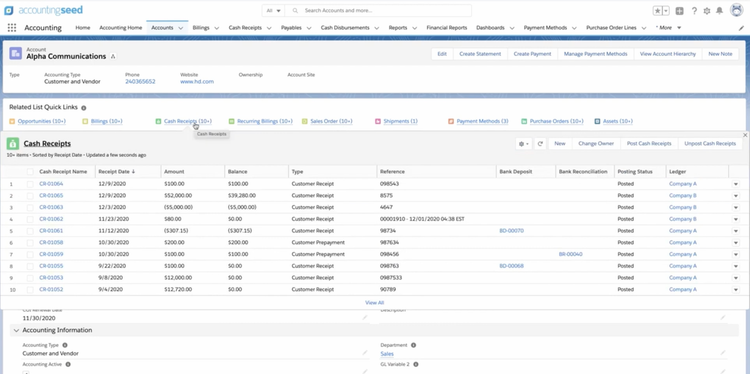

Accounting Seed - Best for Salesforce Users

Accounting Seed is our top pick for Salesforce users, built directly on the platform and offering a native integration. This seamless connection allows Accounting Seed users to manage the entire financial lifecycle from quote to close directly within Salesforce. Accounting Seed’s features, such as reporting and billing, can easily connect with other events and applications on Salesforce, providing a customizable solution tailored to unique business requirements.

For mid-sized businesses, automating repetitive financial tasks like invoicing, bank reconciliations, and expense tracking is crucial. These features, combined with the software’s ability to manage inventory, payroll, order management, and more, make Accounting Seed an effective solution for mid-sized businesses already utilizing Salesforce in their tech stack.

What is Accounting Software for Midsize Businesses?

Accounting software for midsize businesses provide applications not found in traditional small business accounting software, such as a larger-scale billing and invoicing process, in-depth inventory management, and payroll.

These systems will provide basic income and expense tracking but are intended for growing companies who find their current accounting software to be too limiting. Some industry-specific accounting solutions are also available for midsize businesses that handle fund accounting, DCAA compliance, job costing, and more.

Growing small and midsize businesses (SMBs) must add more employees to the payroll, process more transactions, and create more custom financial reports to monitor cash flow. Many small business accounting systems limit the number of transactions or employees you can add and standard reporting. Finding software for midsize to large businesses will allow you to process more without slowing down your system.

Key Features

| Feature | Description |

|---|---|

| Core Accounting | Includes expense management and income tracking. Modules include accounts payable, accounts receivable, and general ledger. |

| Billing and Invoicing | Create and send invoices for products and services rendered. Set up one-time or recurring billing. Automate payment reminders. Allow online payment processing through bank account transfer or credit card payments. |

| Inventory Management | Track on-hand inventory items in real-time including quantities, product descriptions, and prices. Automate purchase orders to replenish low stocks. |

| Payroll | Automate wage calculation, check printing, wage tax reports, ACH deposits, and more. |

Advanced Accounting Features

As midsize companies become larger, advanced accounting features become more important to continue growing. Some advanced features include:

| Feature | Description |

|---|---|

| Business Intelligence | Run historical reports and predictive analysis on finances, business operations, personnel, and more. |

| Budgeting and Forecasting | Create detailed financial plans that estimate the future revenue and expenses of your company. |

| Currency Exchange | Manage currency exchange rates for international orders. Report on multi-currency orders in a consolidated single-currency value. |

| Customer Relationship Management (CRM) | Store customer contact information, purchase histories, saved/wishlist items, and more to guide sales and marketing efforts. |

| Bank Reconciliation | Import bank records in real-time to ensure bank records and accounting records match. |

Industry-Specific Accounting Features

Growing businesses often need industry-specific features as they move forward from small business accounting software. Some industry-specific accounting solutions offer functionalities including:

| Feature | Industry Types | Description |

|---|---|---|

| Fund Accounting | Nonprofits and Government Agencies | Track money from donations and grants. Manage donor/grant requirements and profitability. |

| DCAA Compliance | Government Contractors | Manage accounting starts for government contractors in accordance with the Defense Contract Audit Agency (DCAA) compliance regulations. |

| Job Costing | Manufacturing and Construction | Track expenses and profitability on a job-by-job basis. Also referred to as construction or project accounting. |

Primary Benefits

Accounting software for midsize businesses helps companies do more than what their current small business accounting software offers. Some benefits of midsize business accounting software include:

More Capacity for Managing Customers, Inventory Items, and Vendors

Accounting software for midsize to large businesses can store more information without slowing down. Small business accounting software often caps things like the number of inventory items, customers, vendors, and concurrent users you can keep stored in the system. For example, QuickBooks can store a maximum of 14,500 inventory and stock items, 10,000 payroll items, and 14,500 names (customers, suppliers, vendors, and employees combined). Small business systems also tend to become bogged down with too much data.

Accounting software for midsize businesses is built to allow for more data storage and concurrent users. Many solutions will scale with you as your business grows, so you can do more with less downtime, upgrading or replacing the entire accounting system.

Streamline Billing and Invoicing

Midsize business accounting software makes it easy to manage larger-scale invoicing to ensure you’re getting paid while reducing overhead. The software will automate billing and invoicing processes including:

- Automatically perform checks to make sure goods and services match the orders and receipts. Orders that don’t match get flagged for manual checks.

- Recurring bills for regular services will be sent out automatically at a specified date.

- Reminders can be set up to notify customers of upcoming or overdue payments.

- Custom late payment fees can also be charged automatically.

Your accounting solution will track the invoice number, payment status, and descriptions of the products or services rendered for each customer. Many systems also allow online payment processing. When you get paid, the system will update the payment status in real-time.

Keep Expenses Organized

All businesses need to keep expenses organized to control costs and accurately monitor profibatility. As your business grows, expense tracking can become more complex.

For example, midsize and larger companies often need to track purchase requisitions. The accounting software allows employees to request purchase orders for business supplies, materials, or equipment. The purchasing department can approve or deny the requests and begin the purchasing process if needed. The software will help you control costs with customizable rules for approval, mitigate the risk of purchase order fraud, and provide real-time reports on spending.

QuickBooks for Midsize Businesses

Midsize businesses sometimes keep QuickBooks because it is a system they’re familiar with, and it can have a more budget-friendly price point than other solutions. If you’re outgrowing QuickBooks Desktop Pro or QuickBooks Premier, you can upgrade and stay on the platform you’re comfortable with. QuickBooks Enterprise is an on-premise accounting solution that is marketed towards small to medium-sized businesses. This system is advertised to have 6x more capacity than either Pro or Premier. Enterprise can manage more customers, inventory, vendors, and concurrent users than its predecessors.

If you’re looking to stay with QuickBooks for the cost-saving benefits, there are add-ons and third-party integrations you can use to pick up slack in other areas of your business. Using an integrated solution or add-on alongside QuickBooks can give you some of the same benefits as a full midsize business accounting solution. Some examples of integrated solutions or add-ons:

| You’re looking for… | Example options… |

|---|---|

| In-depth inventory control | Fishbowl Inventory or IntelliTrack |

| Customer relationship management | Copper CRM or RedHorse CRM |

| Larger-scale billing | BQE CORE or BILL |

| Payroll | QuickBooks Payroll Enhanced or Easypay Payroll |

| Document management | SourceLink or DocuXplorer |

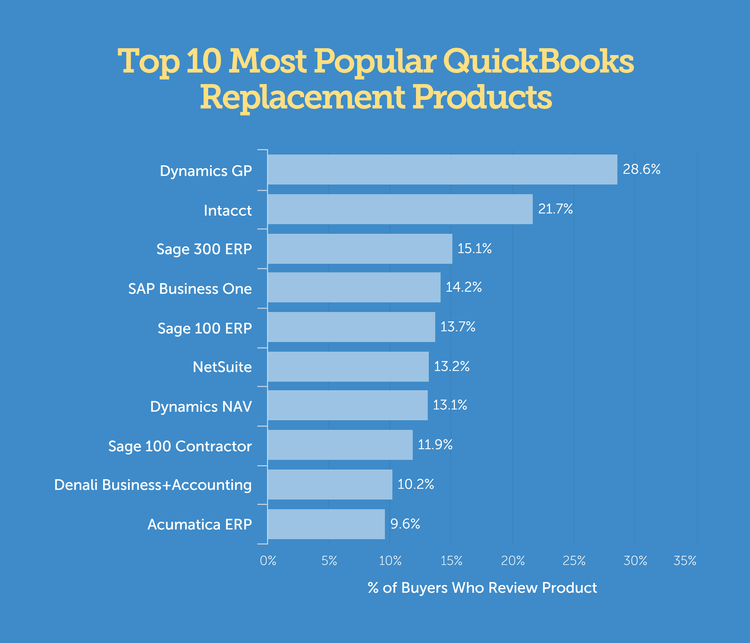

Common QuickBooks Replacements for SMBs

While basic accounting software like QuickBooks Online, Xero, and FreshBooks are powerful accounting systems for startups and small businesses, many companies eventually outgrow them. QuickBooks can be limited in its reporting capabilities, access for multiple concurrent users, and workflow management. Some businesses need more industry-specific functionality like project management, estimating, job costing, fund accounting, and more.

Cloud Accounting Options

Online accounting solutions are popular for midsize businesses that want to keep software costs low and have a program that scales with their business. Most cloud accounting software will feature multiple plans or modules that can be turned on and off, so you get exactly the functionality you need.

Another advantage of cloud-based accounting software is the ability to browse financial information from any device with an Internet connection. Online accounting software also allows for remote data entry. For example, employees who work in the field can bill clients and accept payment from a mobile device. Some solutions also have standalone mobile apps that can be downloaded to an Android or iOS device.

ERP Systems

Enterprise resource planning (ERP) solutions are available for midsize companies looking for all-in-one software with strong accounting tools and business management functionality. ERP systems are generally customizable and scalable–you can add on or remove modules as your business grows.

Depending on the solution and your industry-specific business needs, ERP software will help you manage processes like project management, supply chain management, human resources, time tracking, quality control, order management, and more. Examples from our list include NetSuite, Multiview, Dynamics 365 Business Central, and Acumatica.