The Best ERP Systems for Small Businesses

Small businesses need an ERP system that is affordable, user-friendly, and customizable to their needs. We tested and reviewed the best small business ERPs based on various features, including financial management, CRM, and inventory tracking.

- Powerful mobile access

- Highly scalable

- Wide range of features across all industries

- Large number of available modules

- Cloud-first solution

- Industry-specific customizations

- Multi-dimensional reporting capabilities

- Integrates with Salesforce, Versapay, etc.

- Provides multi-entity support

We’ve evaluated the best ERP systems for small businesses, focusing on affordability, scalability, and ease of use. These solutions streamline key operations like accounting and supply chain management while growing your business.

We’ve compiled the best picks, whether you’re looking for a solution with strong customization options or one suitable for distributors.

- Dynamics 365 Business Central: Best Overall

- NetSuite: Most Customizable

- Sage Intacct: Strong Financial Management

- SAP Business One: Best CRM Features

- Odoo: Best Open Source Solution

- Acumatica: Best for Distribution

- QuickBooks Enterprise: Best Payroll Tools

- xTuple: Best for Manufacturing

- Striven: Best for Project-based Businesses

- ERPNext: Best for Global SMEs

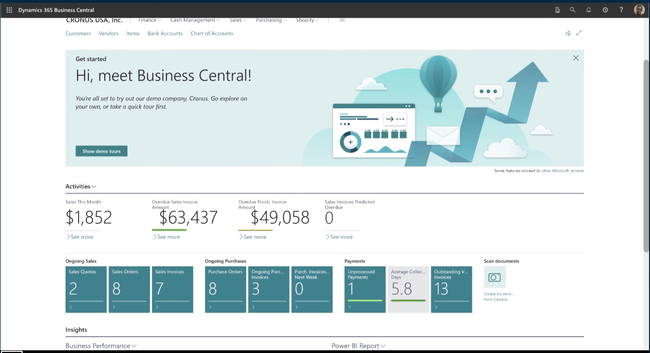

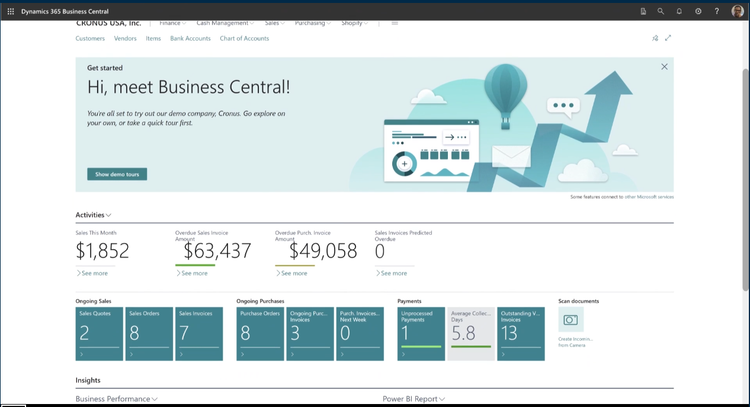

Dynamics 365 Business Central - Best Overall

Business Central’s tight integration with the Microsoft 365 ecosystem makes it especially well-suited for smaller companies. When you don’t have dedicated accounting staff or IT teams, handling purchase orders, invoices, and payments right from Outlook keeps everything simple—no copy-pasting or extra logins required.

For example, your staff can open a customer’s email in Outlook, launch the Business Central add-in, and instantly see that customer’s quotes, orders, and balances. The add-in scans the email for items and quantities so your team can quickly review the details. Once they finalize and save, the sales order is created in Business Central. From there, they can send a confirmation email with a PDF attachment—all without leaving Outlook.

The “Edit in Excel” feature comes included with your Business Central subscription at no extra cost. While Odoo and NetSuite allow data exports and imports, Business Central lets you open records in Excel, make changes, and sync them back with all permissions and validation rules in place. This makes it easy for your team to update data in a familiar spreadsheet interface, reducing manual entry while keeping a clear audit trail.

Business Central starts at $70/user/month, billed annually, with flexible options for unlimited users as you grow. That said, Power BI Pro and Copilot Studio are sold separately. While built-in Copilot features like chat assistance and contextual suggestions are included, creating custom AI agents across apps requires a separate Copilot Studio license.

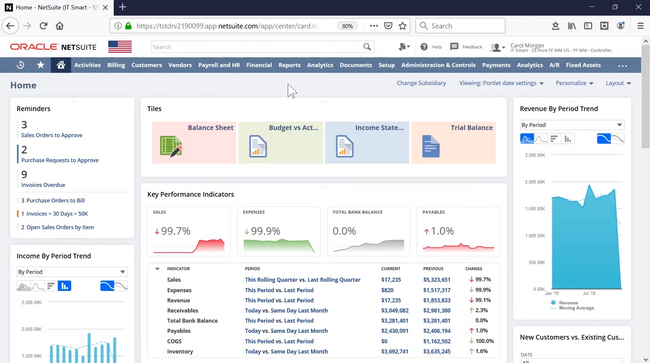

NetSuite - Most Customizable

NetSuite is our top pick for businesses seeking ERP customizations. Whether it’s a B2B or B2C company, firms can mold NetSuite to provide the optimal fit.

Businesses can harness tools like SuiteScript for full automation and integration with third-party apps. They can also finetune the system with tailored forms, custom fields, personalized roles, and real-time dashboards. These features collectively enhance operational compatibility, letting businesses manage data and processes in ways most aligned with their daily functions.

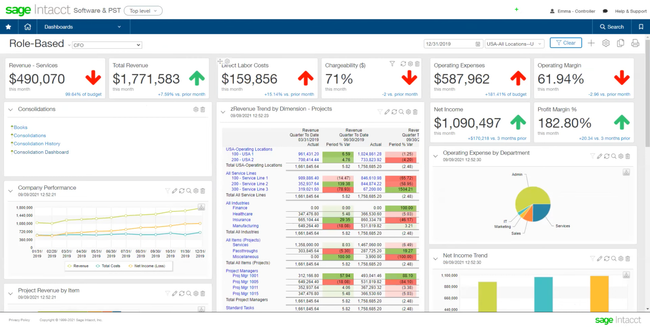

Sage Intacct - Strong Financial Management

Sage Intacct has advanced financial management capabilities. It offers a multi-dimensional general ledger that tracks financial data based on multiple dimensions, such as department, project, location, or product line. This enables detailed financial reporting and analysis, providing insights into the performance of different business segments.

The platform includes features for automated revenue recognition, helping you comply with standards like ASC 606 and IFRS 15. It supports various revenue recognition methods and provides real-time visibility into revenue streams.

SAP Business One - Best CRM Features

SAP Business One has strong CRM features, offering marketing campaigns, customer master data, and opportunity and sales management in a central platform.

SAP Business One allows you to create and maintain email, telemarketing, and direct mail campaigns. It also allows you to manage sales opportunities and track activities. The software provides a service component in CRM to manage warranties and service contracts. Finally, it offers strong analytics and reporting to gain insights into customer data and sales performance.

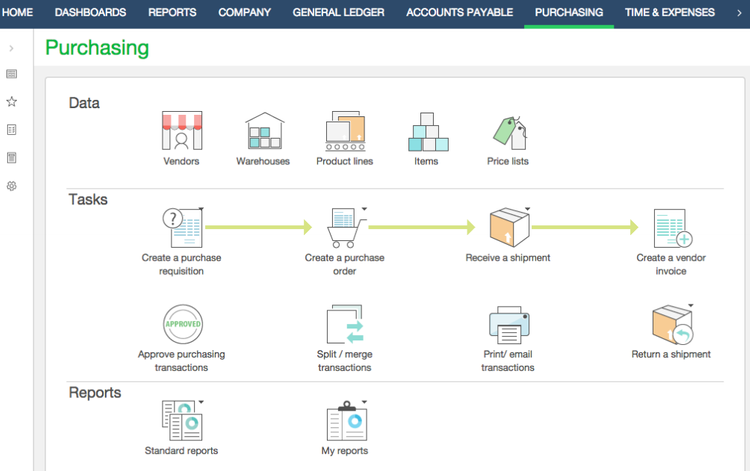

Odoo - Best Open Source Solution

Odoo has strong open-source solution due to its unparalleled flexibility and adaptability. You can access and customize the source code to fit their specific needs. This can help you save on software costs and ensure a system meets your unique requirements.

Odoo has a large and active community of developers and users who share knowledge, best practices, and custom modules. This can help you get support and find solutions to common challenges.

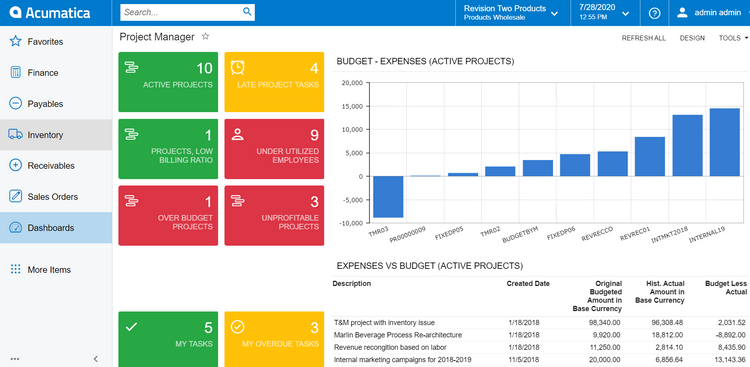

Acumatica - Best for Distribution

Acumatica’s distribution edition offers a comprehensive inventory management module for wholesalers and consumer goods. The price management tool lets you stay flexible with specific item costs. Set different price classes with minimum and default markup percentages, ensuring you receive a baseline profit for each sale. Access the side panel in the price manager to see any sale prices for current promotions or customer-specific rates. This helps you stay competitive and adaptable in your pricing models.

The inventory module also optimizes your replenishment. Easily configure parameters for each item, like safety stock, reorder point, and maximum quantity. On the same screen, you can see the current demand forecast with the recommended settings, helping you adjust to any fluctuations. And because it supports multi-warehouse operations, you can quickly transfer stock between locations to help meet demand.

Acumatica offers a resource-based pricing model that enables you to pay for the resources you use rather than the number of employees or users added to the system. It’s also a modular system, so small businesses can pick and choose the modules they need and add more as they scale.

QuickBooks Enterprise - Best Payroll Tools

QuickBooks Desktop Enterprise offers a built-in payroll module so you can sync your accounting with employee payment data. It automatically calculates earnings, deductions, and taxes to ensure accuracy and filing timeliness. This eliminates the need to integrate with other systems or manually import data.

Additionally, it provides an online employee portal so your team members can access important information. This includes digital pay stubs, available time off, and W-2s through their desktop or mobile apps. This gives your employees access to their financial information to recognize any errors in their pay stubs while reducing your administrative workload for manually generating and sending tax information.

QuickBooks Desktop Enterprise’s base Gold package starts at $1922/year for 1-10 users, or up to 30 users. It includes payroll, accounting, and inventory modules with cloud or on-premise deployment.

xTuple - Best for Manufacturing

xTuple is a manufacturing ERP that supports make-to-order, make-to-stock, and mixed mode operations. You can easily set up MRP planner codes. These let you fine-tune your material handling rules, like grouping items for production or editing lot sizes. This gives you greater control of your inventory for complex production orders.

You can also run extensive reports on all your manufacturing processes. View summarized backlogs and availability by sales order, customer type, and inventory. Running these reports helps you gain granular insights into your operations so you can adjust to boost efficiency and profitability.

xTuple is one of the most affordable manufacturing ERPs on the market, with pricing starting at $175/user/month. While the UI is a bit dated, it’s a great option for smaller job shops to automate processes without going over budget.

Striven - Best for Project-based Businesses

Striven’s cloud-based platform combines various business management tools into one cohesive system, including accounting, CRM, project management, HR, and inventory management. This integration enhances productivity and collaboration across different departments.

Striven integrates seamlessly with third-party systems like Google, Microsoft, and various payment processing gateways. With automated workflows and a mobile responsive design, the platform offers customizable portals for vendors, customers, and candidates to improve external communications and operations. Striven’s pricing is also competitive, making it an affordable option for small businesses looking to leverage ERP functionalities without a hefty price tag.

ERPNext - Best for Global SMEs

ERPNext multilingual support makes it a fitting choice for companies with a diverse workforce or those operating in multiple countries.

With a free, open-source version and affordable managed hosting options, ERPNext provides an avenue for scaled operations without incurring significant software costs. The software handles accounting, CRM, HRM, manufacturing, and project management functions, all designed to meet the complex needs of SMEs in various sectors.

Other Systems We Like

Multiview ERP is a great option for small healthcare organizations. The platform can help meet HIPAA compliance and integrate with your EMR system for seamless data sync.

What is Small Business ERP Software?

Small business ERP is a software system that integrates key business functions, such as accounting, sales, and inventory, to streamline operations in small businesses. Enterprise resource planning or (ERP software) specifically built for small businesses provides an affordable, easy-to-use, and secure way to manage business processes, financials, and sales in real-time. Software streamlines your work across multiple areas, from back-office accounting to front-end customer support. Both small and midsize companies can benefit from using one ERP software solution to cover a variety of business operations.

Read more: What is ERP?

Running a small business is no easy feat. Depending on your industry and market, there might be a lot of behind-the-scenes tasks you need to complete yourself. Fortunately, ERP systems typically include customizable modules you can use to meet your specific workflow needs. For smaller businesses and startups, it’s important only to choose the modules you really need to cut down on costs - you can always add more functionality later on as your business grows.

Key Features

| Feature | Function |

|---|---|

| Human Resources (HR) Management | Automate payroll processing, track time and attendance, and manage employee records like performance reviews, payroll benefits, and scheduling. Self-service HR functionalities allow employees to request time off or view their attendance records. |

| Financial Management](/financial-management/) | Track income and expenses through recorded transactions and account structures to forecast profit and loss. |

| Inventory Management | Record information on items you build, store, buy, or sell. Keep up-to-date stock records to avoid running out of items or buying items unnecessarily. |

| Customer Relationship Management (CRM) | Manage customer contact info, order histories, invoices, and quotes. |

| Supply Chain Management | Manage the flow of goods and services from raw material acquisition to delivery of the finished product to the customer. |

| Analytics and Reporting | Measure key performance indicators (KPIs) like income (Accounts Receivable) and expenses (Accounts Payable), top performing products, or open orders over a set period of time. |

Benefits

The primary benefit of implementing an ERP at your growing company is the ability to streamline many separate business functions into one solution. Both on-premise and cloud-based ERP platforms can help your business in a variety of ways:

- Streamline workflows and processes across a common interface and database

- Visibility and transparency into business management workflow to increase optimization

- Better decision-making by analyzing data by region, location, profit center, employee, and more

- Improve data security to ensure key company information is not compromised

- Increase opportunities for interdepartmental collaboration on documents, files, audio and video media

- Scale operations to match your expanding business needs as you grow

Additional benefits vary depending on the exact nature of your work, your industry, and projected growth.

What is a Small Business?

In the software industry, small businesses can be defined in a number of different ways. Employee count, annual revenue, business needs, and industry are often factors. Generally, small businesses have annual revenues under $50 million and fewer than 100 employees.

Price Guide

For small businesses, ERP ranges from $4,000 to over $55,000. Your final costs will generally vary based on the number of concurrent users, add-on modules, implementation fees, maintenance, and employee training.

Low Tier ERP: $4,000 – $12,000/year

Mid Tier ERP: $12,000 – $25,000/year

- Company Size: 25–75 employees

- Examples: xTuple, Dynamics 365 Business Central

High Tier ERP: $25,000 - $55,000/year

Hidden ERP Costs

Be aware of hidden costs, which can make ERP software much more expensive. You might think you’ve found a cheap SaaS solution for a few dollars a month, only to be hit with implementation or onboarding fees. The ERP vendor you choose should be able to help you narrow down the functionalities you need to ensure your solution is as cost-effective as possible.

Free Software Options

When running a small business, your operating budget is likely small, at least to start. Luckily, there are many cheap and affordable ERP solutions for SMBs. Some are even free, though sometimes this is limited to a short-term trial of services. However, there are usually some additional costs associated with these systems, such as installation fees, training, maintenance, and any add-on functionality.

Some examples of free and open-source small business ERP software include:

- Odoo: The free SaaS plan, Odoo Community, is an open-source ERP software including one app of your choice (some examples include CRM, invoicing, expense tracking, eCommerce, appointment scheduling, and POS). You can add on additional apps ranging in price from $12 per month to $72 per month. Integrations with eBay or USPS will increase costs to another $36 to $72 per month.

- Dolibarr: A free, open-source ERP system featuring CRM, HR, CMS, inventory control, marketing automation, and project management. Free and purchasable add-ons are also available.

Integrations

When evaluating ERP solutions, don’t rush into implementing a system because it fits now - think about what you’ll need in the coming years. You might hire more employees, open another location, or expand your professional services. As your business brings in more sales, you’ll need a more comprehensive system for order management, multi-location inventory, and more.

Many small business ERP systems allow you to add and remove modules as needed and provide integration with other management systems. Some standalone software like business intelligence (BI) systems, CRM, and manufacturing execution systems (MES) might not be required for you business now, but could play an important role as you grow in the next few years. You can purchase a standalone system when ready and integrate it with your ERP system without much trouble.

Other Small Business Software Solutions

Is a full ERP still too much for your growing business or startup? As mentioned before, there are specific small business ERP alternatives for different business processes:

- Small business accounting software

- Human resources software

- Invoicing software

- Small business manufacturing software

- Payroll sofware

- Recruiting software

With the right ERP software, you can help your SMB grow into a medium- or enterprise-level business.

Types of Small Business ERP

Some ERP solutions are marketed as being only for small businesses. These solutions can be on-premise or cloud-hosted, with web-based SaaS options being more popular due to the lower upfront cost. ERP software exclusively for small businesses is less complex than more expansive systems, with limited scalability to cut costs and tailor to the needs of smaller companies.

Going with a small business-specific ERP means you’re not paying for features you don’t want or need. For instance, if you operate a local store with no eCommerce capabilities, you won’t need a full-scale ERP to handle multiple currencies and exchange rates. A small solution will cover what you need without charging you more for what you don’t.

Industry-Specific ERP Options

Many companies, regardless of size, prefer to use industry-specific ERP solutions to cater to their unique business needs without paying for extra customization. For instance, small business manufacturers should seek ERP with supply chain management functionality, while construction contractors would want a solution with project management capabilities.

Examples of some well-known industry-specific ERP software include BatchMaster ERP for process manufacturers and abas ERP for general manufacturing. Remember, these may be designed for companies of all sizes and may be more expensive.