The Best ERP Software

We’ve evaluated top ERP systems to optimize your business operations–from supply chain management to financial planning. Whether you’re in manufacturing, distribution, or retail, we can help you find a solution managing CRM, production, and inventory.

- Strong financial planning tools

- Revenue recognition

- Demand planning features

- Combine ERP and CRM

- Detailed item editor

- Similar interface to Microsoft Word and Outlook

- CRM module with marketing dashboard

- Multiple editions

- Open architecture for rapid integrations

In this guide, we’ve ranked the top platforms based on their support for different industries and company sizes, from small manufacturers to enterprises.

| System | Best Suited For | Starting Price | Deployment Options |

|---|---|---|---|

| Acumatica | Midsized construction, distribution, or manufacturing companies | Around $1,800/month for 10 or less users | Cloud or on-premise |

| Brightpearl | Multi-channel retailers or eCommerce stores | Quote-Based | Cloud |

| Deltek Vantagepoint | Mid to large-sized consultant or architecture and engineering firms | Quote-Based | Cloud or on-premise |

| Microsoft Dynamics 365 Business Central | Small to midsize distributors or manufacturers | $70/user/month | Cloud or on-premise |

| NetSuite | Mid to large-sized distributors or professional service companies | Around $1,299/month plus $99/user/month | Cloud or on-premise |

| Odoo | Small to midsized manufacturers or distributors | Free; paid plan starts at $24.90/user/month | Cloud or on-premise |

| Sage Intacct Construction | Mid to large-sized general contractors and subcontractors | Quote-Based | Cloud |

| SAP S/4HANA | Enterprise manufacturers and distributors | Quote-Based | Cloud or on-premise |

| SYSPRO | Manufacturers of all modes and types | $99/user/month | Cloud or on-premise |

| TallyPrime | Small businesses needing accounting and inventory optimization | $81/month | Cloud or on-premise |

- NetSuite: Best for Financial Planning

- Dynamics 365 Business Central: Best for Distribution

- Acumatica: Best CRM Module

- Odoo: Best Open Source

- Brightpearl: Best for Retail

- Sage Intacct Construction: Best for Construction

- SYSPRO: Best for Manufacturers

- SAP S/4HANA: Best for Global Enterprises

- Deltek Vantagepoint: Best for Professional Services

- TallyPrime: Best for Small Businesses

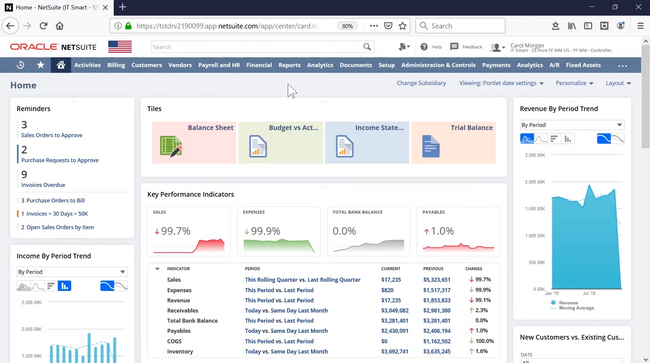

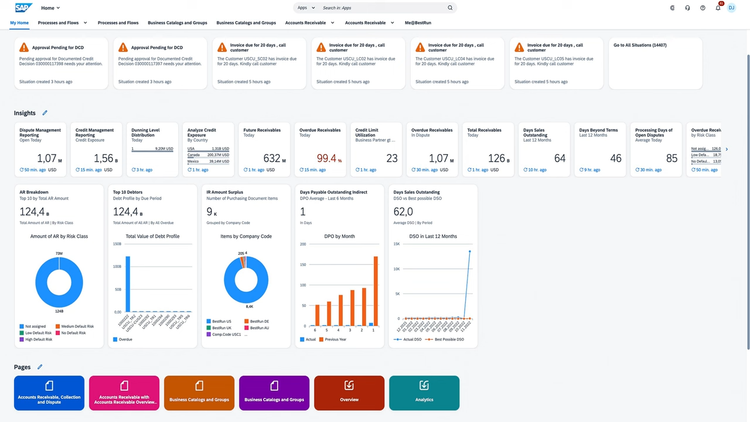

NetSuite - Best for Financial Planning

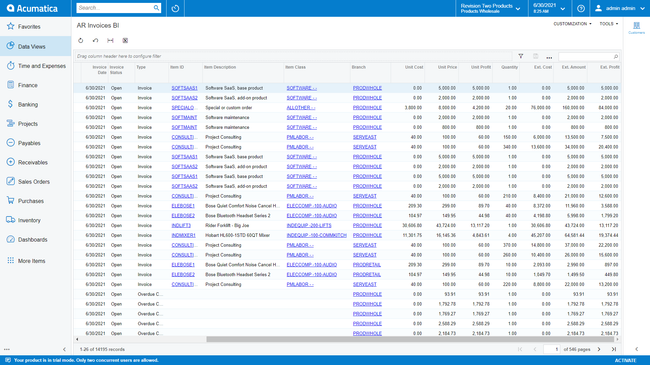

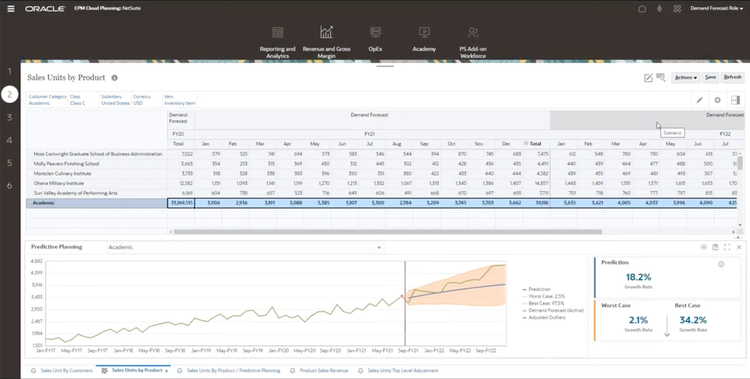

While NetSuite offers several accounting features, it stands out with its financial planning module. It allows you to forecast sales demand for specific customers or products, which is ideal for distributors looking to optimize inventory. If you project an increase or decrease in sales for a product, simply enter the expected percentage change, and it will automatically adjust the demand forecast for all customers who typically buy it.

To create more accurate projections, you can conduct predictive scenario planning using historical sales data. Analyze specific customer segments and items by generating a sales prediction graph to compare with your demand forecast. The model displays best and worst-case scenarios, with drill-down capabilities for each item or client. By comparing the two figures, you can compare analyses and potentially adjust your demand models to create more accurate projections.

Additionally, you can perform scenario analysis for your budgets. The module uses real-time financial data from NetSuite’s general ledger to compare with static budget projections from the beginning of the fiscal year. It calculates their gross profit, expenses, and net income variance. From there, you can adjust top-level budgets, and they will automatically update throughout the system. This streamlines processes and ensures all data is up to date.

NetSuite’s strong financial tools make it one of the most popular systems on the market, though it has its faults. Its setup is tedious, as you’ll need technical expertise during implementation. While it does offer solutions like SuiteSuccess to help, it will still take several months for most businesses to implement.

NetSuite uses a quote-based pricing model. That said, expect prices to start around $1,299/month, plus $99/user/month for the cloud-based starter accounting package. While it may price out small businesses, its automated financial tools are well-suited for midsized distributors and service-based companies that have outgrown simple accounting systems like QuickBooks Online.

Read our full NetSuite review.

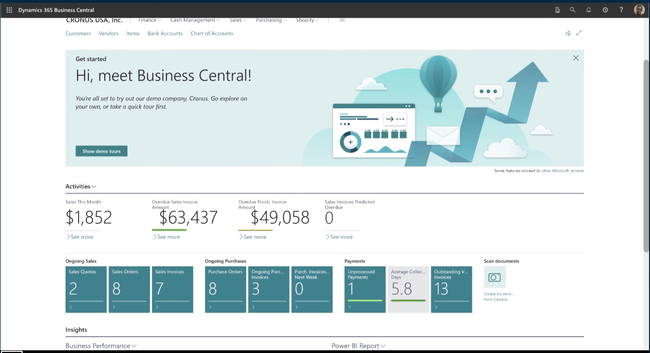

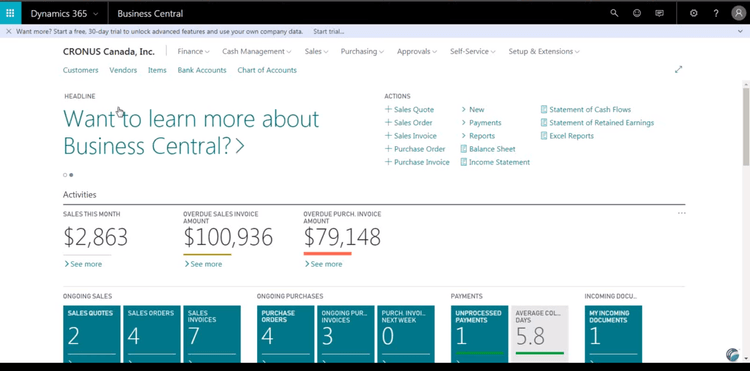

Dynamics 365 Business Central - Best for Distribution

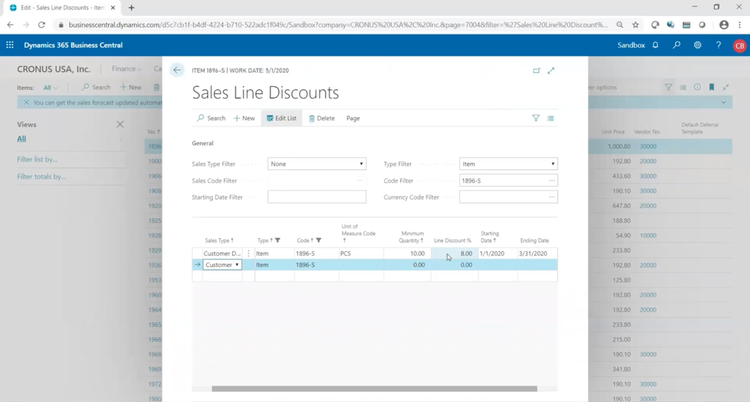

Microsoft Dynamics 365 Business Central offers a detailed item editing module that streamlines pricing for distributors and wholesalers. You can create and apply flexible pricing structures for each item in your inventory, such as customer-specific or seasonal prices. This helps you manage several strategies at once to ensure every product is priced accordingly.

Within the item editor, you can also optimize the reordering process. You choose between multiple reordering policies for each item, including lot-for-lot, fixed quantity, or maximum quantity. For each, set parameters to ensure you don’t overstock or run out of a specific product. This helps you quickly modify reorder quantities during seasonal fluctuations or adjust lead times based on supplier trends.

Business Central features a user-friendly interface across the entire system, including the item editor module. Those already using Microsoft tools like Excel and other Office 365 programs will be familiar with the navigation and interface. Additionally, Copilot Chat offers AI-driven assistance with data entry and reporting, integrating into the interface to guide users through tasks like updating item records.

Additionally, Business Central is affordable for small to midsize distributors. Its “Essentials” plan starts at $70/user/month and includes crucial modules like financial management, CRM, inventory, and supply chain management.

Read our full Dynamics 365 review.

Acumatica - Best CRM Module

Acumatica features a modular architecture and industry-specific versions packed with integrated functionalities. These include packages for the professional services, construction, manufacturing, distribution, and retail industries. This design allows businesses to handpick modules they currently need, ensuring they aren’t overwhelmed. This is ideal for growing and mid-sized companies requiring scalability as their needs expand.

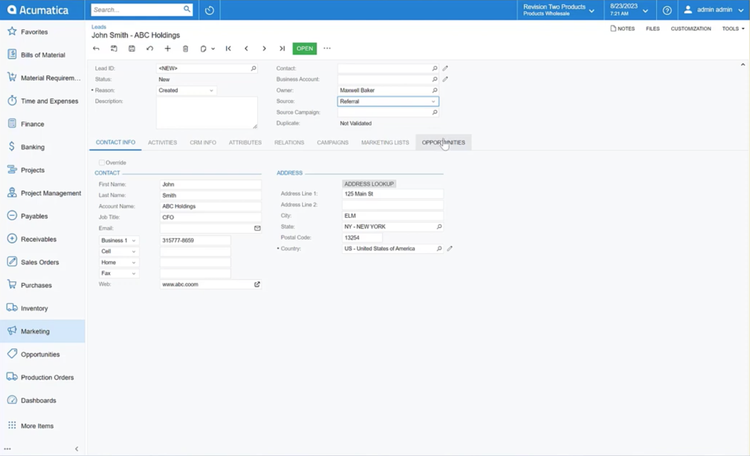

Specifically, we found Acumatica’s fully integrated CRM module effective, so you don’t need extra tools like HubSpot or Salesforce. It features a marketing dashboard to track and monitor important KPIs, like leads generated by source and opportunity win rate. Because of the all-in-one nature of ERP, the system uses data from the accounting module to see which customers are most profitable. This lets you extract granular insights into campaign performance and see your top-performing channels.

Salespeople can view and manage leads that Acumatica consolidates from your campaigns, referrals, or through manual entries. In the activities tab, you can directly link phone calls and emails to a lead for full transparency. If your team uses Microsoft Outlook for communication, the system has an add-in so you can view lead details without leaving the platform to streamline workflows.

Acumatica offers a unique consumption-based pricing model, meaning you pay for the computing resources, applications, and transaction volume you use. This is different from most ERPs, which deploy a user- and modular-based system. While Acumatica tailors the cost to your circumstances, it can increase the price if you need several modules. Its base package starts at around $1,800/month for 10 users or less, which may be too steep for small companies.

Read our full Acumatica review.

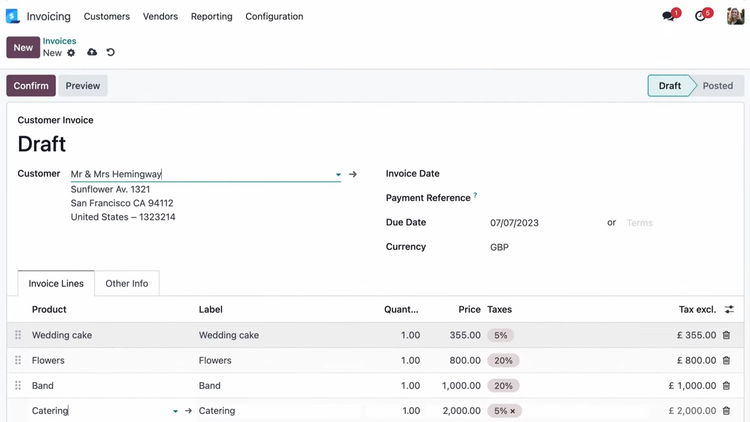

Odoo - Best Open Source

Open-source ERP software such as Odoo allows access to the source code, which provides new opportunities for customization and lets end-users have more impact on product development. This leads to transparency that elevates quality standards. If you install and manage the software, Odoo can be a free system. Otherwise, it offers online hosting for all apps at $24.90/user/month.

One of Odoo’s strongest features is its invoicing, which helps retail, services, and distribution companies get paid faster. The simple user interface makes it easy to navigate, helping lessen the learning curve for new users. All customer and product information is available from your database, which it uses to auto-populate addresses, descriptions, and prices. It even applies and calculates the correct tax rate. This allows you to efficiently create accurate bills from sales orders without significant manual entry.

Once clients receive your invoices via email, they can pay using a secure customer portal. They can choose between Paypal, credit and debit cards, or a wire transfer. This streamlines the payment process for your customers, helping you receive payments faster and increase cash flow. The system stores all posted bills on one dashboard so you can track whether you have received payment or if you need to follow up on late statuses.

Odoo is a great open-source option for small to mid-sized businesses. However, it requires a high degree of technical expertise, and the customization options can be overwhelming to some. Companies looking for a more standard, pre-built ERP option may find Microsoft Dynamics 365 Business Central more appealing.

Read our full Odoo review.

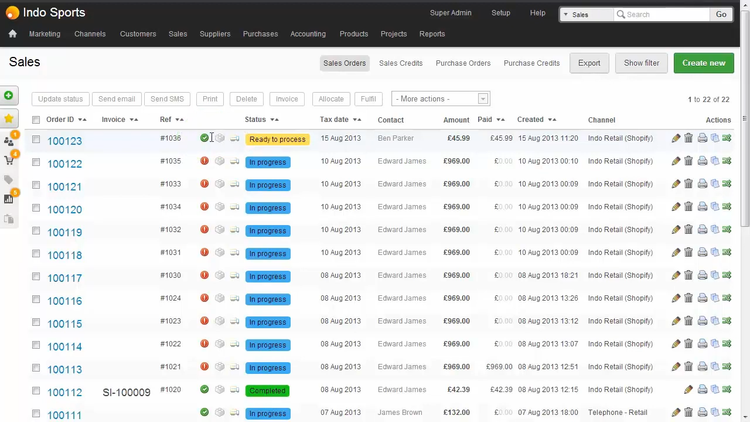

Brightpearl - Best for Retail

Brightpearl’s order automation engine helps retailers streamline multi-order management. The system lets you set up customized rules for inventory allocation, order routing, fulfillment, and shipping to optimize workflows. When a customer places an order, Brightpearl instantly updates inventory across all sales channels, whether it’s through the integrated POS app in brick-and-mortar stores or via your eCommerce platforms. This eliminates overselling, which leads to complicated refunds and customer dissatisfaction.

If you utilize different fulfillment methods, Brightpearl has you covered. It helps automate dropshipping, multi-location, partial, and Fulfillment by Amazon to cater to your complex workflows. Its native eCommerce integrations with leading platforms, like Amazon, Walmart, Shopify, and BigCommerce, can handle large order volumes and fulfill them correctly.

Brightpearl also offers an analytics module to evaluate KPIs, such as average order value or revenue per sales channel. You can also view your refund and return volume over a period to identify any process causes, such as improper order processing or incorrect inventory counts. Further, by integrating Sage Intacct, you can also analyze all financial impacts and accounting insights. This helps you ensure profitability and adapt in a volatile retail industry.

Brightpearl is best for small to midsize companies that are managing multiple eCommerce platforms and physical stores. Unfortunately, they do not reveal pricing figures publicly, so businesses must request a quote.

See our Brightpearl page.

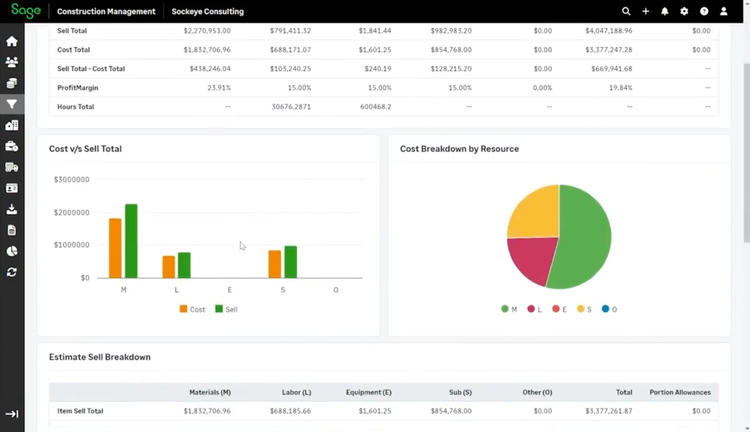

Sage Intacct Construction - Best for Construction

Sage Intacct Construction combines the accounting of Sage Intacct and Sage Construction Management to create an all-in-one ERP system. Specifically, its lead tracking and bid management tools help estimators create winning proposals. You can view all active leads on a single customizable dashboard with a built-in calendar view for upcoming events or meetings. From here, track statuses and prioritize opportunities to better manage potential sales.

Once leads are in the system, you can create accurate estimates. You can import all your cost codes and items from the invitation to bid document, and the system generates an accurate list with total quantity, cost, and sell amounts. It displays all information in the summary and reports tab, breaking down costs on intuitive charts for an easy-to-understand estimate. To provide more context, attach documents, drawings, and photos.

Sage Intacct Construction is a good fit for mid to large-size general construction or subcontractor companies managing several complex projects simultaneously. Because it combines Intacct’s comprehensive financial management tools with end-to-end construction features, the system has a high learning curve for new users. However, they do provide training and onboarding assistance to lessen this.

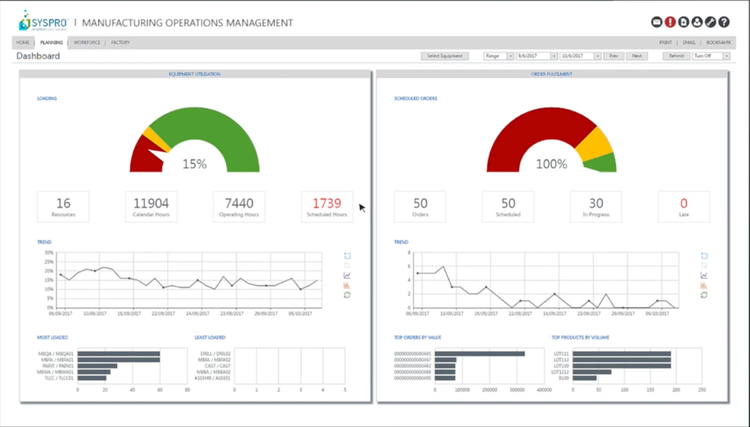

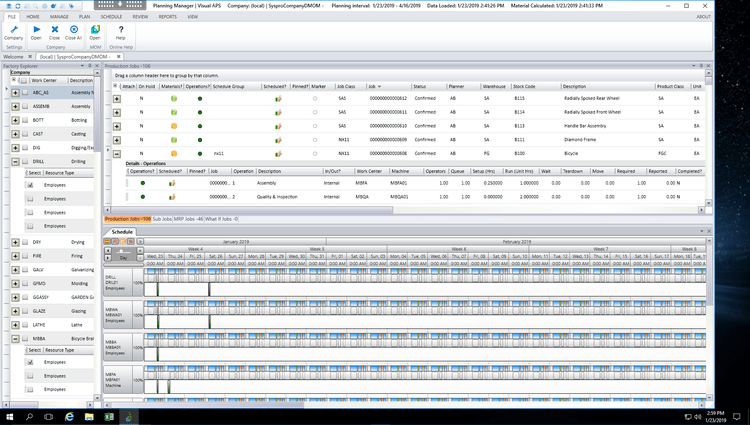

SYSPRO - Best for Manufacturers

SYSPRO is a manufacturing ERP system with a highly effective production planning tool. It supports various modes, including engineer-to-order, make-to-stock, and mixed-mode operations. You can quickly drag and drop orders or tasks into the schedule to ensure high-priority jobs are completed or configure auto-scheduling. Each operation includes job details with a description, start and end time, and the stock code for easy reference.

The module also includes a dashboard that displays equipment utilization and order fulfillment metrics. Based on calendar and operating hours, see which machines are over- or underutilized and adjust accordingly. Also, you can see how many orders are currently scheduled and in progress, and compare volumes across different periods. This allows you to analyze shop floor production efficiency and make more informed decisions to minimize production costs.

SYSPRO supports cloud and on-premise deployment, with prices starting at $200/user/month. Its flexibility makes it a great option for several manufacturing companies, from discrete automotive to food and beverage plants. That said, it lacks HR and payroll modules, so you’ll have to integrate third-party systems to gain those functionalities.

Read our full SYSPRO review for more info.

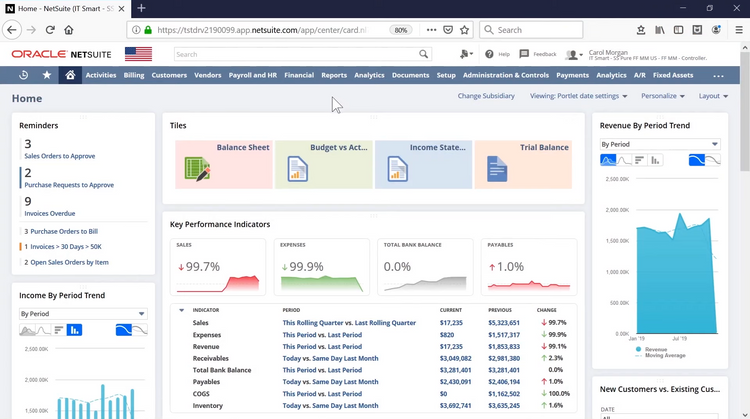

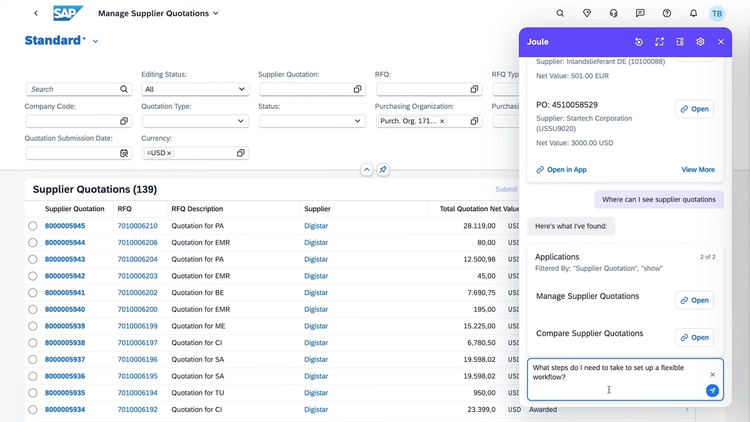

SAP S/4HANA - Best for Global Enterprises

SAP S/4HANA’s global financial management module is useful for enterprise companies with complex accounting processes. The system consolidates your entire business’s financial data from all sales channels, departments, and countries to give you a clear view of your health. As transactions occur, it automatically posts the journal entry into the database to accelerate financial reporting.

Through the customizable financial dashboard, you can view and track real-time KPIs for crucial business metrics. While the interface can get a bit cluttered, especially for enterprises, you can efficiently analyze high-level data from one screen. You can enable automatic prioritization of overdue invoices or late payments to optimize cash flow. For global companies, you can segment analysis by region to ensure statutory reporting compliance and gain geographic-specific insights.

SAP S/4HANA has a complex setup and implementation process due to its several comprehensive modules and support for high data volumes. When purchasing, you’ll need a dedicated team of IT professionals. While pricing figures are not public, we estimate that the monthly subscription cost will start at over $9,000/month for businesses with over $100 million in annual sales.

Visit our complete SAP S/4HANA review.

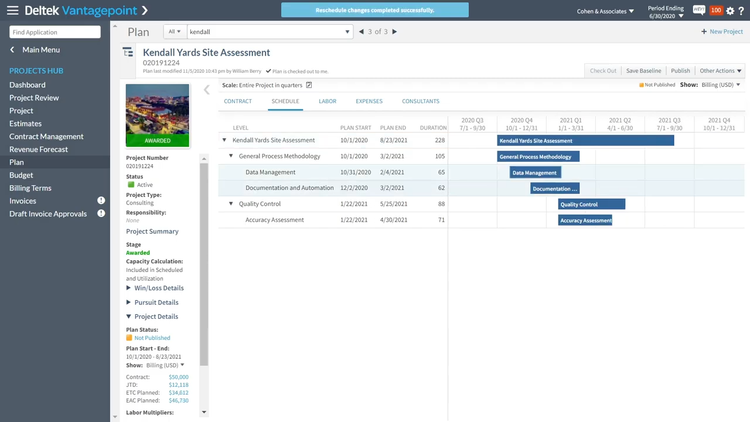

Deltek Vantagepoint - Best for Professional Services

Deltek Vantagepoint’s project management module helps professional service firms manage resources and deliver on tight deadlines. It features an interactive Gantt chart to schedule project tasks efficiently. Configure dependencies so that dependent tasks adjust automatically to keep schedules aligned when one deadline changes. It’s especially useful for architecture and engineering firms, as phases like development require schematic design approval before starting.

In the labor tab, you can view current employee workloads across a period for individual projects. Compare planned hours with allocated assignments to see whether changes are needed to stay within their limits. Reallocate tasks between team members, whether it’s for better skills matching or to meet increasing client demands. This allows you to manage resources effectively to avoid employee burnout and adapt to shifting timelines.

Additionally, Vantagepoint lets you create detailed project plans to determine project success and profitability. The dashboard displays all current jobs with their planned vs. actual billed hours in real time, so you can quickly see if your team is meeting its targets. Before projects even start, you can allocate labor to optimize schedules and match skills. This is crucial for consulting firms, as some client work requires specialized certifications or experience.

Due to its breadth of features and higher price point, Deltek Vantagepoint is ideal for mid to large-sized professional service firms. The system is offered in Basic, Advanced, and Ultimate packages. While prices are not public, the tiered model allows businesses to select a plan that suits their needs.

For more info, visit our Deltek Vantagepoint page.

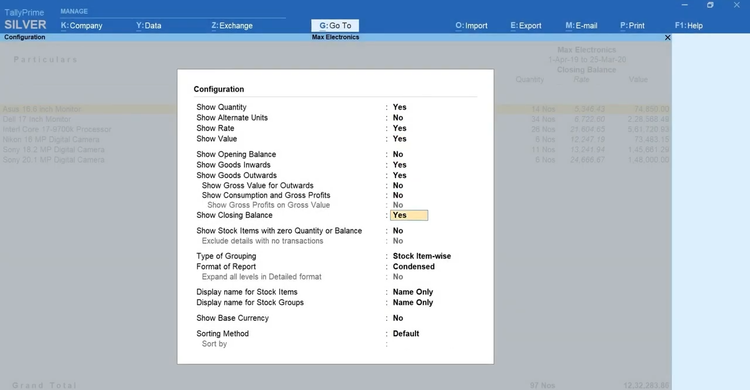

TallyPrime - Best for Small Businesses

TallyPrime’s easy-to-use features and low cost make it a strong option for small businesses upgrading from spreadsheets or a basic accounting system. It offers a streamlined reporting module that’s configurable to your business needs. You can create reports for the following fields:

- Accounting: Core accounting reports include detailed profit and loss, cash flow statements, and AR/AP analysis for greater financial management.

- Inventory: Generate movement analyses, stock queries, and profitability per item reports easily to analyze your operations.

The reporting module is integrated with its cost control center, allowing you to conduct further financial analysis. Here, you can set budgets for every level of your business, from individual salespeople to entire departments. You can also track performances and compare your projections with actuals, helping you make more informed decisions about inventory levels, sales strategies, or company-wide spending.

TallyPrime’s Silver plan starts at $81/month for a single user, making it an affordable solution for small companies. That said, its interface is a bit dated, so companies valuing a modern feel may want to look at Odoo as an alternative.

See our TallyPrime product profile.

Other Systems We Recommend

ERPNext is open-source software that offers a high degree of customization and accounting, CRM, manufacturing, and project management capabilities. It’s ideal for small to mid-sized companies in the distribution, retail, manufacturing, and service sectors.

Oracle Fusion Cloud ERP is a full ERP suite that automates financials, procurement, EPM, SCM, and risk management. It includes embedded artificial intelligence, like generative AI that can draft an entire project plan from past campaigns, including social media strategies and resource costs.

What is ERP Software?

ERP software is an integrated suite of business applications designed to automate or help with your organization’s back-office functions, including end-to-end business processes such as financials, sales, and operations. More commonly, ERP software can be considered all-in-one software for a business, covering a variety of processes.

ERP systems include various modules chosen to meet your business’s specific needs. These features connect all areas of your business to create maximum efficiency. By enabling inter-departmental collaboration, ERP software provides a means for better financial tracking and forecasting.

Read More: What is ERP and How Do ERP Systems Work?

Common Challenges

Some of the most common problems that ERP software can solve include replacing legacy systems, managing large levels of customization, and integrating with other systems.

- Replacing legacy systems: These platforms become outdated and cumbersome to your business, resulting in costly IT maintenance and siloed data. They may even be coded in different languages, and the original developer may no longer support the software.

- Lack of customization: Many basic systems lack the customization options your business needs as it grows. This can lead to your team creating inefficient workarounds or paying for expensive custom code. ERP customization can streamline operations and automate processes tailored to your company.

- Integration issues: Standalone systems like basic accounting software often require integrations with third-party systems to add more functionality. ERP integration is often unnecessary since it’s an all-in-one solution.

ERP Modules

To discover which ERP modules are relevant to your specific needs, you’ll need to know what features you’ll need to implement and how you can implement them effectively to streamline business management. Each has its functionalities and benefits that can help your business automate processes.

- Accounting: Tracks revenues and expenses. Includes modules such as accounts payable, procurement, accounts receivable, a general ledger, and payroll for employee compensation.

- Budgeting and forecasting: Creates and manages detailed corporate financial plans that estimate a company’s future revenues and expenses. This includes departmentalized budgeting, budget approvals, rolling budgets, predictive budgeting, dashboards, and workforce planning.

- Customer relationship management (CRM): Support sales, marketing, and service activities with contact management, conversation history, lead tracking, order histories, quote/invoice creation, and call center integration.

- Human resources (HR): Provides human capital management for current employees and aids in the hiring and onboarding process for new employees. Includes features such as application processing onboarding, time and attendance tracking, and benefits management.

- Inventory management: Tracks all information about the items your company builds, buys, stores, or sells.

- Supply chain management: Manage the flow of goods and services between locations as efficiently and as cost-effectively as possible

Industry-Specific ERP Software

ERP modules are available for virtually every task, program, or function that a business performs. Some products are specifically designed for small business ERP, while others are aimed at enterprise-level corporations.

ERP solutions include modules that help with all facets of a business but should be prioritized based on what industry your business falls under:

- Construction: Contractors need to focus heavily on the task at hand and spend less time worrying about their back-office procedures. Construction ERP software provides financial accounting and operational modules designed specifically with contractors in mind. Core functionalities include accounting, job costing, project management, and estimating.

- Manufacturing: MRP systems, provide the necessary tools for your manufacturing company. This includes material resource planning, quality management, and inventory control.

- Supply chain management: Those who deal with wholesale and distribution trade need to improve the efficiency of their logistics. SCM systems include improved order management, purchase orders for needed goods, inventory control and/or warehouse management for efficient stock control and pick/pack improvements, and tracking deliveries.

- Architecture and engineering (AE) firms: AE ERP software includes built-in project management tools to better manage resources and ensure project profitability.

Benefits

Why is a centralized, comprehensive ERP software solution necessary in the modern business environment? What is the business value of cloud-based ERP? Some of the top benefits of ERP that businesses and departments alike have experienced via improved workflows, streamlined business functions, and significant savings:

- Streamlined workflows and processes. Disconnected systems are inherently inefficient. Data may exist in multiple places at once and there is a time cost paid every time data is transferred between them. By providing a common interface and database, data is managed singularly, allowing much more efficient processes.

- Visibility into workflows. ERP can speed up internal processes and also provide a mechanism to monitor them for continuous improvement. Transparency is a central goal to effectively deploy ERP systems. ERP allows organizations to consider processes from a more holistic standpoint to spot issues preventing optimization.

- Better financial planning and decision-making. Reporting is key to ERP solutions. The ability to slice and dice data by region, location, profit center, employee, and in a variety of other ways allows decision-makers to make more nuanced and accurate decisions about the financial direction of the business.

- Improved data security. Managing security permissions and access across various systems is a daunting challenge. A typical control system allows organizations to ensure key company data is not compromised.

Replacing or Upgrading ERP

Technology is being upgraded and replaced at such a rapid pace that it can be challenging for businesses to keep up. At the same time, it’s essential not to fall victim to every new tech fad. When the time comes for an ERP platform upgrade or even to purchase a new solution, you may feel overwhelmed by the volume of options available.

Some important questions to ask yourself about your company include:

- How do you currently handle financials, sales, and other business operations?

- What new functionalities do you want most, either in the base software or as an add-on module?

- Which deployment options will offer the greatest accessibility?

Questions to ask ERP vendors include:

- Does your software include industry-specific modules or customization?

- Do you offer on-premise ERP or cloud-based software? Is there a hybrid option?

- How much training would need to be administered?

- Does the software require additional hardware? Can it be accessed on mobile devices (smartphones, tablets)?

- Is there a one-time perpetual license fee, or are subscription payments required?

ERPs that are software-as-a-service (SaaS) include routine upgrades and maintenance as part of the ongoing subscription cost. While you may pay more for the software throughout ownership, you’ll have peace of mind knowing you have the latest ERP applications at all times.

Read more: Deciding When to Replace or Upgrade Your ERP Software

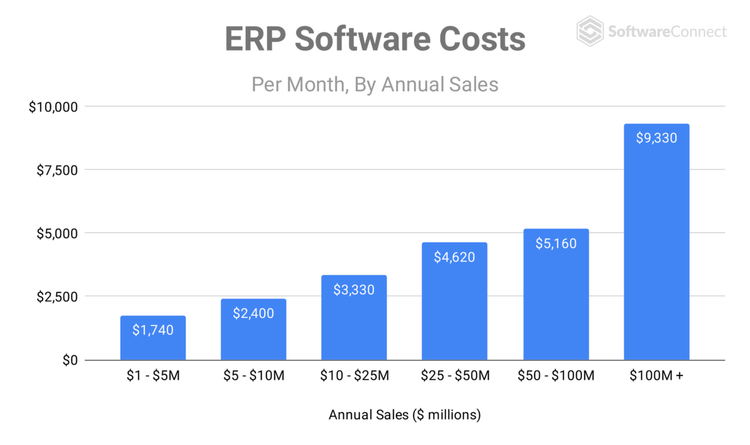

Pricing Guide

ERP monthly subscriptions can range from $400 to $12,500 for small to midsize businesses. Most ERP vendors estimate that software should cost about 3% of annual sales.

- ERP open-source products like Odoo are free to use if you have extensive technical expertise.

- Small business ERP ranges from $5,000 to $30,000/year for up to 50 employees; products like TallyPrime start at $81/month.

- Midsize ERP ranges from $30,000 to $150,000/year for 50-250 employees; Acumatica ranges from $5,500-$6,500/month.

- ERP for large businesses falls between 150,000 to $500,000/year for 250 to 1,000 employees; Epicor Kinetic ranges from $4,000 to $20,000/month.

- Enterprise ERP exceeds $500,000/year for over 1,000 employees; SAP S/4HANA can cost over $9,000/month.

ERP pricing depends on many variables, such as the number of active users, total employees, and whether the system is on-premise or cloud-based.

Implementation costs are another key variable, as they can drastically increase the total cost of ownership (TCO) during the first year of use. The general rule of thumb for calculating implementation fees is to double the cost of using the software annually.

ERP Software Trends

Increased use of Cloud and Mobile ERP

While interest in cloud technology is growing overall, large companies still have a distrust towards cloud hosting. Our recent buyer trends survey found that companies with 50+ employees shopping for accounting software were 41% less likely than smaller companies to review cloud-hosted software. Hybrid ERP is also an option to consider.

Read More: On-Premises ERP Software vs. Cloud-based ERP Solutions

Artificial Intelligence

Top ERP vendors are introducing AI into their ERP systems. SAP developed their own AI business assistant, Joule, and has implemented it it into their S/4HANA software. Oracle developed Oracle AI, which is now embedded into all NetSuite packages. These programs aim to:

- Provide quick data insights and uncover patterns.

- Analyze historical data to generate predictive analytics and forecast future demand.

- Analyze the way users access and interact with the systems to create automated actions.

- Automate processes like data entry and answering customer service inquiries.

Increased focus on business intelligence

Business intelligence systems are becoming more of a necessity for businesses of all sizes. Large enterprises are not the sole beneficiaries of the type of reporting and data that can be gathered from a valuable BI system. Our buyer trends survey also found that companies with over 50+ employees were 70% more likely to need software that handles budgeting, business intelligence, and fixed asset management.

Frequently Asked Questions

Is QuickBooks an ERP?

While not ERP software in the traditional sense, QuickBooks Enterprise brands itself as an “ERP alternative.” QuickBooks Enterprise attempts to let smaller businesses get ERP-level functionality at a small business software price and offers an easy transition from their more simple options (Pro, Premier, or Online) to a business that suddenly needs more advanced functionality.

The software can manage and integrate all components of their businesses, such as marketing, accounting, sales, costing, manufacturing, and more. The software offers advanced functionality of the modules you’ll find in its Pro and Premier versions, such as inventory tracking, pricing, and reporting.

Read more: Is QuickBooks an ERP System?