The best construction project management software simplifies intricate construction tasks, optimizes resources, mitigates risk, and fosters team communication, boosting efficiency, cost reduction, and timely project completion.

Our software experts have evaluated 2024’s leading construction management software, using our review methodology to help contractors, engineers, and architects like you find the ideal fit for your business needs.

- Procore: Best Overall

- Contractor Foreman: Best for Small Businesses

- Buildertrend: Best for Home Builders

- ProjectSight: Best for Mid-Sized Businesses

- Fieldwire: Best Free

- Spectrum: Best Full ERP Option

- Houzz Pro: Most Affordable

- 123worx: Best for Residential and Commercial

- JobTread: Best Estimating Tools

- Buildxact: Another Good Option

- JobPlanner: Best Value

1 Procore - Best Overall

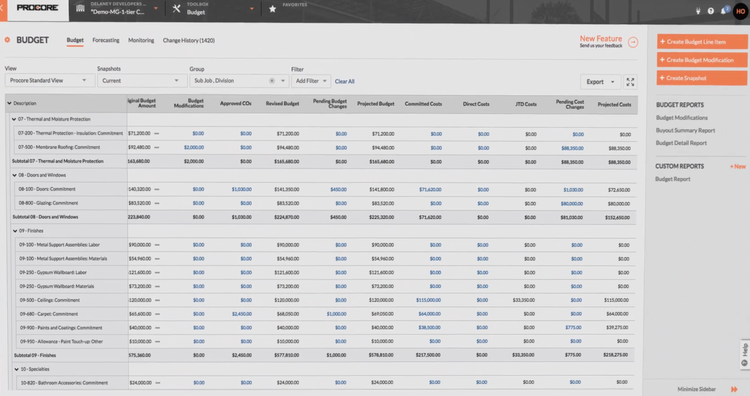

Why We Chose It: Procore’s strength lies in its construction project management, while also offering a financial management portion if in need of something fully integrated. The application includes quality and safety, design coordination, and building information modeling (BIM). The tool lets construction companies know what tasks need to get done to stay on schedule and lets users identify issues before they impact the budget.

Procore claims that 75% of construction project managers reduce project duration by at least 3 days using their program. The software also offers easy integration with other financial solutions such as Sage 100 Contractor and Viewpoint in case you are not looking to use their construction accounting application.

2 Contractor Foreman - Best for Small Businesses

Why We Chose It: Contractor Foreman was created specifically for small and medium-sized businesses, whether they be residential or commercial, trade or general contractors. Marketed as an all-in-one solution, Contractor Foreman has over 35 features available through its varying plans. The standard version starts at $49/month, paid annually.

Contractor Foreman integrates with existing office software such as QuickBooks, Zapier, MS Project, and more. This means you can continue with standard reporting in the accounting software you already have, then use Contractor Foreman for estimates, bid management, change orders, and purchase orders.

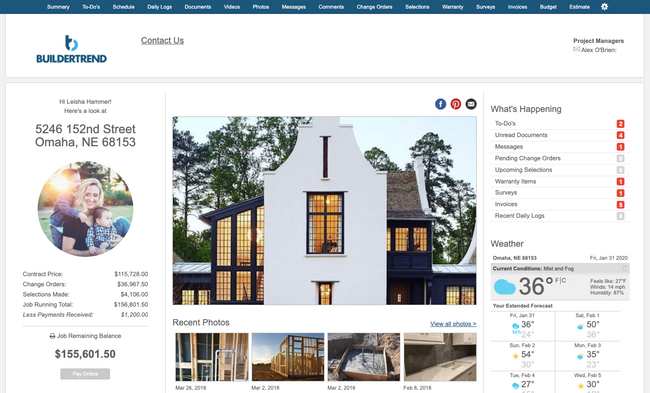

3 Buildertrend - Best for Home Builders

Why We Chose It: Buildertrend is a cloud-based project management software that empowers the construction industry with a better way to build by reducing delays, eliminating communication errors, and increasing customer satisfaction.

It includes tools for estimating, scheduling, and change order features. It also has client communication and document management functionality to store details about every job. These features are designed to streamline every aspect of the construction process.

4 ProjectSight - Best for Mid-Sized Businesses

Why We Chose It: ProjectSight by Trimble is a robust, configurable construction management software, designed to cater to mid-sized to larger contractors and specialty trades. It has features like project status monitoring, user permissions, cost management, and change order tracking to control operations. ProjectSight’s integration with other Trimble solutions provides automatic backup of project files and data.

Along with its extensive project management capabilities, ProjectSight also recognizes the essentials of construction accounting. It provides internal options through other Trimble offerings and an open API for external integrations. The platform uniquely integrates 3D modeling, aiding in effective planning and conflict resolution, and offers mobile applications for constant access to project information. However, we found it does come with certain limitations, including rigid workflows and the need for a separate accounting solution.

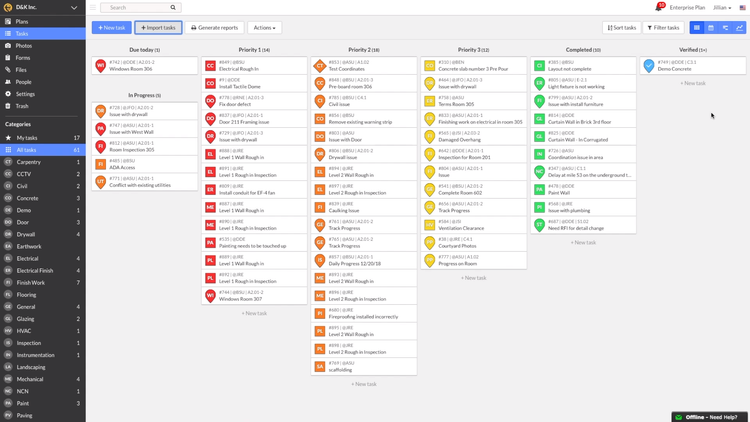

5 Fieldwire - Best Free

Why We Chose It: Fieldwire is a field management solution popular with construction teams, powering 500,000 job sites worldwide. It acts as a hub for coordinating with your project team, tracking the performance of jobs, and reducing your overall risk. Features include messaging, task lists, scheduling, and reporting.

The free “Basic” version of Fieldwire is intended for small teams looking to try some core features. The solution is limited to 100 sheets and 3 projects. Given the customization options and the ease of upgrading into a paid plan, the free version of Fieldwire is a great way to see if it’s right for you.

6 Spectrum - Best Full ERP Option

Why We Chose It: Spectrum from Viewpoint is an easy-to-use construction ERP software that is completely web-based. This fully integrated set of tools includes construction accounting, construction project management, equipment and materials management, service, HR and payroll, and reporting. This system is a top option for companies looking for a built-in ERP with a complete construction management module.

Note: Spectrum was developed originally by Dexter and Chaney before the Viewpoint acquisition in 2017. Because of this, the solution has years of history operating as its own powerful tool. It continues to be sold today as a powerful tool in the Viewpoint line of products.

7 Houzz Pro - Most Affordable

Why We Chose It: Initially made for interior designers, Houzz Pro has expanded into one of the most affordable construction project management systems on the market. Its most popular Pro plan features a project management schedule tool, daily logs, change orders, and advanced invoicing. This plan is $200/month and includes a 30-day free trial.

Houzz Pro is a great fit for builders, remodelers, and property owners looking to integrate an affordable project management system with accounting software such as QuickBooks. Users can optimize processes such as estimating, takeoffs, and product selections, making it ideal for smaller contractors who need to save time and digitalize tasks. That said, we wouldn’t recommend Houzz Pro for large to enterprise-sized businesses requiring more advanced features.

8 123worx - Best for Residential and Commercial

Why We Chose It: 123worx is particularly suitable for a range of construction-related businesses, from residential remodelers to commercial contractors. This adaptability is one of its primary strengths, making it a good fit for businesses seeking multifaceted construction software.

Some standout features we highlighted in our review include the customizable dashboards and extensive document libraries for every tool, enhancing its usability and organizational capabilities. The integration with Microsoft 365 (Outlook, Word, Excel, PowerPoint, OneNote, and Teams) is another key advantage, especially for businesses already using those tools. Additionally, 123worx’s recognition as the official software of the Holmes Group adds to its credibility and trustworthiness in the construction industry.

9 JobTread - Best Estimating Tools

Why We Chose It: We included JobTread because of its strong estimation tools. The system helps contractors estimate more efficiently with custom formulas and parameters, automatic budget updates, and pre-built cost templates. These tools also enable more accurate estimates, which raises win rates and profits.

JobTread also offers a complete project management module, featuring subcontractor and vendor portals that streamline administrative tasks. Through the portal, management can communicate with subs on all projects in one location, minimizing miscommunications and increasing productivity.

10 Buildxact - Another Good Option

Why We Chose It: Buildxact is a project management tool that helps residential builders with pre-construction tasks. We like that users can compare pricing with industry averages when creating estimates, ensuring the best costs for material and labor. Its point-and-click digital takeoff tool makes the process more efficient and can help builders win more work.

One of Builxact’s key strengths for construction project management is its cost tracking. Builders can compare the cost of items against their total budget, create accurate purchase orders, and manage multiple projects in one place. However, one feature we didn’t like was its invoicing, as users are limited in customizations like changing colors and fonts.

11 JobPlanner - Best Value

Why We Chose It: JobPlanner is one of our top picks for its competitive, transparent pricing. JobPlanner offers a 30-day free trial, with its Basic plan starting at just $25/user/month. Users can also schedule a demo beforehand to see how the software will address their unique needs, from preconstruction to project management.

We like that the Basic plan is feature-rich, including unlimited projects, document management, RFI, reporting, time cards, and more tools. However, companies needing to integrate accounting systems like QuickBooks or Sage will need to upgrade to the Advanced plan at $35/user/month.

Our Methodology for Choosing Construction Management Software

At Software Connect, we personally review software to help you find the right solution for your business needs. When looking at construction project management software, here is the review methodology we use when evaluating a product:

1 Features

The first thing we look at when evaluating construction management software is the scope of functionality. Based on our survey of construction management software buyers, the features we find the most critical include:

- Job costing

- Project management, tracking, and estimating

- Scheduling

We also looked for which software goes beyond these essential functions, as our survey found 14% of buyers wanted tools for migrating data to other industry-focused software.

2 Value

Next, we check the value of the construction management software by comparing the estimated starting price against all the included features. With industry costs always rising, we know how important it is to find reasonably priced options.

3 Performance

Finally, we test out the software ourselves to see how it performs in different scenarios. We look for potential delays when sharing data from a mobile application to a desktop version to see what conditions would be like when working in the field. And we test the navigation to see how intuitive it is to new users.

What is Construction Management Software?

Construction management software is a combination of applications to aid project managers, engineers, general contractors, and architects in improving decision-making in performing the necessary planning, building, and assembling task management in construction projects. Tools include project and contractor management, estimating and bidding and job cost accounting to organize jobs, win more bids, and ultimately make work more profitable.

Cost accounting capabilities help project managers determine the project costs of a construction job by analyzing labor, materials, equipment, and subcontractors. Construction project management (PM) capabilities coordinate planning, scheduling, resource allocation, quality management, time tracking, and collaborative document sharing. Together, these features help construction businesses to plan and control their build process more effectively.

Features of Construction Management Software

| Feature | Functionality |

|---|---|

| Construction Accounting | Tracks revenue and expenses. Includes modules such as accounts payable, accounts receivable with invoicing, and a general ledger. |

| Job Costing | Facilitates the assignment of costs to individual cost categories in order to enable improved cost control and job profitability analysis. Such cost categories typically include labor, equipment, materials, and subcontractors. |

| Estimating | Builds cost models for executing job-based work. Includes functionalities such as takeoff and easily syncs with purchase orders required to complete a job. |

| Project Management | Coordinates the execution of project tasks, including planning, plan markup, equipment tracking, project scheduling, resource allocation, quality management, time tracking, and collaborative document sharing amongst team members, clients, and specialty contractors. |

| Document Management | Keeps digital copies of all documents for the entire project in one secure and easy-to-access location. |

| Bid Management | Streamlines the entire construction procurement and bid process, such as project planning with customizable quote templates. Handles RFIs and submittals between your team members and any change orders required. |

| Project Scheduling | Assists in project scheduling by managing the distribution of labor and resources to create ideal timelines. Kanban boards and Gantt charts measure project progress to calculate an accurate completion date. |

| Customer Relationship Management (CRM) | Keeps detailed information on past clients, current customers, and prospective leads. |

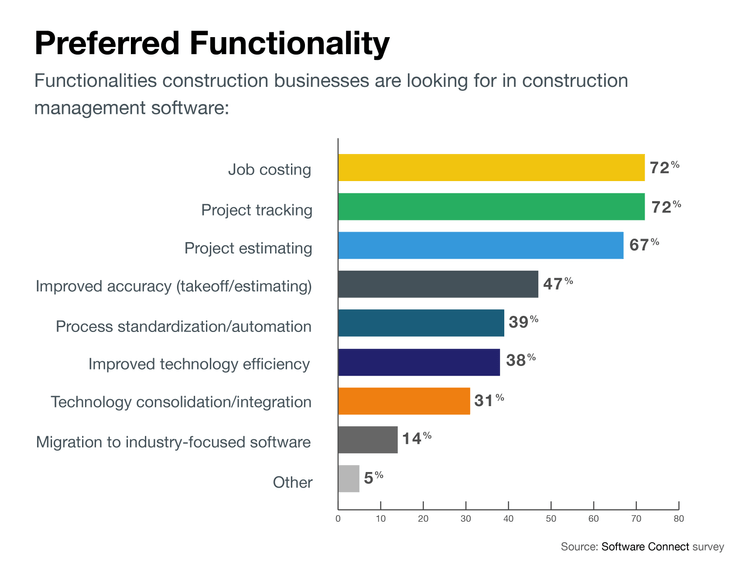

According to our recent Construction Technology Trends survey, two-thirds of construction software buyers desire project management tools for job costing, project tracking, and project estimating.

Best Construction Management Software Benefits

Home builders, remodelers, and other users of construction management software can improve their business workflows in a number of ways. Benefits include:

Eliminate Time-Consuming Manual Processes

Manually tracking projects in a spreadsheet or jotting down cost estimates with paper and pencil might be a familiar or comfortable way of running a business, but it’s not the most efficient. It also leaves you open to human error. Construction management software optimizes how you schedule your workers and predict project timelines. And with cloud-based apps, you can even make updates from mobile devices while out in the field.

Control Over Job Costs

Cost management tools help to keep project expenses in line with functionality such as job costing, project tracking, project estimating, material take-off, time and materials billing, bid management, and purchasing. With real-time updates, you can see how you’re spending your budget before going over. And you can make updates to the final bill for accurate invoicing at the end of each project.

Stay Organized with Document Management

Construction management software offers a broad, consolidated view of the business in one spot. This can help construction professionals make more effective use of their time through project tracking, reduce expenses through job costing, and collect on-time payments through simplified billing and invoicing.

Properly organizing and storing physical documents on an active job site comes with a lot of risks. Construction software provides document management tools for easily storing and retrieving digital versions of all your most important documents, from project bids to final invoices. Project teams can immediately collaborate by creating, sharing, and archiving documents to show real-time progress.

Work On-Site and Away from the Office

Construction software can provide real-time collaboration, so users can access and upload project contacts, plans, drawings, and photos at any time, from any location. Project teams can also improve their project collaboration via punch lists created in the field. Punch lists let project teams conduct efficient walkthroughs and inspections to close out faster.

Construction Management Software Costs

The starting cost of cloud-based construction management software ranges from $7 per month to $200 per month when using a subscription-based pricing model. The total SaaS price generally depends on the number of users and the level of applications needed. Some free construction management software options exist, though there are often associated costs for additional users or specific functionality.

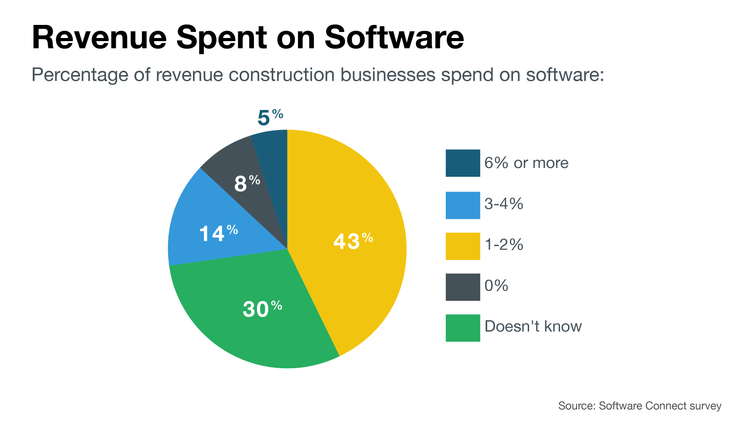

Our construction buyers trends survey found 43% of construction businesses spend 1%-2% of their revenue on software, making it a worthwhile investment. “With rising material and labor costs, firms will likely struggle to maintain their margins in the coming year,” according to Construction Dive in a review of construction industry trends. Construction management software helps businesses trim those costs and ensure profit margins aren’t squeezed.

Types of Construction Software

Most construction project management software is created with a specific scope of business in mind, such as accounting or project scheduling. Depending on your size, you might weigh certain project management solution features above others:

Small Builders and New Companies

If you’re small or new, job costing will be the most important feature to help you manage your basic accounting much easier. Most basic construction accounting software should offer some sort of cost management functionality for making general estimates on upcoming projects.

Mid-Level Companies

Growing and established companies looking to upgrade will likely desire more in-depth functions beyond basic accounting software, such as estimating tools and some level of bid management. These functionalities are best provided by an industry-specific construction management solution or from a vendor specializing in software implementation in construction environments.

Large Construction Companies

Companies in need of a full suite of functionalities should look towards construction ERP solutions to provide enterprise-level construction management. These will be popular software solutions with a long proven track record of assisting construction companies. Advanced ERP software can have a level of custom development to make them more in-tune with a company’s estimating and bid management needs, to ensure the solution works along the project lifecycle as a complete all-in-one system.

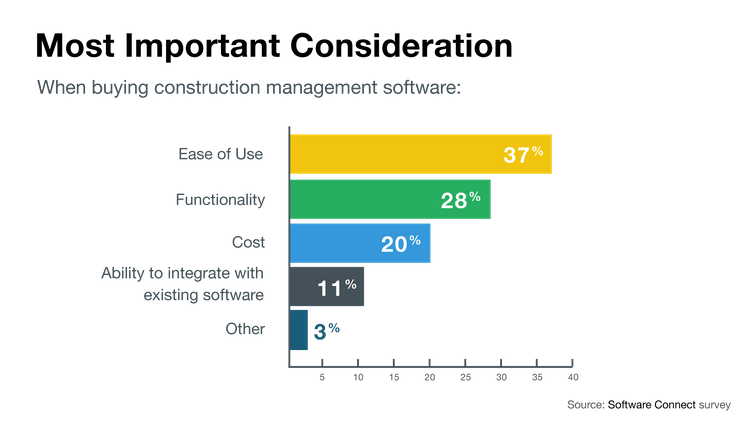

In our recent technology trends survey, 37% of construction businesses identified ease of use as the most important consideration when buying construction software. Other notable considerations include:

Construction businesses should be clear about who will be using the software and, as such, who will need to be trained on how to operate it. Before buying software, inquire about the availability of training and customer support from the vendor.

Is QuickBooks a Construction Management Software?

** [QuickBooks Online] (/accounting/intuit-quickbooks-online/) ** has been used successfully by thousands of construction companies. While it lacks industry-specific construction management functionality, the solution can handle the accounting needed for most construction businesses. This includes managing job costs, tracking time and expenses for projects, and running various reports on a job/project level.

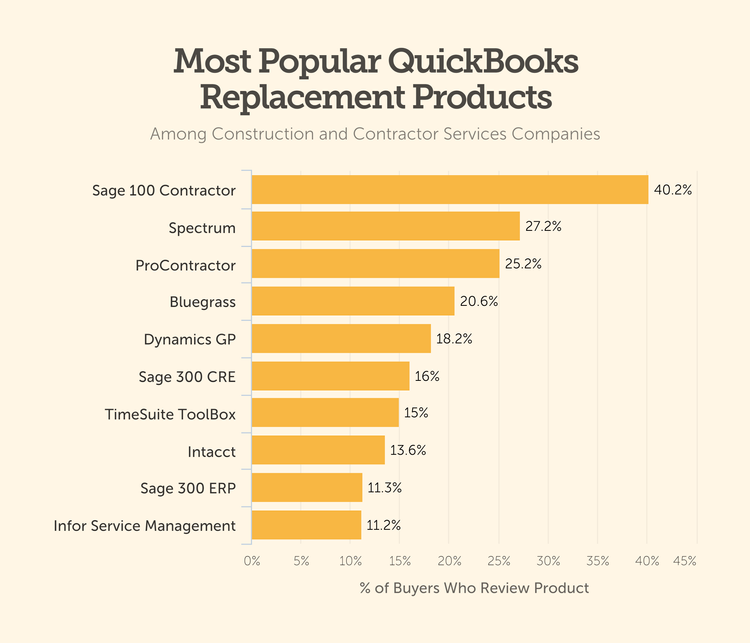

However, research over the past few years shows more than 35% of construction businesses have been looking to upgrade from QuickBooks in some way. Fortunately, a number of QuickBooks alternatives are available for construction businesses that have outgrown the product.

Market Trends in Construction Management Software

Based on a recent technology survey by Software Connect, some of the top trends in construction software include:

- 80% of companies rely on manual methods to carry out basic business functions.

- Job costing and project tracking are the top two functionalities sought by construction businesses (72% each), with project estimating in third place (67%). While this ranking of functionalities should not dictate the software needs of a construction business, it does offer some guidance.

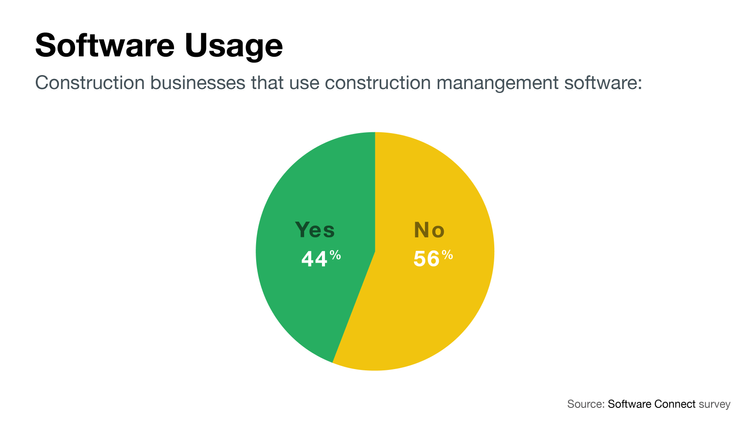

- 56% of construction businesses said they use construction management software. The remainder (44%) don’t use construction software and, as a result, might be wasting time and money.