To help you choose the right solution for your business, we found and ranked the best fixed asset management software in the market today.

- AssetMAXX: Best Overall

- Asset Panda: Customizable Asset Adaptability

- Sage Fixed Assets: Strong Depreciation Engine

- EZOfficeInventory: Most Intuitive UI

- eWorkOrders: Seamless Maintenance Reporting

- WorthIt Fixed Assets: Strong Compliance Management

- Bar|Scan Asset Management: Advanced Inventory Control

- CenterPoint Depreciation: Precision Asset Valuation

1 AssetMAXX - Best Overall

Why we chose it: We found AssetMAXX best overall because it’s a user-friendly option based on automated workflow processes. These reduce manual input in tasks like adding, disposing, transferring, and modifying asset records.

Additionally, AssetMAXX integrates with existing ERP systems, a feature that can be beneficial for organizations looking to consolidate their asset management without overhauling their existing systems. Finally, it provides compliance with GAAP and GASB 34/36 standards. This saves users time preparing reports. It includes a collection of standard reports and the ability to create custom ones as needed.

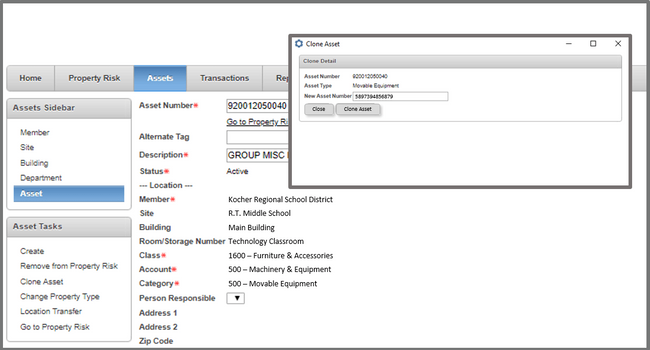

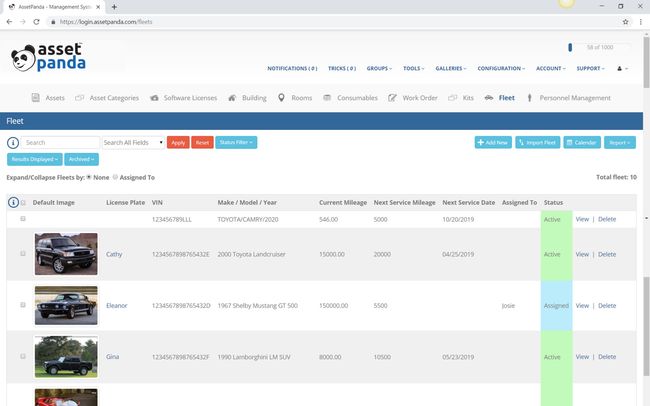

2 Asset Panda - Customizable Asset Adaptability

Why we chose it: We think Asset Panda is a good pick because it has a highly customizable no-code fixed asset management module. We think its flexibility is one of its strongest suits. Recognizing that every business has unique asset management needs, Asset Panda allows for customization of asset fields, ensuring that the system aligns with the specific language and requirements of each organization.

The software’s mobile compatibility is another significant advantage. Whether on-site or remote, users can access the platform via the web or through its mobile app for both Android and iOS devices.

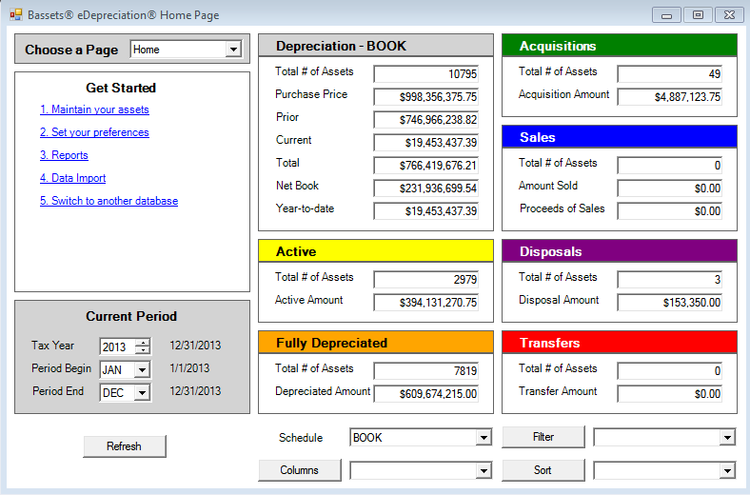

3 Sage Fixed Assets - Strong Depreciation Engine

Why we chose it: Sage Fixed Assets is in our top three because of its powerful depreciation engine. It supports 50+ methods for precise asset valuation and offers customizable reports.

Sage Fixed Assets’ modular design, encompassing depreciation, planning, tracking, and reporting, ensures comprehensive asset oversight. The tracking module is crucial for preventing asset losses.

The software integrates seamlessly with ERP systems like Microsoft Dynamics and Oracle, optimizing operational efficiency. Through a partnership with WebHouse, Sage also facilitates real-time asset access for remote workers.

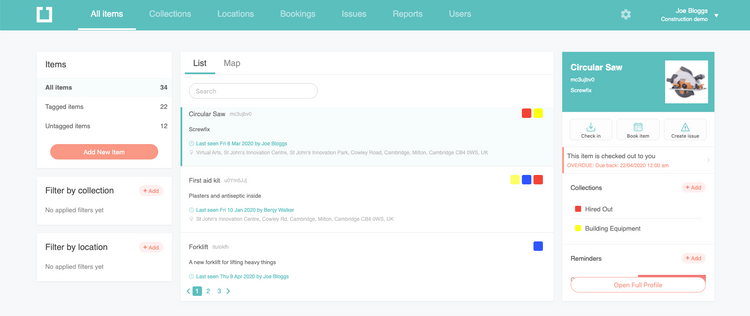

4 EZOfficeInventory - Most Intuitive UI

Why we chose it: We found EZOfficeInventory to be the most user-friendly option because it has an intuitive interface. Streamlined and navigable, it ensures that even beginners can use the platform without much of a learning curve.

With the availability of a mobile app, users can manage their assets on-the-go. The ability to scan barcodes and QR codes directly from the mobile app makes fixed asset tracking convenient, especially for businesses with assets spread out across multiple locations.

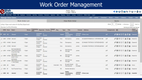

5 eWorkOrders - Seamless Maintenance Reporting

Why we chose it: We think eWorkOrders offers the best maintenance reporting because employees don’t have to search for personnel to report an issue. They can simply use a requester link, complete a customizable form, and generate an official work order instantly.

Once a work order is generated, eWorkOrders uses smart algorithms to decide on task assignments. If a particular task pertains to a specific expertise, such as an electrical issue, only technicians with that expertise get alerted. We also found its location-based assignments helpful for technicians. This prioritizes employees working in proximity to an asset.

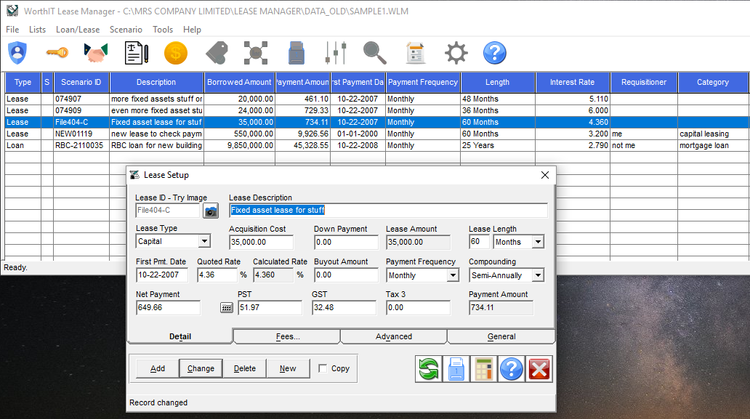

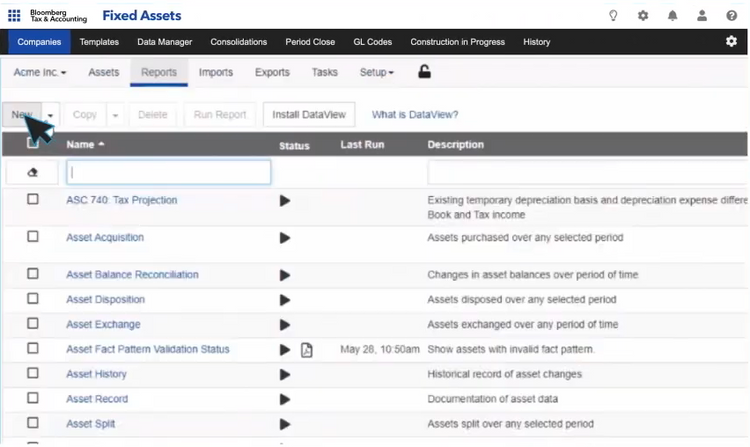

6 WorthIt Fixed Assets - Strong Compliance Management

Why we chose it: We found WorthIt Fixed Assets’s compliance management features extensive. The platform adheres to various accounting standards, making it ideal for companies needing to maintain compliance with regulations such as IFRS, GAAP, or tax rules.

WorthIt Fixed Assets automates complex depreciation calculations, reducing the risk of errors and saving time for accounting teams. Its comprehensive reporting capabilities also allow businesses to generate detailed asset reports for auditing and strategic planning purposes.

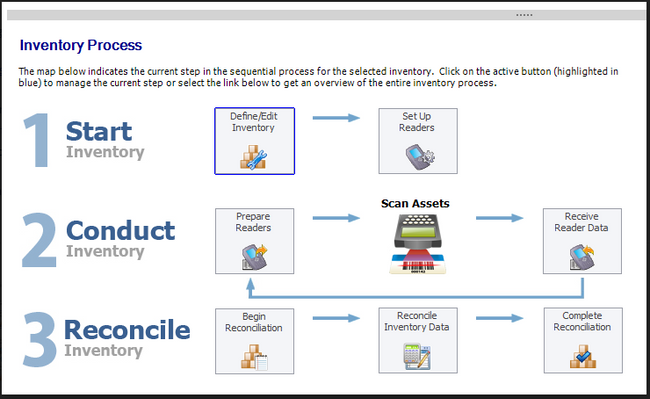

7 Bar|Scan Asset Management - Advanced Inventory Control

Why we chose it: Bar|Scan Asset Management delivers comprehensive asset tracking. Its barcode and RFID technology enable efficient tracking of assets across multiple locations.

This software is particularly strong in inventory management, providing real-time asset status, location, and history updates. The user interface is designed for ease of use, simplifying the process of asset tracking for businesses of all sizes.

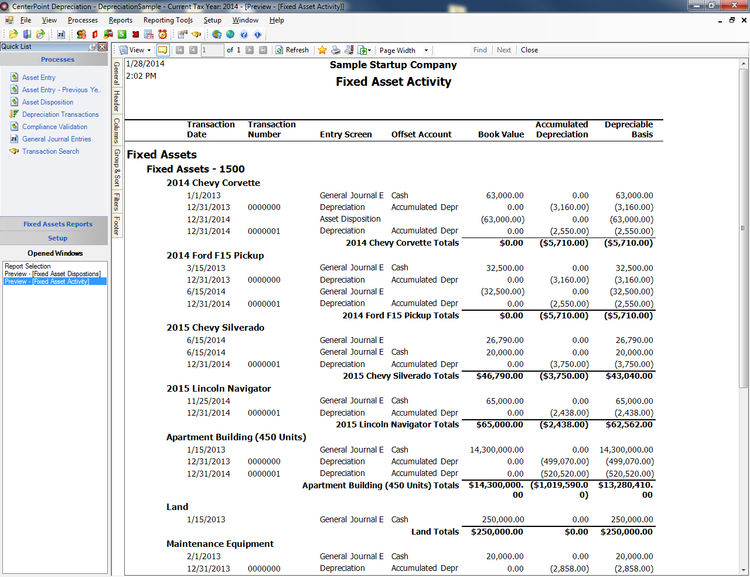

8 CenterPoint Depreciation - Precision Asset Valuation

Why we chose it: CenterPoint Depreciation provides a range of depreciation methods and allows for in-depth asset analysis, making it suitable for businesses looking for accurate and detailed asset valuation.

The software’s flexibility in handling different types of assets and its user-friendly interface make it accessible to manufacturing, construction, and more sectors. It integrates with CenterPoint Accounting to streamline the overall asset management process.

What is Fixed Management Asset Software?

Fixed asset management software helps you track purchase cost, valuation, depreciation and gain or loss on your assets. Because of the complexity of the financial calculations, utilizing an automated software can save hours of time otherwise spent on traditional, manual fixed asset management practices.

Fixed asset management software streamlines financial asset accounting, preventive maintenance scheduling, and managing depreciation. The software can also automate inventory management workflows with the audit trails created in asset tracking, providing a clear record of where physical assets were at any time.

Fixed asset management can often be found as an application within a larger accounting software for straight-line depreciation calculations. However, businesses with a large volume of assets need a standalone solution to scale with growing production. Fortunately, fixed asset management software provides automation features for depreciating asset value, letting you identify optimal asset management strategies and act accordingly.

Choosing the Best Fixed Asset Management Software

1 Assess Business Needs and Objectives

- Inventory of Assets: Understand the types and quantities of assets your company manages.

- Business Scale and Complexity: Consider the size of your business and the complexity of your asset management needs.

- Regulatory Compliance: Identify the regulatory requirements relevant to your industry for asset management and reporting.

2 Feature Evaluation

- Depreciation Calculation: Look for software that offers diverse and accurate depreciation methods.

- Integration Capabilities: Ensure the software can integrate seamlessly with your existing ERP software or accounting software.

- Customizability: Evaluate if the software can be tailored to your specific business processes and reporting needs.

- Reporting and Analytics: Check for customizable reporting for depreciation, asset valuation and lifecycle, location tracking, usage and performance, and compliance and audits.

- Asset Tracking and Auditing: Consider the software’s ability to track assets through RFID, GPS tracking, QR codes, or barcode scanning. Confirm that the platform supports audit processes.

3 Usability and Accessibility

- User Interface: Opt for a platform with an intuitive and easy-to-navigate interface.

- Training and Support: Assess the availability and quality of customer support and training materials.

- Mobile Accessibility: Confirm a mobile app is available for iOS and Android with built-in scanner capabilities for barcodes or RFID tags.

4 Cost-Benefit Analysis

- Pricing Structure: Analyze the pricing model (subscription, per-user, etc.) and ensure it aligns with your budget.

- ROI Consideration: Evaluate the potential return on investment by considering time and resource savings.

Fixed Asset Management Software Key Features

- Asset Accounting and Depreciation Management: Calculate costs for managing assets as they depreciate to stay within your operating budget

- Asset Lifecycle Management: Control assets over the entire course of ownership, from the initial acquisition to depreciation

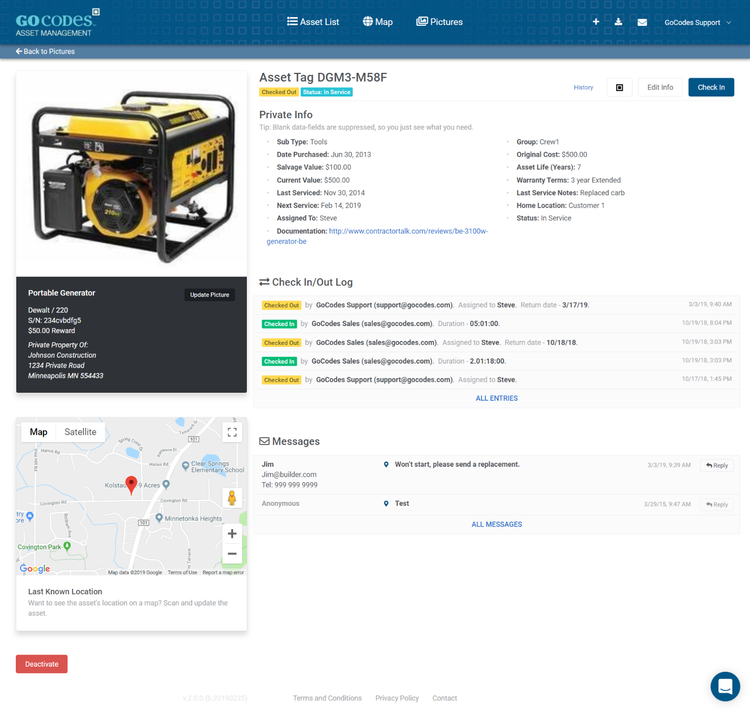

- Barcoding and RFID Tracking: Asset barcode labeling and scanning for quicker asset recognition; Check-in/check out tools provide real-time asset location information and record historical movement in an audit trail

- Document Management: Keep digital records of all asset information in one shared, easily accessible location

- Inventory Management: Record the location of assets within your inventory with barcodes, RFID, or QR codes

Other notable features include:

- Multiple depreciation methods: Automated calculation of asset depreciation based on customizable depreciation methods such as straight-line, declining balance, and others

- Tax form support: Ability to create required tax forms for asset depreciation including forms 3468, 4626, 4255, 4797, 4562, and T2S8

- Cost center assignments: Management of corporate cost codes with the ability to allocate assets to the correct department or cost code

- Asset grouping: Reporting capabilities allowing assets to be grouped by type, cost center assignment, or location

- Asset retirement planning: Forecasting of all future costs considering maintenance and asset value depreciation in order to provide asset retirement scheduling recommendations

- Lease vs buy analysis: Lifetime cost calculations considering asset depreciation value for providing lease versus buy recommendations

Best Fixed Asset Management Software Benefits

The top benefits of fixed asset management software include:

Keep Assets in Peak Operating Condition

One benefit of FAM software is the ability to stay on-top of an asset’s condition. Without regular, real-time updates, you could be left with broken down equipment and delayed production. To ensure your assets are operating in peak condition, use software to schedule reactive and preventive maintenance. Taking care of your assets now can increase their overall lifespan and increase uptime in the future.

A full fixed asset management software can record where assets are, how they are being used, and when they are operating or down. Historical data on asset performance can forecast when maintenance should be scheduled, spare parts ordered, or new options purchased. Combined with asset accounting, FAM software can determine when an asset’s value has depreciated past the point of usefulness and affordability.

Update Asset Records

Keeping records on your assets can be difficult due to the sheer volume of data being tracked. And manual data entry is not the best tracking system when your assets range from typical office equipment to vehicles, machinery, hardware, and more. Fortunately, a fixed asset management software not only stores all that information automatically, but also organizes it in a way that’s easy to understand–especially if you are trying to search for specific asset data quickly.

Fixed asset tracking software records when a machine or piece of equipment was purchased, the last time it was serviced, if it is still under warranty, and when preventative maintenance is scheduled. Automated notifications inform you when maintenance is due, so you can take care of it before it might arise. Having these records stored in a single system makes it much faster to find information without having to look through tons of paperwork or Excel spreadsheets.

These assets are usually managed via asset tags, which can be tracked through serial numbers or bar codes. Access to real-time asset information at a moment’s notice puts less strain on employees to gather data last minute when it’s time for audits or reports. It also streamlines the assembly of regularly scheduled reports, like quarterly reviews.

Prevent Depreciation with Up-to-Date Asset Valuation

A fixed asset management software can automate depreciation calculations along the asset lifecycle and keep financial reporting processes compliant. Yet calculating proper depreciation is only a starting point for today’s fixed asset management software systems. In addition, almost all of the systems compute gains and losses on the sale of assets and often provide more advanced features. With tax laws constantly changing, you need automated software to take advantage of all available tax savings.

It’s an unfortunate reality that many companies overpay in taxes and insurance due to ineffectively managing their fixed assets. Using a fixed asset software application can help your firm maximize the payoff from capital investments by clearly identifying each investment, its value, location, purchase details, depreciation method and accumulated depreciation.

How Much Does Fixed Asset Management Software Cost?

Fixed asset management software can cost as anywhere from $10 to $99/month. One-time fees for perpetual licenses range from $295 to $6,800. However, there may be additional costs for user training, hardware installation, and implementation.

Other factors to consider are how many assets you have, whether you prefer an on-premise or cloud-based management platform, or want mobile apps on Android or iOS. For instance, web-based FAM software can be accessed anywhere, which is favored by companies with assets spread out over multiple facilities. Integrations with other software, like ERP solutions](/erp/), and optional add-ons with extra functionality may also increase your total price.

Does QuickBooks Cover Fixed Assets?

QuickBooks, a popular accounting software preferred by small businesses, has some fixed asset management functionality. The Fixed Asset Manager (FAM) is only available in QuickBooks Desktop on the Premier Accountant, Enterprise, and Enterprise Accountant plans. If you have a high volume of fixed assets, you should consider a standalone asset management system instead of a QuickBooks add-on.