To help you choose the right solution for your business, we found and ranked the best ERP systems today using our advanced review methodology.

- NetSuite: Best Overall

- Dynamics 365 Business Central: Best for Small Businesses

- Acumatica: Best Mid-Market Option

- Odoo: Best Open Source

- Lightspeed Retail: Best for Retail

- Epicor Kinetic: Best for Manufacturers

- SAP Business One: Best for SMBs

- SYSPRO: Best for Discrete Manufacturing

- Sage Intacct

- TallyPrime

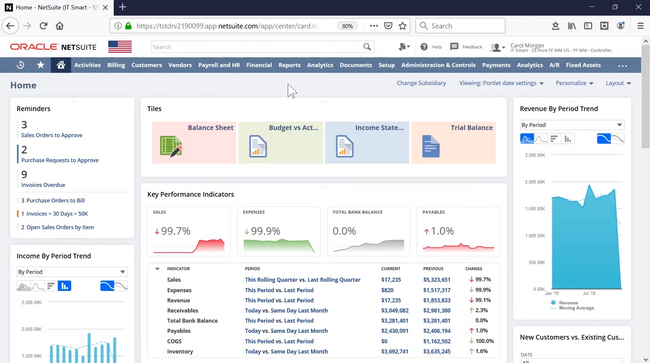

1 NetSuite - Best Overall

Why We Chose It: NetSuite stands out as the best ERP due to its scalability to add modules on at a later date and it’s cloud hosted nature. Designed with growing companies in mind, its modular approach allows users to begin with core financial functionalities like A/R, A/P, cash management, and project accounting. As businesses evolve, they can seamlessly integrate additional modules such as payroll, HR, CRM, and eCommerce.

This flexibility, combined with the option to host internally or via a Software as a Service (SaaS) framework, ensures that sales teams, field technicians, and production staff can access vital data wherever they are. This not only fosters enhanced communication but also caters to the diverse needs of various sectors and organizational sizes.

Read our full NetSuite review.

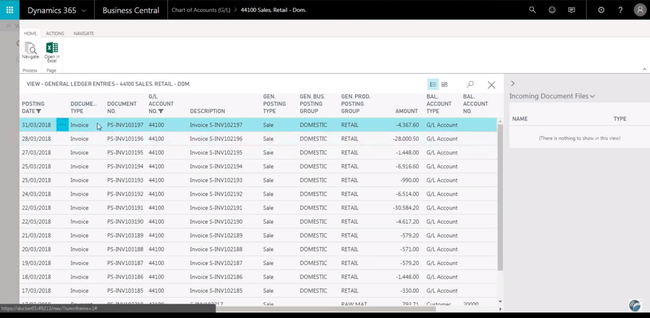

2 Dynamics 365 Business Central - Best for Small Businesses

Why We Chose It: Microsoft Dynamics 365 Business Central is a standout ERP solution tailored specifically for small to mid-sized businesses. The user-friendly interface is designed with familiarity in mind, especially for those already using Microsoft tools like Office 365. This ensures a reduced learning curve and quicker adoption.

Its accounting module is another highlight, offering detailed audit trails that ensure transparency in financial transactions. This is further complemented by multi-currency and multi-language support, catering to growing businesses with international aspirations. The software’s automation capabilities, particularly in invoicing and reporting, are not just about efficiency but also about accuracy, ensuring businesses maintain impeccable financial records.

Read our full Dynamics 365 review.

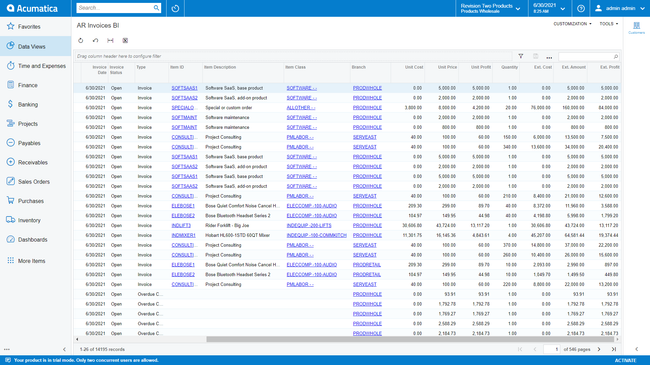

3 Acumatica - Best Mid-Market Option

Why We Chose It: Acumatica is a top ERP solution for mid-market businesses, primarily due to its modular architecture and industry-specific versions. This design allows businesses to handpick and license only the functionalities they currently need, ensuring they aren’t overwhelmed or overcharged. As these businesses grow and their needs evolve, Acumatica’s scalability comes into play, allowing them to seamlessly integrate additional modules.

The industry-specific editions allow companies in sectors like construction or manufacturing get tools tailored to their unique challenges and workflows. This precision ensures that businesses can optimize their operations without unnecessary workarounds. Furthermore, being cloud-based, Acumatica guarantees data security and offers both public and private hosting options, giving businesses the flexibility to choose based on their data handling preferences. This makes Acumatica a tailored, scalable, and secure choice for the established mid-market business.

Read our full Acumatica review.

4 Odoo - Best Open Source

Why We Chose It: Open source ERP software such as Odoo allows access to the source code, which provides new opportunities for customization and lets end-users have more impact on product development. This leads to transparency that elevates quality standards. Odoo can be a completely free ERP software, if you install and manage the software yourself. Otherwise, Odoo offers online hosting and several paid applications.

A standout feature we appreciate is its accounting module. Odoo’s accounting module offers bank synchronization, which reduces manual entry errors, and its pre-configured tax reports based on fiscal localization ensure businesses remain compliant without the usual hassle.

Read our full Odoo review.

5 Lightspeed Retail - Best for Retail

Why We Chose It: Lightspeed is our pick as the top retail ERP system, as it caters to a vast array of retail sectors. Its user-centric design ensures ease of use, while its robust security features, including EMV compatibility and PCI compliance, prioritize customer data protection.

One of Lightspeed’s standout features is its comprehensive inventory management, which not only tracks sales but also offers real-time reporting, ensuring businesses stay ahead of demand. For companies with a larger inventory dealing with several product categories, Lightspeed lets you get as broad or detailed as you would like. Lightspeed also allows for reserved inventory, that lets you sell products that will remain on-site until a later date (for shipping or customer pick-up).

6 Epicor Kinetic - Best for Manufacturers

Why We Chose It: Epicor Kinetic is our top manufacturing ERP due to discrete manufacturing capabilities. It’s tailored to handle unique, non-repetitive manufacturing processes, ensuring each product is made to specific customer requirements. Its robust product configuration stands out, allowing businesses to define and manage a multitude of product variations with ease. This is crucial for manufacturers who need to cater to diverse customer needs without compromising on efficiency.

Additionally, the low-code customization options allow businesses to mold the platform to their specific workflows, as opposed to rigid, one-size-fits-all software. This adaptability ensures that the ERP system grows and evolves with the business, rather than becoming a hindrance.

Read our full Epicor Kinetic review.

SAP Business One SYSPRO Sage 300/Intacct/Business Cloud ERP TallyPrime Cougar Mountain Denali Summit JD Edwards EnterpriseOne Deltek Costpoint QT9

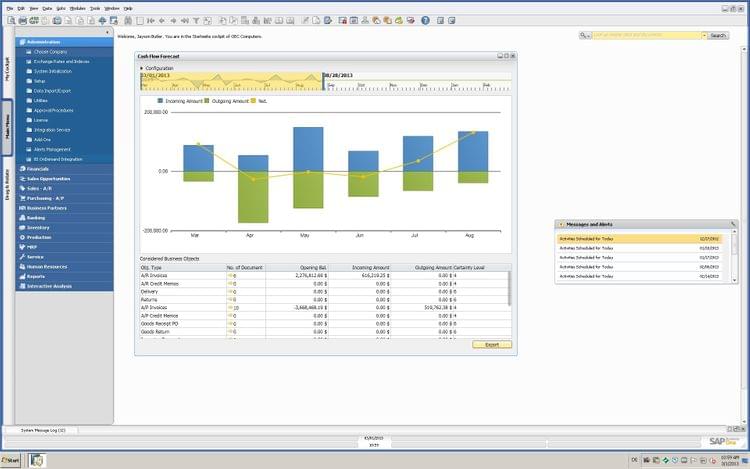

7 SAP Business One - Best for SMBs

Why We Chose It: SAP Business One is an ERP suitable for small and medium-sized companies looking to streamline their operations. The system’s administrative and system-level features, such as multi-currency/multi-language support, notifications, role-based permissions, and data migration capabilities, set it apart in the SMB ERP market.

SAP Business One also stands out for its scalability, ensuring that growing organizations can easily adapt to increased data, transactional, and user demands without major disruptions. And this software caters to a wide range of industries and company sizes, making it a versatile and accessible choice for businesses seeking efficient and scalable ERP solutions.

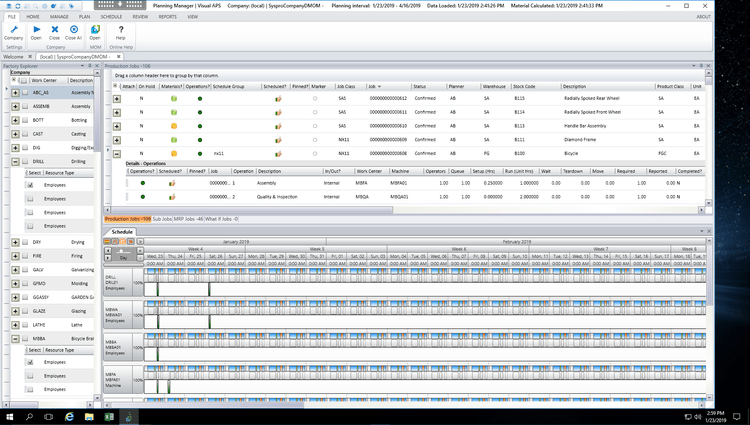

8 SYSPRO - Best for Discrete Manufacturing

Why We Chose It: SYSPRO is a manufacturing ERP which supports various manufacturing modes including engineer-to-order, make-to-stock, and mixed-mode operations.

The integration of AI and IoT technologies is a valuable feature, enhancing decision-making and operational efficiency. And the option for hybrid on-premises and cloud deployment adds further flexibility to accommodate a variety of business preferences and regulations. However, users should be aware of the need for third-party add-ons for payroll and HR modules.

9 Sage Intacct

Why We Chose It: Sage Intacct provides a solid foundation for financial management while ensuring GAAP compliance. The software’s flexibility extends to tax management with Avalara integration, making tax calculations, reporting, filing, and auditing accurate and efficient. The endorsement by the AICPA adds credibility to its financial management capabilities.

What makes Sage Intacct particularly attractive is its scalability, making it suitable for small to mid-sized businesses with annual revenues between $5 million and $250 million. Its multi-entity support, project accounting, and multi-dimensional reporting capabilities are noteworthy, allowing businesses to adapt and grow as needed.

10 TallyPrime

Why We Chose It: TallyPrime is an ERP software solution particularly known for its user-friendly approach and versatility. A range of features includes invoicing, accounting, payroll management, inventory management, business reporting, and more.

One notable feature of TallyPrime is its flexibility, as it can be easily customized with integrations and extensions, ensuring that it can adapt to the unique needs of different businesses. Its compatibility with various devices and web browsers allows for convenient access from anywhere, enhancing the software’s usability and accessibility.

Our Methodology for Choosing ERP Software

At Software Connect, we personally review software using an in-depth methodology we use when evaluating ERP software. However, in many cases, the following criteria tend to be the most important:

1 Key Features

ERP software should effectively meet your organization’s core business requirements. Assess whether the software offers the necessary modules and integrations to support your specific processes and workflows. The availability of essential features in the base program can significantly impact the software’s suitability and total cost of ownership.

2 Usability and Performance

The usability of the software is another top consideration we have. A user-friendly interface and intuitive navigation can significantly enhance user adoption and productivity. We know if the software is overly complex and requires extensive training to master, it can lead to inefficiencies and increased support costs. So we look to see if the software’s layout and functionality align with an average users’ skills.

We also compare how usable the software is to how well it performs. Some simple interfaces increase usability but at the cost of the ERP’s performance. We check to make sure the two are well-balanced.

3 Scalability

The last main criteria we use for evaluation is scalability, or the ability of software to evolve and grow with your business needs. We assess how easily an ERP software can accommodate changes, such as adding new users, locations, or features. We consider both the time and cost implications of scaling the software to meet your future needs when looking for ERP systems which can adapt to growth without process disruptions or expenses.

What is ERP Software?

ERP software is an integrated suite of business applications designed to automate or help with back-office functions of your organization, including end-to-end business processes such as financials, sales, and operations. More commonly, they can be thought of as all-in-one software for a business, covering a variety of processes.

ERP systems include a broad variety of modules chosen to meet the specific needs of your business. These features connect all areas of your business to create maximum efficiency. By enabling inter-departmental collaboration, ERP software provides a means for better financial tracking and forecasting. Comprehensive analytics use in-depth insights and real-time data to better inform your business decisions.

Read More: What is ERP? A Comprehensive Guide

ERP Modules

To discover which ERP modules are relevant to your specific needs, you’ll need to know what features you’ll need to implement and how you can implement them effectively to streamline business management.

- Accounting: Tracks revenues and expenses. Includes modules such as accounts payable, procurement, accounts receivable, a general ledger, and payroll for employee compensation.

- Budgeting and forecasting: Creates and manages detailed corporate financial plans, which estimate a company’s future revenues and expenses. Includes departmentalized budgeting, budget approvals, rolling budgets, predictive budgeting, dashboards, and workforce planning.

- Customer Relationship Management (CRM): Support sales, marketing, and service activities with contact management, conversation history, lead tracking, order histories, quote/invoice creation, and call center integration.

- Human resources (HR): Provides human capital management of current employees and aids in the hiring and onboarding process for new employees. Includes features such as application processing onboarding, time and attendance tracking, and benefits management.

- Inventory Management: Tracks all information about the items that your company builds, buys, stores, or sells.

- Supply Chain Management: Manage the flow of goods and services between locations as efficiently and as cost-effectively as possible

Benefits of ERP Software

Why is a centralized, comprehensive ERP software solution necessary in the modern business environment? What is the business value of cloud-based ERP? Some of the top benefits of ERP that businesses and departments alike have experienced via improved workflows, streamlined business functions, and significant savings:

- Streamlined workflows and processes. Disconnected systems are inherently inefficient. Data may exist in multiple places at once and there is a time cost paid every time data is transferred between them. By providing a common interface and database, data is managed singularly, allowing much more efficient processes.

- Visibility into workflows. ERP can speed up internal processes and also provide the mechanism to monitor them for continuous improvement. Transparency is a central goal to effectively deploy ERP systems. ERP allows organizations to consider processes from a more holistic standpoint to spot issues preventing optimization.

- Better financial planning and decision-making. Reporting is key to ERP solutions. The ability to slice and dice data by region, location, profit center, employee, and in a variety of other ways allows decision-makers to make more nuanced and accurate decisions about the financial direction of the business.

- Improved data security. Managing security permissions and access across a variety of systems is a daunting challenge. A common control system allows organizations the ability to ensure key company data is not compromised.

- Increased opportunities for collaboration. Data takes different forms in the modern enterprise. Documents, files, forms, audio and video, emails. Oftentimes each data medium has its mechanism for allowing collaboration. That’s inherently wasteful. Employees are more effective when they spend more time collaborating on content, rather than mastering the learning curve of communicating in different formats and across distributed systems.

Industry-Specific ERP Software

ERP modules are available for virtually every task, program, or function that a business performs. There are even specific products to handle small business ERP while others are aimed at enterprise-level corporations.

ERP solutions include modules that help with all facets of a business, but should be prioritized based on what industry your business falls under:

- Construction businesses: Contractors need to focus heavily on the task at hand and spend less time worrying about their back-office procedures. Construction ERP software provides financial accounting and operational modules designed specifically with contractors in mind. Core functionalities include accounting, job costing, project management, and estimating.

- Manufacturing: MRP systems, provide the necessary tools for your manufacturing company. This includes material resource planning, quality management, and inventory control.

- Supply chain management: Those who deal with wholesale and distribution trade need to improve the efficiency of their logistics. This includes improved order management, purchase orders for needed goods, inventory control and/or warehouse management for efficient stock control and pick/pack improvements, and tracking deliveries.

Is QuickBooks an ERP?

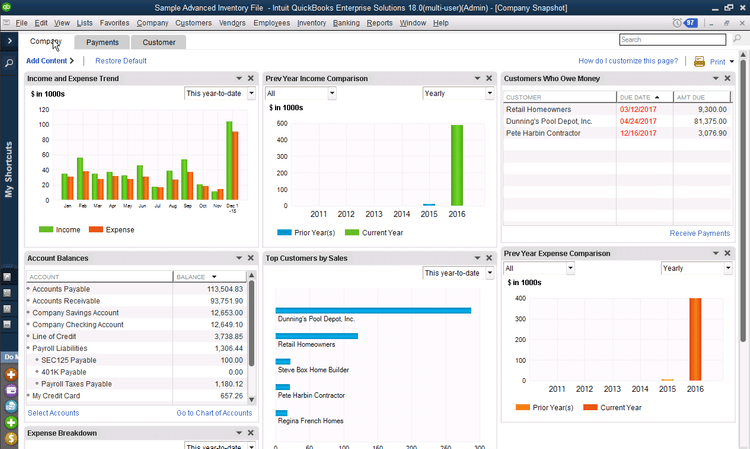

While not an ERP software in the traditional sense, QuickBooks Enterprise brands itself as an “ERP alternative”. QuickBooks Enterprise attempts to let smaller businesses get ERP-level functionality at a small business software price and offers an easy transition from their more simple options (Pro, Premier, or Online) to a business that is suddenly in need of more advanced functionality.

The software can manage and integrate all components of their businesses such as marketing, accounting, sales, costing, manufacturing, and more. The software excels at offering advanced functionality of the modules you’ll find in its Pro and Premier versions, such as advanced inventory tracking, advanced pricing, and advanced reporting.

Read more: Is QuickBooks an ERP System?

When Should an ERP Be Replaced or Upgraded?

Technology is being upgraded and replaced at such a rapid pace, it can be hard for businesses to keep up. At the same time, it’s important not to fall victim to every new tech fad. When the time does come for an ERP platform upgrade or even to purchase a new solution, you may feel overwhelmed with the volume of options available.

Some important questions to ask yourself about your company include:

- How do you currently handle financials, sales, and other business operations?

- What new functionalities do you want most, either in a base software or as an add-on module?

- Which deployment options will offer the greatest accessibility?

Questions to ask ERP vendors include:

- Does your software include industry-specific modules or customization?

- Do you offer on-premise ERP or cloud-based software? Is there a hybrid option?

- How much training would need to be administered?

- Does the software require additional hardware? Can it be accessed on mobile devices (smartphones, tablets)?

- Is there a one-time perpetual license fee or are subscription payments required?

ERP which is software-as-a-service (SaaS) includes routine upgrades and maintenance as part of the ongoing subscription cost. While you may pay more for the software throughout ownership, you’ll have peace of mind knowing you have the latest ERP applications at all times.

Read more: Deciding When to Replace or Upgrade Your ERP Software

What Business Problems are Solved by ERP Software?

Some of the most common problems that ERP software can solve include replacing legacy systems, managing large levels of customization, and integrating with other systems.

Replacing legacy systems

If you’re searching for a new ERP software system, it’s likely because what your company runs now is outdated. Older systems were coded in different languages and the software may no longer be supported by the original developer. The solution may have also been developed in-house by an employee who is no longer with the company. Maintaining support on this type of system is costly and exhausting.

Read more: The Challenges of Legacy ERP vs. Modern ERP

Daunting levels of customization

When ERP solutions first became a thing, heavy customization was a must to ensure the solution did what you want. This meant developers and vendors spent a lot of time writing custom customization code for your company, which was expensive. On top of that, any updates to the systems would require maintenance of the custom code.

Over time, ERP systems have begun to offer standard modules that most have some use for. Nowadays, customization is limited to creating modules that will help you go above and beyond your competitors.

Read more: ERP Customization: Risk Mitigation and Best Practices

Integration issues with other systems.

Even under the best of circumstances, ERP integration can spiral in an unforeseen direction. Besides customization, one of the biggest headaches of an ERP implementation is getting it to work with existing systems.

ERP vendors may push for their solution to be the one and only system being used at your organization. That’s not always possible. Before making the substantial investment in an ERP solution, decide what integrations are needed, if any, and make sure your business has the appropriate budget to cover what your staff wants or needs.

ERP Software Pricing

The cost of ERP monthly subscriptions ranges from $1,700 to $10,000 for small to midsize businesses. Most ERP vendors estimate software should cost about 3% of annual sales.

ERP pricing depends on a lot of variables, such as number of active users, total employees, and whether the system is on-premise or cloud-based. Monthly subscription costs can range from

Implementation costs are another key variable, as they can drastically increase the total cost of ownership (TCO) during the first year of use. The general rule of thumb is to calculate implementation fees is to double the cost of using the software annually.

ERP Software Trend: Increased use of Cloud ERP and Mobile ERP

While interest in cloud technology is growing overall, large companies still have a distrust towards cloud hosting. Our recent buyer trends survey found that companies with 50+ employees shopping for accounting software were 41% less likely than smaller companies to review cloud-hosted software. Hybrid ERP is also an option to consider.

Read More: On-Premises ERP Software vs. Cloud-based ERP Solutions

ERP Software Trend: Artificial intelligence in ERP

A report from Nextec Group suggests that artificial intelligence can help advance ERP capabilities in years to come. This is by providing enhanced customer service through:

- AI-generated answers

- Mining data during an interaction with a customer for further evaluation

- Analyzing the way users access and interact with the systems to create automated actions

- Using virtual reality tools in the field to let other employees interact and provide insights

ERP Software Trend: Increased focus on business intelligence

Business intelligence systems are becoming more of a necessity for businesses of all sizes. Large enterprises are not the sole beneficiaries of the type of reporting and data that can be gathered from a valuable BI system. Our buyer trends survey also found that companies with over 50+ employees were 70% more likely to need software that handles budgeting, business intelligence, and fixed asset management.

Top ERP vendors will need to either invest heavily in providing a business intelligence module or look to integrate with some of the top options on the market.